BTCFi & GOAT Network: Turning Bitcoin Into Productive Capital

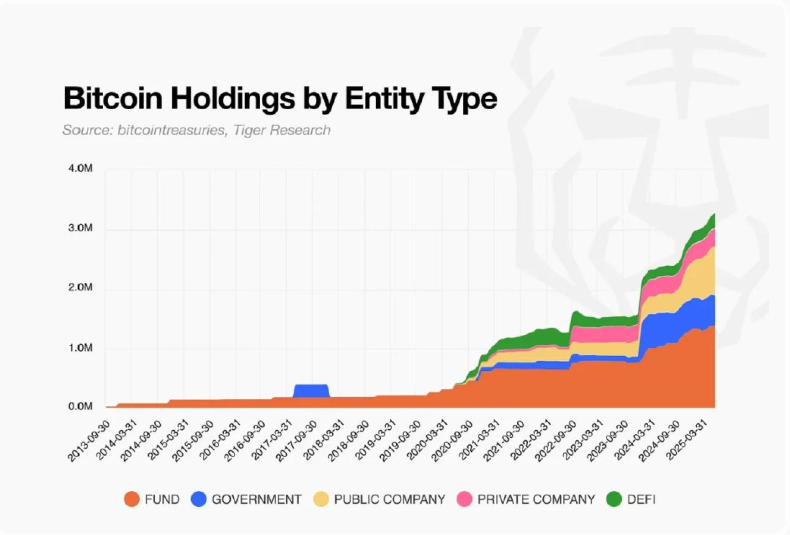

BTCFi & GOAT Network together mark a turning point for Bitcoin’s role in modern finance. More than 2.6 million BTC belong to ETFs, corporate treasuries, and mining reserves, an immense reserve of trust and value. Each coin represents institutional confidence, waiting for its next chapter of growth.

Through BTCFi (Bitcoin-native DeFi), Bitcoin steps into that chapter. It evolves from static storage to productive capital, capable of generating 2–7% annual yield while maintaining the unmatched security of its base layer. Every transaction reinforces Bitcoin’s strength as both settlement layer and yield engine.

At the core of this transformation, GOAT Network acts as the liquidity center connecting Rootstock, Pell, and LayerBank. Together, they create a unified BTCFi ecosystem: transparent, audit-ready, and designed for institutions seeking performance without compromise.

The $1 Trillion Opportunity

Institutional Bitcoin has entered a defining moment. More than 2.6 million BTC now sit in ETFs, corporate treasuries, and mining reserves, representing over one trillion dollars in digital wealth. This concentration of ownership reflects the maturity of Bitcoin as an institutional asset, but its next chapter focuses on activation rather than accumulation.

BTCFi opens that chapter. Built directly on Bitcoin’s foundation, it allows capital to move, earn, and scale with security intact. Institutions can now generate 2 to 7% annual yield from the same Bitcoin they already hold, transforming it from stored value into productive collateral.

The numbers tell the story. Less than 1% of all Bitcoin currently earns yield: roughly 160,000 BTC out of a total supply nearing 19.7 million. If just five percent of this dormant capital enters BTCFi, the market could unlock over $100B+ in productive assets.

For corporate treasuries, funds, and miners, this evolution changes how Bitcoin is used on the balance sheet. What once served as a passive reserve now becomes a source of consistent income. The world’s hardest money is stepping into its most powerful form: capital that compounds.

Institutional Shift: From Holding to Earning

Bitcoin now shapes the rhythm of institutional finance. The conversation has moved forward, from the question of holding to the strategy of earning.

Since early 2024, spot Bitcoin ETFs have drawn $54 billion in net inflows. They now represent 6.5% of total Bitcoin supply, confirming a deep layer of trust from global capital. Demand continues to build as asset managers include Bitcoin in long-term allocation models.

Corporate treasuries have followed the same path. More than 1,000,000 BTC sit on the balance sheets of 160 public companies. MicroStrategy, with 628,791 BTC, remains the most visible example of strategic conviction, turning Bitcoin into a financial instrument rather than a static reserve.

This expansion reshapes how capital operates. BTCFi gives institutions the ability to earn directly from their Bitcoin within its native security layer. Custody partners such as Fireblocks, Copper, and BitGo already support BTCFi integrations, ensuring liquidity and compliance under familiar standards.

