Stablecoins Emerge as the Hidden Growth Engine of the Gaming Industry

- Stablecoins are transforming the $350B global gaming market, according to a Blockchain Gaming Alliance (BGA) report.

- Developers are using USDT and USDC to power in-game economies, creator payments, and item pricing.

- Unlike volatile play-to-earn tokens, stablecoins offer predictable, fiat-like value stability.

- The BGA calls them the new “monetary operating system” for the next wave of Web3 gaming.

- Stablecoin-powered ecosystems are already being tested, such as Sui’s Game Dollar.

A new report from the Blockchain Gaming Alliance (BGA) reveals that stablecoins are becoming the quiet financial backbone of the global gaming industry, reshaping how developers and creators earn, spend, and scale digital economies. Once viewed merely as payment tools or liquidity assets for DeFi, stablecoins are now powering the next phase of blockchain-based gaming infrastructure.

The BGA’s research shows that fiat-pegged assets such as Tether’s USDT and Circle’s USDC are increasingly being used by developers to handle creator payouts, item pricing, and cross-platform transactions. Their predictable value helps game studios and players escape the volatility that crippled many play-to-earn ecosystems.

“Stablecoins are transforming fragmented, speculative game economies into scalable, player-first systems,” said Amber Cortez, head of business development at Sequence, one of the firms contributing to the report.

Stability Wins Over Speculation

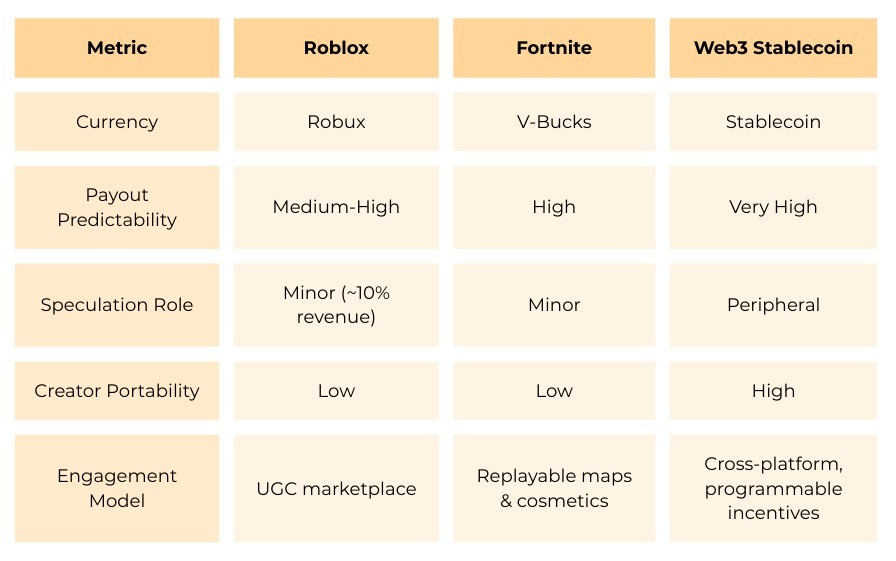

According to the BGA, players and developers alike prefer the stability of pegged digital currencies over speculative in-game tokens. The report cites mainstream games like Roblox and Fortnite, where closed-loop economies with stable pricing have proven that consistent value retention encourages long-term engagement.

In Roblox, for instance, the top 10 creators earn an average of $38 million annually, enabled by a fixed exchange rate that shields them from market shocks. Stablecoins replicate this model in an open blockchain environment, combining the trust of fiat-backed systems with the programmability and transparency of blockchain technology.

The BGA draws a clear contrast between stablecoin-based systems and play-to-earn (P2E) token models such as Axie Infinity, which saw user numbers plummet after token crashes exposed the fragility of speculative economies.

“The success of gaming’s biggest economies rests on stable value,” the report notes. “Stablecoins bring that principle into the open metaverse – turning virtual currencies into real-world financial rails.”

Early Signs: Game Dollar and Beyond

Stablecoin-based gaming initiatives are already emerging. In May 2025, the Sui blockchain announced Game Dollar, a programmable stablecoin tailored specifically for gaming economies. Game Dollar aims to provide fast, stable payments across multi-game ecosystems while ensuring low transaction friction.

As more studios experiment with DeFi-powered microtransactions, stablecoins are poised to become the default settlement layer for digital games – connecting fiat liquidity, player earnings, and NFT marketplaces.

Despite a challenging funding climate, blockchain gaming saw a modest rebound in Q3 2025, attracting $129 million in venture capital, according to DappRadar. This brings the year’s total to $300 million, signaling cautious optimism after 2024’s $1.8 billion boom faded.

Analysts believe that stablecoin integration could play a pivotal role in stabilizing gaming revenues, attracting traditional studios, and reducing the financial risks associated with crypto-native economies.

The Bottom Line

While early play-to-earn experiments struggled under speculative pressure, stablecoins offer a viable bridge between real-world stability and digital innovation. The BGA’s report suggests that the future of blockchain gaming won’t be driven by hype cycles, but by financial infrastructure that enables sustainable growth – and stablecoins are quietly becoming its most important engine.