Skinny Master Account: Fed’s New Gateway for Fintech & Crypto

Recently, Fed Governor Christopher J. Waller announced the central bank is proposing a new type of payment account that would grant full access to the Fed’s payments rails for ALL legally eligible institutions.

“I believe we can and should do more to support those actively transforming the payment system,” said Fed Governor Christopher J. Waller during his speech at the Payments Innovation Conference on Tuesday. He added: “To that end, I have asked Federal Reserve staff to explore the idea of what I am calling a “payment account.”

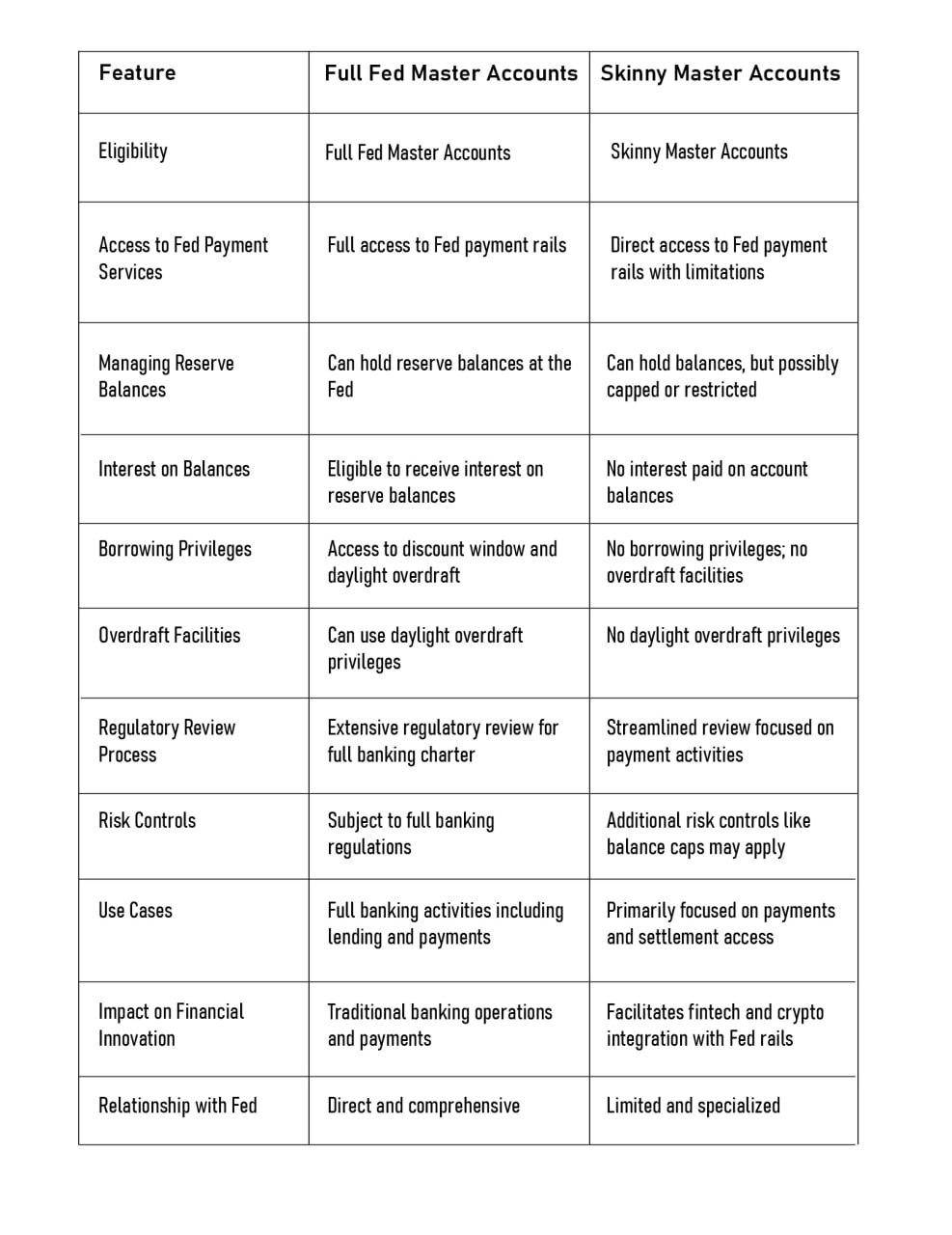

This move, if approved, would be a tremendous advantage for fintech companies seeking to utilize the Fed’s payment services, signaling the end of the crypto industry’s banking challenges. Though firms would not have a complete range of services like borrowing from the Fed like in a master account, with the “skinny master account” (as Waller calls it), institutions no longer need to rely on a third-party bank.

How Skinny Master Accounts Differ from Fed Master Accounts

While the idea is still in an experimental stage, we can see that the Fed is now making endeavors for the integration of fintech and crypto-native firms into the traditional finance (TradFi) system.

In fact, the Fed has been experimenting with blockchain technology for payments even before announcing the idea of the “skinny” master accounts. As our team researched, here are some features that the new account may possess.

While the proposal remains in its early stages, its potential market impact is already sparking debate.

Potential Winners and Losers

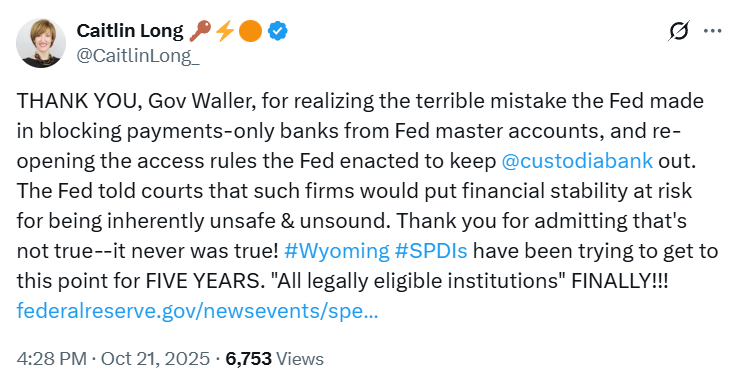

The news was praised by several industry watchers, including the potential winner Custodia Bank. On her X post, Caitlin Long, founder and CEO of Custodia Bank, wrote: “THANK YOU, Gov Waller, for realizing the terrible mistake the Fed made in blocking payments-only banks from Fed master accounts, and re-opening the access rules the Fed enacted to keep @custodiabank out.”

Besides crypto-native fintechs and stablecoins issuers like Custodia Bank and Kraken, who have struggled to get full Fed master account, beneficiaries may include Ripple and Anchorage. Innovative DeFi platforms and payments-focused firms (e.g., Uniswap, Frax Protocol) could benefit indirectly, enabling easier stablecoin transactions and liquidity operations.

However, this might not be good news for traditional banks as they face competition from new fintech entrants. Similarly, entities that are heavily dependent on borrowing from the Fed or large Fed balances will find skinny accounts limited due to restrictions on overdraft and interest benefits.

The “skinny master account” proposal underscores the Fed’s growing recognition of fintech’s role in modern payments. If adopted, it could mark the first real bridge between decentralized innovation and the central bank’s trusted infrastructure: redefining access, compliance, and competition in the digital finance era.