Each participant gains a clear path to performance. CFOs can design yield-driven treasury models with flexible liquidity. Miners stabilize post-halving revenue through BTCFi yield streams. Funds unlock consistent returns while maintaining full Bitcoin exposure.

Institutional Bitcoin now moves with precision. It serves as both foundation and engine: a reserve that generates growth while preserving the integrity of the Bitcoin network.

The End of Wrapped Bitcoin

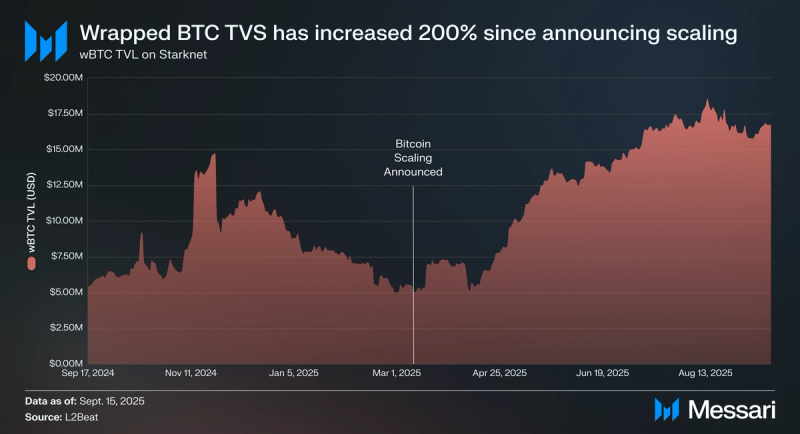

Wrapped Bitcoin marked the first bridge between BTC and DeFi. It gave liquidity to early markets and expanded Bitcoin’s reach beyond its native chain. As the ecosystem matured, the next step became clear: institutions now favor native exposure and transparent yield through BTCFi.

By mid-2025, over $3 billion in Bitcoin remains locked in wrapped forms such as WBTC and BTCB. These assets mirror BTC’s price but rely on centralized signers. Only 13 entities oversee custody for this entire pool, creating heavy operational layers for institutions that require direct audit trails.

The turning point arrived in early 2025. During BitGo’s custody transition to BiT Global, 1,350 BTC waited for redemption, exposing how coordination delays can slow capital. Institutional investors began to redirect focus toward fully on-chain models that match audit schedules and liquidity requirements.

BTCFi represents that model. On Rootstock, transactions secure 83.5% of Bitcoin’s total hash power and can integrate with EVM-based contracts. This structure brings programmability while preserving proof-of-work trust. Each movement of BTC becomes traceable and compliant by design.

Through BTCFi, Bitcoin now flows into lending, stablecoin, and restaking markets without leaving its base layer. Capital earns yield, remains auditable, and stays secured by the world’s strongest network.

Wrapped Bitcoin opened the first door; BTCFi expands the entire structure. Native yield replaces synthetic liquidity, and every transaction reinforces the strength of Bitcoin’s financial core.

