Bitcoin Escapes “Fear” Zone as Confidence Creeps Back Into the Crypto Market

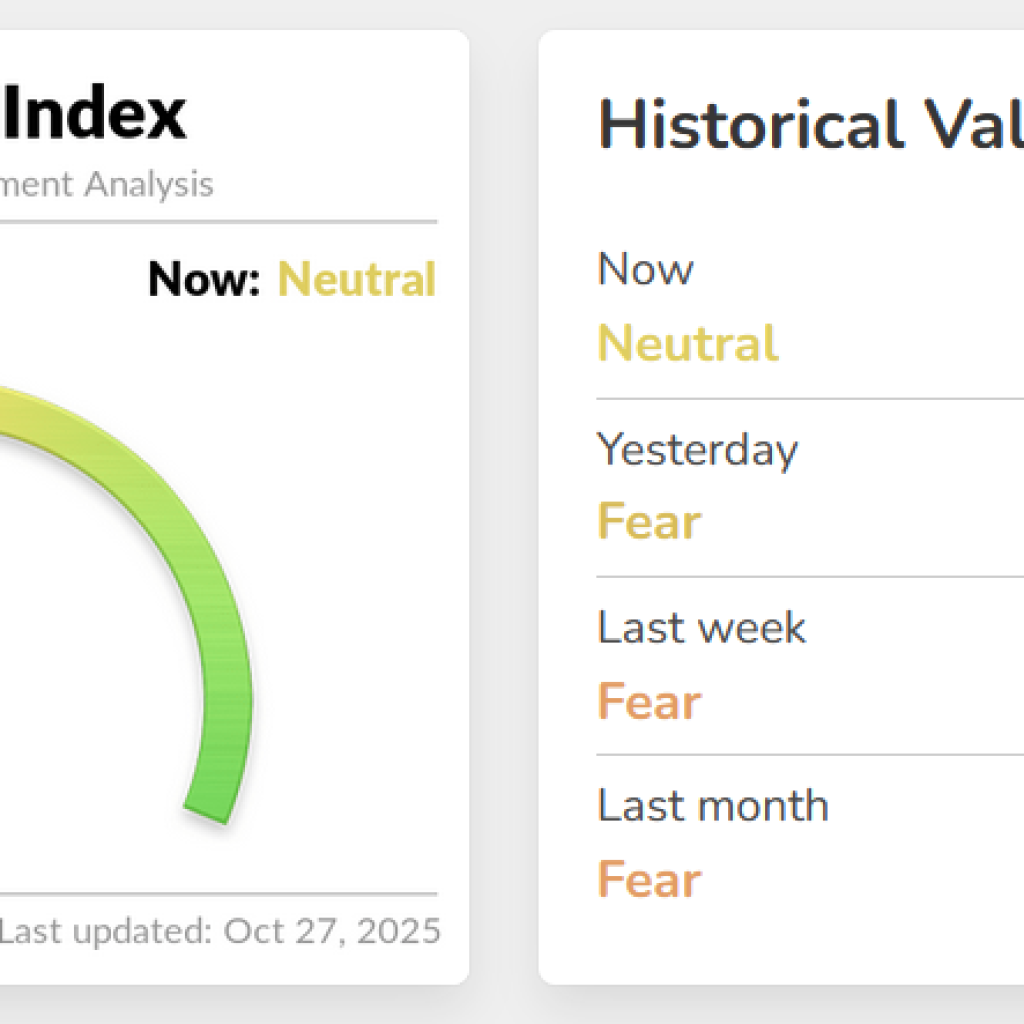

- The Crypto Fear & Greed Index flipped from “fear” to neutral (51/100) for the first time since mid-October.

- Market confidence is returning as Bitcoin rebounds to $115,000.

- The October 10 Trump tariff crash had earlier sent the index plunging to 24 (extreme fear).

- Glassnode says “aggressive selling pressure” is subsiding, hinting at a trend reversal.

- Funding rates remain cautious but stabilized, suggesting the bottom might be in.

- Traders are eyeing the Federal Reserve’s Oct. 29 meeting, where a rate cut is 96.7% likely.

