Gold Loses $2.5 Trillion in Historic Sell-Off: What It Means for Bitcoin

- Gold suffered its largest two-day drop since 2013, erasing $2.5 trillion in market value.

- The decline equals more than the entire Bitcoin market cap ($2.2T).

- Analysts cite profit-taking and FOMO unwinding as the main causes.

- Bitcoin fell 5.2% intraday but recovered to a smaller 0.8% daily loss.

- Fear & Greed Index hits lowest level since 2022, reflecting investor anxiety.

Gold, long regarded as the world’s most reliable store of value, has just experienced one of its sharpest declines in years – a loss so steep it wiped out an estimated $2.5 trillion in market capitalization within 24 hours. The plunge was so massive that it exceeded the entire market cap of Bitcoin, underlining that even “safe-haven” assets are not immune to volatility.

According to data from The Kobeissi Letter, gold’s market correction began on Tuesday and deepened Wednesday, marking an 8% decline – its worst two-day performance since 2013. The sudden sell-off rattled global markets, particularly as many investors had turned to gold as protection against inflation and equity market weakness following its 60% surge earlier in 2022.

While Bitcoin (BTC) is known for its frequent double-digit swings, this rare collapse in gold demonstrates that no asset class, no matter how established its reputation, remains exempt from large, rapid corrections.

Why Gold Crashed

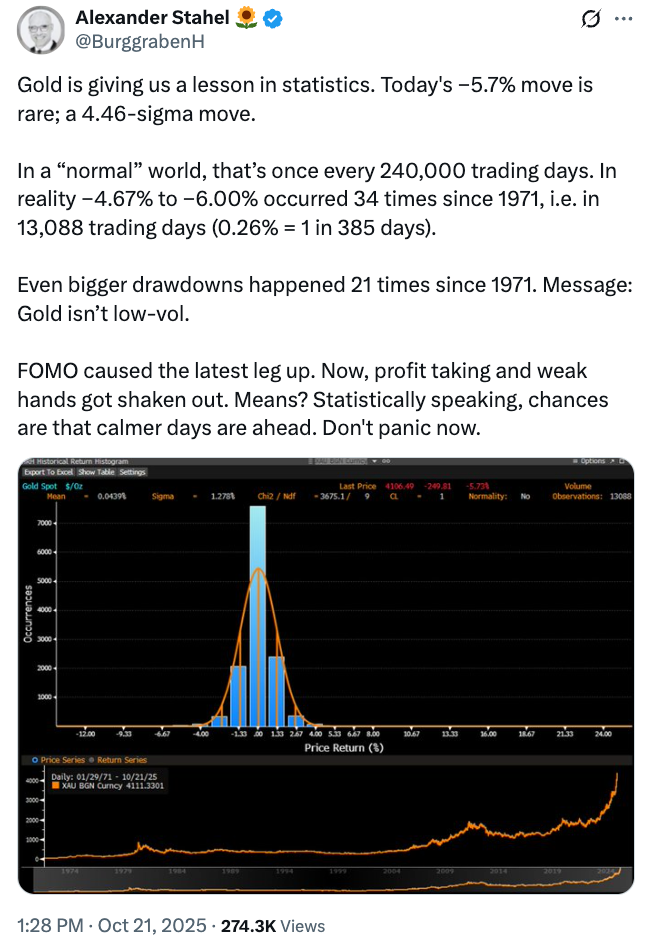

The magnitude of the decline stunned analysts. Alexander Stahel, a Swiss resources investor, noted on X that statistically, a 7% single-day drop in gold “should only happen once every 240,000 trading days.” Stahel attributed the event to a “FOMO-driven rally” in recent weeks as retail and institutional buyers piled into gold equities, physical bullion, and tokenized gold assets.

“FOMO caused the latest leg up. Now, profit-taking and weak hands got shaken out,” Stahel wrote, suggesting the correction was an inevitable cooldown after an overheated market. He added that historical data suggests “calmer days are ahead.”

Comparing Gold and Bitcoin

The sell-off also sparked comparisons with Bitcoin, which many view as digital gold. Veteran trader Peter Brandt pointed out that the $2.5 trillion wiped from gold’s value is equivalent to 55% of the total crypto market capitalization.

Bitcoin itself saw a 5.2% intraday dip to around $108,000, but stabilized to a 0.8% daily loss, according to Coinbase. Despite the mild pullback, the event reignited debate over Bitcoin’s resilience as a store of value relative to traditional assets.

Interestingly, Bitcoin ETFs recorded $142 million in inflows on the same day, suggesting that some investors may be rotating into crypto amid gold’s turbulence.

Fear Grips the Market

The Crypto Fear & Greed Index – a popular sentiment gauge – fell to levels unseen since December 2022, entering “Extreme Fear” territory. Analysts interpreted this as evidence that investors are still on edge, not only from crypto’s recent pullbacks but also from the shock of gold’s collapse.

Meanwhile, Deutsche Bank’s macro strategist Marion Laboure had recently highlighted growing parallels between gold and Bitcoin, noting that both are increasingly perceived as alternative stores of value amid currency devaluation concerns.

Despite gold’s recent parabolic rise, Deutsche Bank analysts pointed out that it only reached its inflation-adjusted all-time high in early October, suggesting that the current correction could mark a necessary rebalancing rather than a full reversal of trend.

Gold’s $2.5 trillion crash is a stark reminder that even the most stable assets can experience extreme volatility in modern markets. As investors reassess risk, Bitcoin’s reputation as “digital gold” could strengthen – particularly as traditional safe havens falter under macro pressure.

Still, both markets now face a crucial test: whether they can maintain investor trust in the face of growing uncertainty.

Final Thought

While gold’s collapse underscores the fragility of even legacy stores of value, Bitcoin’s relative stability amid the chaos offers an intriguing contrast. If digital assets can weather traditional market storms, the definition of “safe haven” may be quietly evolving – from vaults to blockchains.