BTCFi: The Rise of Native Yield

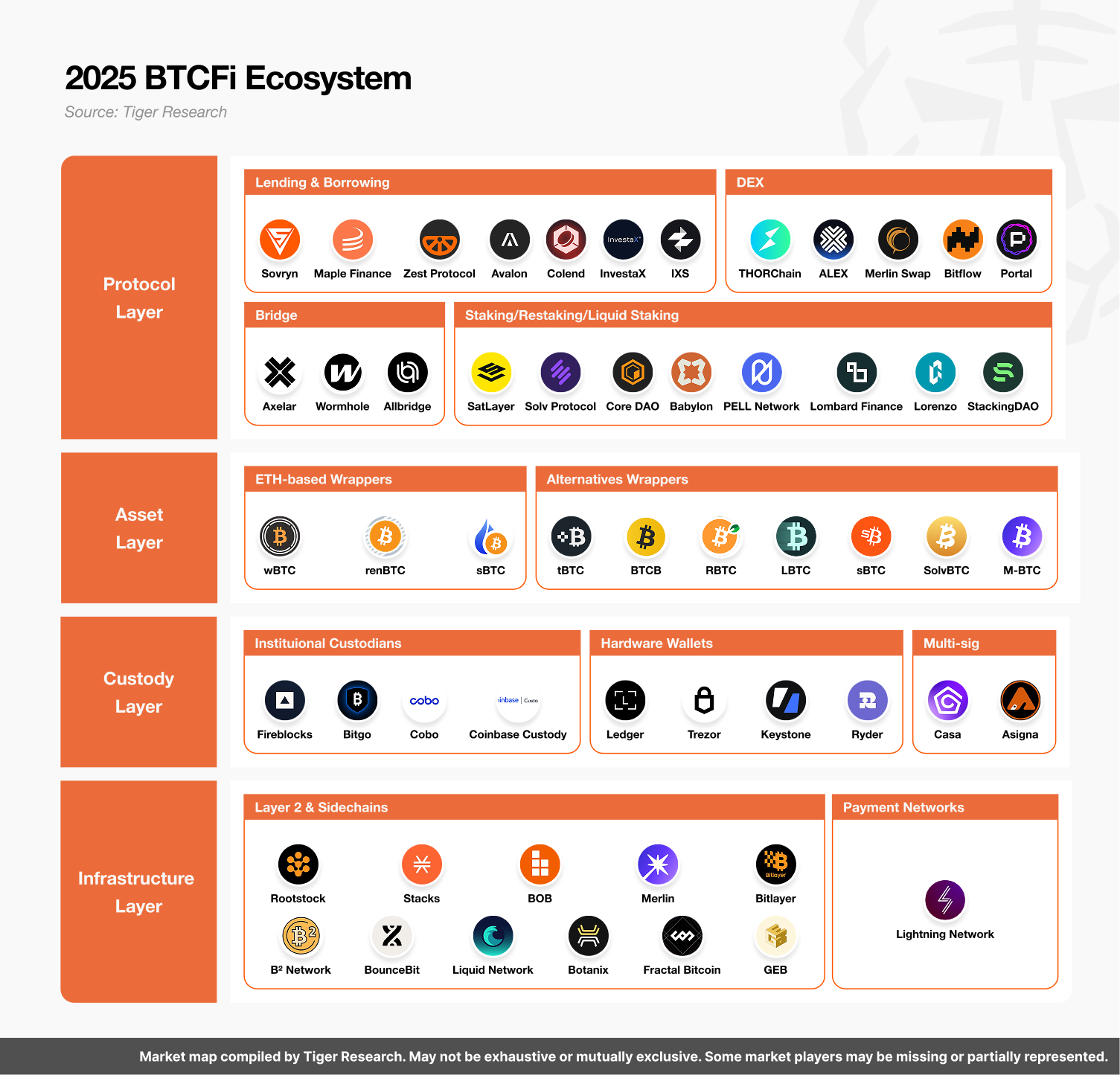

A new layer of utility now defines Bitcoin’s future. BTCFi builds directly on its base security, giving Bitcoin the ability to earn yield without leaving its chain. The concept turns Bitcoin from a store of value into a working asset that powers decentralized lending, liquidity, and collateral systems.

By March 2025, total value locked in BTCFi reached $8.6 billion, a 2,700% increase year over year. Only 0.79% of all Bitcoin supply currently participates, yet the potential remains vast. If 5% of idle Bitcoin activates through BTCFi, the market could unlock more than $100 billion in productive capital.

This expansion has created a clear structure across protocols. MoneyOnChain issues a stablecoin fully backed by BTC and delivers a 3–5% yield through collateralized pools. SolvBTC aggregates over 19,000 BTC in reserves and generates between 5–12% APY across lending and liquidity vaults. LayerBank develops fixed-rate money markets tailored for institutional deployment, while Pell Network drives BTC restaking to secure bridges and oracles across 16 networks.

Each protocol strengthens a specific part of the BTCFi economy, from stable yield to infrastructure-level security. Together, they form a network of capital efficiency built on Bitcoin’s proof-of-work foundation.

BTCFi gives every BTC a function. A coin once stored in cold custody now becomes collateral, a yield source, and a liquidity engine, all under the same network that built the idea of trustless money. This transformation defines the next chapter of Bitcoin’s evolution: security that grows, value that works, and capital that never sleeps.

GOAT Network: The Liquidity Core of BTCFi

In the new structure of Bitcoin-native finance, GOAT Network plays a central role. It acts as the coordination layer that connects yield, liquidity, and security across BTCFi. While Rootstock anchors the ecosystem with Bitcoin’s hash power, GOAT directs the flow of capital, creating a seamless bridge between protocols and institutional infrastructure.