After two tense weeks of market panic, Bitcoin and the broader crypto market are finally showing signs of renewed confidence. The Crypto Fear & Greed Index — a popular sentiment tracker — has officially climbed out of the “fear” zone, turning neutral for the first time since mid-October.

As of Sunday, the index scored 51 out of 100, up 11 points from Saturday’s 40, and a full 20 points higher than last week’s low, signaling that investor confidence is quietly returning.

The current Crypto Fear and Greed score. Source: Alternative.me

From Fear to Neutral: Market Sentiment Improves

The turnaround follows Bitcoin’s weekend surge to around $115,000, a recovery that seems to have lifted spirits after weeks of uncertainty.

The fear phase was triggered on Oct. 10, when former U.S. President Donald Trump’s China tariff announcement sparked a massive market sell-off. The event wiped out $19 billion in leveraged positions and dragged the index down from 71 (greed) to 24 (extreme fear) — its lowest level this year.

Now, however, sentiment data suggests that the worst may be over.

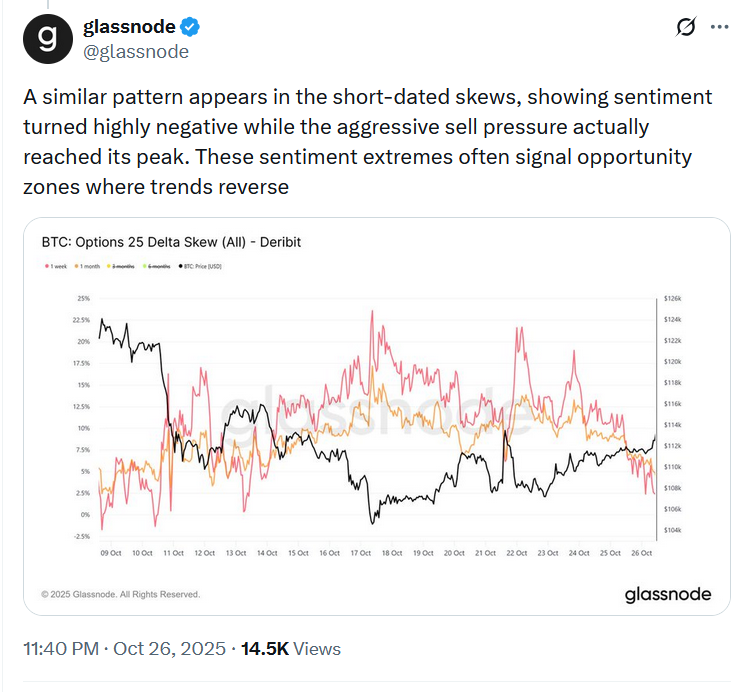

According to onchain analytics platform Glassnode, Bitcoin’s selling pressure is waning, indicating that a trend reversal might already be underway.

In a Sunday post on X, Glassnode noted that both spot and futures CVD (Cumulative Volume Delta) have flattened, implying that “aggressive” sellers are finally backing off.

“For the first time since the October 10th flush, spot and futures CVD have flattened, indicating that aggressive selling pressure has subsided over the last several days,” Glassnode explained.

The firm added that funding rates remain slightly negative, showing that traders are still cautious but no longer overly bearish — a healthy setup for potential upside momentum.

Fed Rate Cuts Could Fuel More Optimism

Adding to the growing optimism, traders are eyeing the upcoming Federal Reserve meeting on Oct. 29, where a quarter-point rate cut looks almost certain.

According to data from CME Group’s FedWatch, there’s a 96.7% probability that the Fed will lower rates — a move that could inject new liquidity into financial markets and bolster risk assets like Bitcoin.

If confirmed, the decision could be the next bullish catalyst, reinforcing the sentiment recovery and potentially pushing BTC back toward new highs.

After weeks of fear, confidence is creeping back into the crypto markets. With selling pressure easing, funding stabilizing, and rate cuts looming, the setup looks increasingly favorable for Bitcoin bulls.

While investors are still cautious, the shift from fear