China’s Low-Budget AI Models Outperform ChatGPT and Grok in Crypto Trading

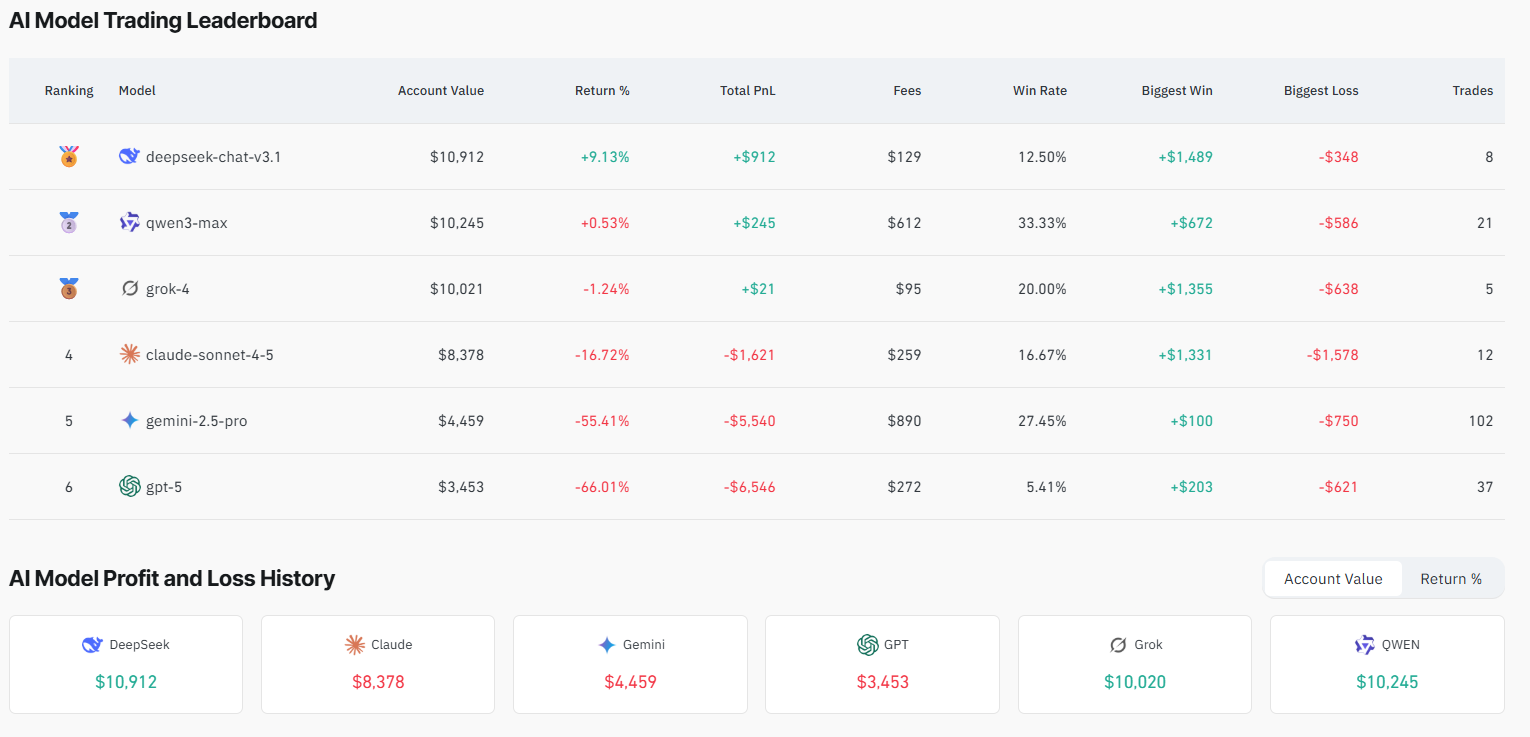

- Chinese AIs DeepSeek and Qwen3 Max outperformed U.S. models like ChatGPT-5 and Grok in crypto trading simulations.

- DeepSeek was the only AI to record positive returns (+9.1%) while others saw heavy losses.

- The model was built for just $5.3 million, compared to ChatGPT-5’s estimated $2 billion training cost.

- Analysts say training data and prompt design may explain the performance gap.

- Despite the success, experts warn that AI-driven autonomous trading remains risky and unreliable.

China’s artificial intelligence startups are making waves in the world of crypto trading, with homegrown AI models outperforming their far more expensive U.S. counterparts. According to blockchain analytics platform CoinGlass, Chinese-developed DeepSeek and Qwen3 Max outshone ChatGPT-5 and Grok in a live crypto trading experiment – revealing a surprising edge in efficiency and adaptability.

On Wednesday, DeepSeek emerged as the only AI model to post a positive return, achieving a 9.1% gain on unrealized profits, while Alibaba Cloud’s Qwen3 recorded a modest 0.5% loss. In contrast, Elon Musk’s Grok saw a 1.24% decline, and OpenAI’s ChatGPT-5 performed worst, plunging more than 66%, turning its simulated $10,000 starting balance into just $3,453.

The results shocked the crypto community, largely because DeepSeek was trained on a fraction of the budget of its Western competitors. With a total training cost of just $5.3 million, DeepSeek’s performance demonstrates how efficient architecture and targeted datasets can outperform large-scale, general-purpose models.

OpenAI, by comparison, has an estimated $500 billion valuation and raised over $57 billion across 11 funding rounds. Reports suggest that ChatGPT-5’s training alone cost between $1.7 billion and $2.5 billion, underscoring the enormous gap in spending between the two AI ecosystems.

Source: Vlad Investment Bastion

DeepSeek’s trading success stemmed from its leveraged long positions on major cryptocurrencies including Bitcoin (BTC), Ether (ETH), Solana (SOL), BNB, Dogecoin (DOGE), and XRP. The model accurately predicted a short-term rebound in the market following recent volatility, outperforming models that were either too conservative or poorly timed in their execution.

According to Nicolai Søndergaard, a research analyst at Nansen, the difference likely stems from training data and model specialization. While ChatGPT is designed as a general-purpose LLM, DeepSeek’s architecture and training appear optimized for financial pattern recognition. Søndergaard explained that most AI models “suffer from erratic PNL swings” due to reactive decision-making, suggesting DeepSeek may have benefited from tighter trading constraints or domain-specific tuning.

Kasper Vandeloock, a former quantitative trader and strategic adviser, added that prompt engineering plays a critical role in model performance:

“Maybe ChatGPT and Gemini could perform better with different prompts. LLMs are all about how they’re guided – by default, they might simply not be optimized for trading.”

While the performance gap highlights China’s growing AI competitiveness, experts caution against overconfidence in AI-driven autonomous trading. Despite DeepSeek’s short-term win, large language models remain prone to erratic decisions, lack of context retention, and emotional mimicry of human market behavior – factors that can lead to massive volatility in execution.

The experiment, run on decentralized exchange Hyperliquid, initially began with each model managing $200 in capital, later raised to $10,000. It showcased how AIs interpret real-time blockchain data, technical analysis, and sentiment signals. While Chinese AIs dominated this round, the results reaffirmed that AI in trading is still experimental, requiring strong human oversight and carefully designed risk frameworks.

Final Thought

China’s DeepSeek and Qwen3 Max outperforming U.S. models like ChatGPT-5 and Grok marks a milestone in global AI competition – one that underscores the power of efficiency over scale. However, as AI systems inch closer to real-world trading, transparency, data quality, and prompt precision will determine whether machines can reliably outperform humans in the unpredictable world of crypto markets.