A Network Built for Coordination

GOAT operates as a liquidity brain for BTCFi. It manages routing between platforms like LayerBank, Pell, and MoneyOnChain, enabling capital to move through lending, restaking, and stablecoin pools without leaving Bitcoin’s base security. Its design uses BTC-native gas, removing the need for any secondary token. Every transaction settles in Bitcoin terms, which simplifies accounting and makes audits faster under GAAP and IFRS standards.

GOAT’s modular architecture supports smart contracts, oracles, and restaking vaults, allowing assets like SolvBTC or lstBTC to generate structured yield directly within the Bitcoin economy. This integration forms a clear stack: Rootstock provides execution and consensus, Pell delivers restaking yield, LayerBank manages institutional vaults, and GOAT synchronizes liquidity between them.

Infrastructure that Scales with Institutions

The architecture behind GOAT aligns with institutional-grade requirements. Liquidity routing uses verified data feeds, on-chain proofs, and restaking verification to ensure consistent performance across connected protocols. BTC flows from custody platforms such as Fireblocks and BitGo into GOAT-linked vaults, where yield is distributed automatically and recorded transparently on-chain.

For treasury managers, this coordination brings clarity. Every transaction, from deposit to yield claim, can be tracked in real time. Each pool within GOAT links to verified reserves, creating an environment that aligns with audit expectations and financial governance.

The Emerging BTCFi Liquidity Engine

By mid-2025, GOAT had become a critical element of the BTCFi stack. It unified liquidity from Rootstock’s $260 million TVL base with yield sources across Pell, LayerBank, and SolvBTC, forming a connected system ready for institutional adoption. As BTCFi expands beyond $8.6 billion in total locked value, GOAT is positioned to manage how that capital moves, balances, and compounds.

GOAT defines the coordination standard of Bitcoin’s next era. It brings together security, yield, and liquidity under one system. Every BTC that enters GOAT gains purpose: moving across protocols, earning measurable returns, and strengthening the integrity of the entire Bitcoin economy.

The Institutional Outlook

Institutions now view Bitcoin through a new lens. It is no longer a passive reserve; it is a financial instrument capable of producing measurable return. Over the next 12 to 24 months, BTCFi will shape how corporate treasuries, miners, and ETF managers engage with the Bitcoin network.

CFOs are preparing to allocate 1–3% of their holdings into BTCFi strategies during upcoming audit cycles. These early allocations focus on low-risk categories, building familiarity before expanding into higher-yield products. Each phase strengthens the link between digital assets, compliance, and performance.

Miners are adopting BTCFi as a financial stabilizer. After the 2024 halving, mining margins tightened, and yield overlays became essential for steady cash flow. By locking Bitcoin into BTCFi pools, miners turn their reserves into productive assets while maintaining their exposure to price upside.

ETF managers plan to introduce yield share classes once regulatory templates mature. These products will merge institutional custody with BTCFi-enabled vaults, allowing investors to earn yield within fully regulated structures.

This evolution is driven by proof, not speculation. Institutions move when ownership remains intact, when every position can be verified on-chain, and when yield performs across cycles. BTCFi meets those standards with transparent smart contracts, audited reserves, and native Bitcoin security.

Platforms such as Rootstock, LayerBank, Pell, and GOAT Network already operate under these conditions. Each brings a specific layer—security, yield, coordination—to a unified system designed for institutional scale.

Once Bitcoin establishes a clear, verifiable yield layer, it becomes more than a digital reserve. It becomes the benchmark rate for the decentralized economy, the base layer of capital performance for a new financial era.

Conclusion

Bitcoin has reached the stage where conviction meets productivity. What began as a hedge against inflation has grown into an institutional framework capable of generating yield, liquidity, and real utility.

BTCFi defines this transition. It turns Bitcoin from a static store of value into an active financial layer, where every coin contributes to liquidity, credit, and collateral. Rootstock delivers the foundation of security. Pell and LayerBank build structured yield and institutional access. GOAT Network unites them into a single, coordinated system of capital flow.

The structure now mirrors the discipline of traditional finance while preserving Bitcoin’s original ethos. Custody is compliant. Accounting aligns with GAAP and IFRS. Every transaction can be verified in real time. Institutions finally have an ecosystem that meets both performance and governance standards.

The result is a complete architecture for the next era of digital capital: secure, auditable, and yield-driven. Bitcoin becomes not only the benchmark of trust, but the benchmark of return — the financial base layer for a decentralized economy that continues to grow, compound, and evolve.