Spot Ether ETFs Record Second Week of Outflows as Investor Demand Cools

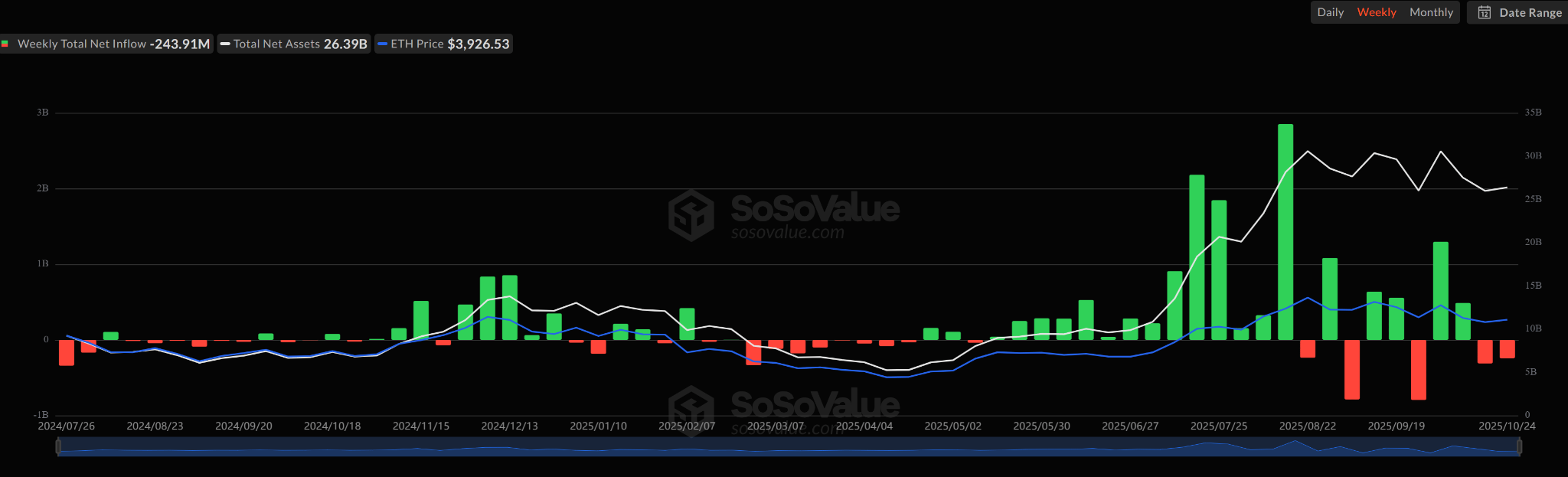

- Spot Ethereum ETFs posted $243.9 million in outflows this week, marking their second straight weekly decline.

- Cumulative inflows across all Ether ETFs now total $14.35 billion, with $26.39 billion in total net assets.

- BlackRock’s ETHA ETF led redemptions, while Grayscale’s ETHE and Bitwise’s ETHW saw minor inflows.

- In contrast, Spot Bitcoin ETFs attracted $446 million in inflows, signaling renewed institutional confidence in BTC.

- Analysts cite a rotation toward Bitcoin amid anticipation of interest rate cuts and macro uncertainty.

Spot Ethereum exchange-traded funds (ETFs) have posted their second consecutive week of outflows, signaling a cooling in institutional demand after months of strong inflows earlier in the year.

According to data from SoSoValue, Ether (ETH) investment products saw $243.9 million in net redemptions for the week ending Friday, following $311 million in outflows the previous week.

The latest figures bring total cumulative inflows across all spot Ether ETFs to $14.35 billion, with net assets standing at $26.39 billion — representing roughly 5.55% of Ethereum’s total market capitalization.

BlackRock’s ETHA Leads Withdrawals

On Friday alone, Ethereum-based ETFs recorded $93.6 million in daily outflows, led by BlackRock’s ETHA ETF, which saw $100.99 million withdrawn.

Other major funds showed mixed performance:

- Grayscale’s ETHE and Bitwise’s ETHW posted small inflows, offsetting part of the decline.

- Overall sentiment remains cautious, with investors taking a “wait-and-see” approach amid muted onchain activity.

While Ether ETFs faced redemptions, spot Bitcoin ETFs showed renewed momentum, attracting $446 million in net inflows over the same week, according to SoSoValue data.

On Friday alone, Bitcoin ETFs added another $90.6 million, bringing total cumulative inflows to $61.98 billion and net assets to $149.96 billion — about 6.78% of Bitcoin’s market cap.

Leading the pack were:

- BlackRock’s iShares Bitcoin Trust (IBIT) with $32.68 million in inflows.

- Fidelity’s FBTC with $57.92 million, maintaining its strong institutional base.

Together, IBIT and FBTC remain the dominant players in the Bitcoin ETF market, holding $89.17 billion and $22.84 billion in assets, respectively.

Analysts See Rotation Into Bitcoin

Vincent Liu, Chief Investment Officer at Kronos Research, told Cointelegraph that the divergence in ETF flows signals a strong investor rotation toward Bitcoin as a “digital gold” and store-of-value asset.

“Renewed confidence in Bitcoin reflects broader market sentiment favoring assets seen as resilient amid global uncertainty and the expectation of rate cuts,” Liu said.

He added that Ethereum’s recent ETF outflows highlight a temporary cooling in demand and lower onchain activity, with institutions likely waiting for new catalysts before re-entering ETH positions.

Looking ahead, Liu expects Bitcoin ETF inflows to remain strong as traders position for potential monetary easing by the Federal Reserve in the coming months.

“Ethereum and other altcoins could recover only if network activity rebounds or new catalysts emerge,” he added.

The contrasting ETF flows underline a broader trend in 2025’s crypto market — one where Bitcoin is regaining institutional dominance, while Ethereum investors pause amid uncertainty and cooling sentiment.