Avalanche Gains Government and Institutional Adoption Despite AVAX Price Drop

- Avalanche is gaining traction with governments and institutional investors

- Wyoming launched its government-backed stablecoin (FRNT) on Avalanche

- SkyBridge Capital will tokenize $300 million in hedge fund assets on the network

- Avalanche ranks third in tokenized US Treasurys with $638 million onchain

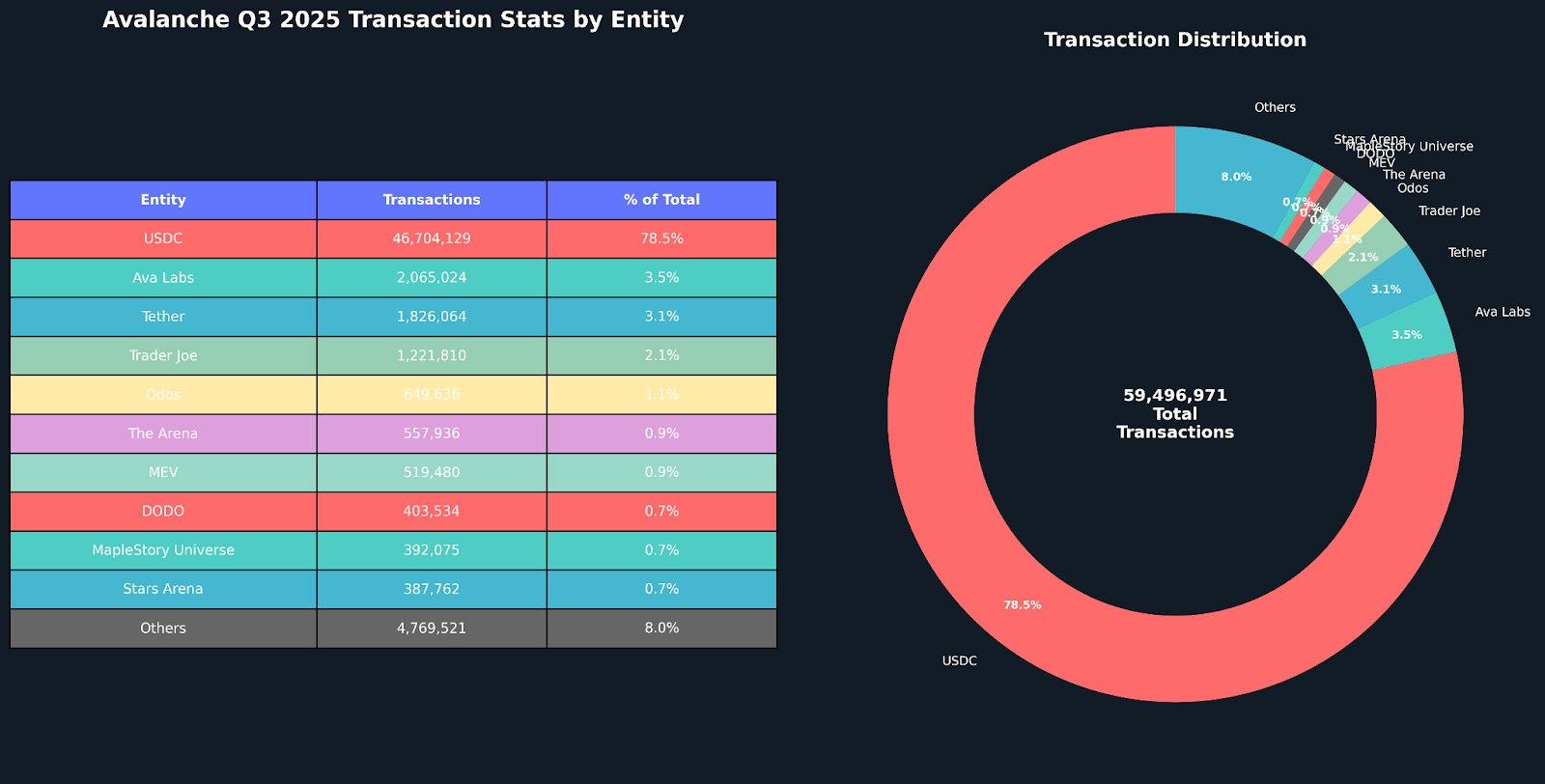

- Network averages 1 million+ daily transactions, with a peak of 51.6 million

- AVAX token remains 86% below its all-time high despite growing adoption

The Avalanche blockchain is emerging as a top choice for governments and major financial institutions, according to recent data from Nansen. While Avalanche’s institutional and government integrations continue to expand, its native token, AVAX, still lags far below its historical peak.

In the third quarter of 2025, the U.S. state of Wyoming made history by launching the Frontier Stable Token (FRNT) on Avalanche — along with six other public blockchains. The FRNT is the first-ever government-backed stablecoin, fully collateralized by U.S. dollars and short-term Treasury bills, and backed by a 102% reserve requirement. This development signals growing government trust in blockchain networks like Avalanche for secure and transparent digital finance solutions.

Avalanche has also gained strong interest from traditional finance (TradFi) players. SkyBridge Capital, led by Anthony Scaramucci, announced plans to tokenize $300 million worth of hedge fund capital on the Avalanche blockchain. According to Nansen, these moves are “quietly turning TradFi and gov tech into onchain reality,” showing how Avalanche is bridging the gap between decentralized finance (DeFi) and institutional investment.

“DeFi just got institutional,” Nansen noted in its Q3 report.

Data from RWA.xyz reveals that Avalanche now holds the position of the third-largest blockchain by the value of tokenized U.S. Treasurys, totaling $638 million. It follows only BNB Chain and Ethereum in this growing real-world asset (RWA) sector.

Tokenized Treasurys are digital versions of U.S. government bonds that exist on the blockchain, making them easier to access, trade, and manage. This trend is part of a larger global movement toward real-world asset tokenization, which integrates traditional finance with blockchain efficiency.

Despite these advancements, AVAX, the network’s native token, has not reflected this institutional growth in its market price. Avalanche averaged over 1 million daily transactions in Q3 and even reached a peak of 51.6 million transactions in a single day, showing strong onchain activity.

However, AVAX remains 86% below its all-time high of $146, recorded in November 2021. At the time of publication, AVAX was trading around $19.66, down 33% over the past month. Analysts attribute this drop partly to the $19 billion liquidation event that shook the crypto market in early October after U.S. President Donald Trump’s tariff threats on Chinese goods.

Still, analysts say Avalanche’s rapid institutional adoption shows that the blockchain’s long-term fundamentals remain strong — even as its token struggles in the short term.

Final Thought

Avalanche is proving that real-world adoption doesn’t always move in sync with token prices. As more governments and funds use Avalanche for tokenization and stablecoin issuance, the network is solidifying its role as a bridge between blockchain innovation and traditional finance. While AVAX may lag for now, the growing institutional confidence suggests that Avalanche’s real value lies in its expanding ecosystem and real-world integrations.