Bybit Suspends New User Registrations in Japan Amid Regulatory Changes

- Bybit pauses new user onboarding in Japan starting Oct. 31

- Move aligns with Japan’s emerging crypto regulations from the FSA

- Existing users can continue trading without disruption

- FSA considering reforms to let banks hold Bitcoin and run licensed exchanges

- Possible new capital and risk-management standards for banks

- Japan’s strict regulations continue to push crypto startups offshore

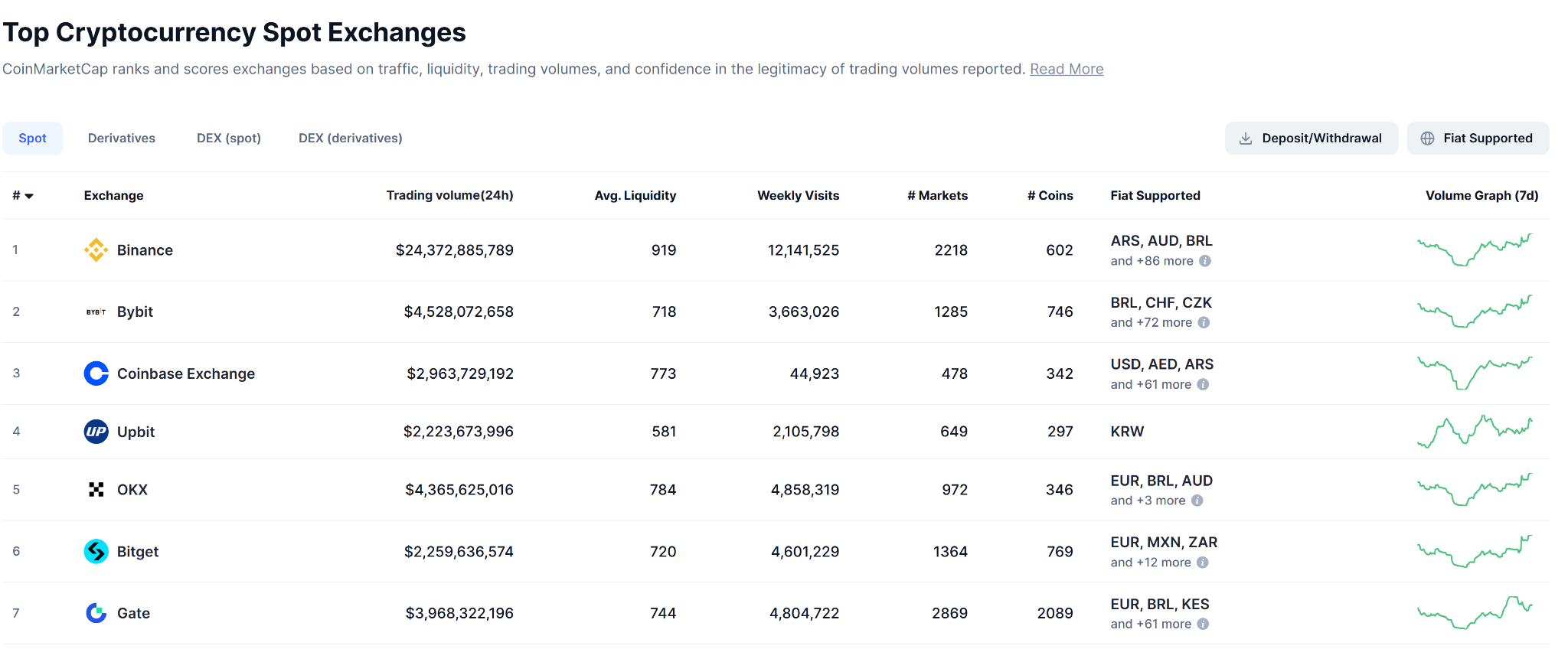

Bybit, the world’s second-largest crypto exchange by trading volume, has announced that it will pause new user registrations in Japan starting October 31, 2025. The decision comes as the exchange works to comply with Japan’s evolving regulatory framework for digital assets, set by the Financial Services Agency (FSA).

In its official statement on Wednesday, Bybit said the move is part of its “proactive approach” to operate responsibly and in full compliance with Japan’s new crypto regulations.

“It has always been Bybit’s commitment to operate responsibly and in compliance with local laws and regulatory expectations,” the company said.

While new users in Japan won’t be able to sign up for now, existing customers will not be affected. All current services, including trading and withdrawals, will remain operational. Bybit also mentioned that it will release further updates as its discussions with Japanese regulators continue.

The timing of Bybit’s decision coincides with Japan’s FSA exploring new crypto reforms. Reports from last week revealed that the agency is considering allowing banks to hold cryptocurrencies like Bitcoin and even operate licensed exchanges.

If approved, this would represent a major shift for Japan’s financial sector, enabling banks to treat digital assets more like traditional financial instruments such as stocks and government bonds. The proposal will be discussed at an upcoming Financial Services Council meeting.

The FSA’s reform plan is expected to include new capital requirements and risk-management standards to address crypto’s volatility before allowing banks to hold or trade these assets. Analysts believe this could pave the way for greater institutional adoption of crypto in Japan’s regulated market.

Meanwhile, Japan’s tough regulatory climate has already caused challenges for local crypto innovation. Maksym Sakharov, co-founder and CEO of WeFi, told Cointelegraph that Japan’s slow and risk-averse approval process — not taxation — is driving startups and liquidity out of the country.

“Even if Japan introduces a 20% flat tax on crypto gains, the real issue is the slow, prescriptive, and risk-averse regulatory culture,” Sakharov said.

Bybit’s temporary suspension reflects the wider trend of crypto exchanges adapting to Japan’s evolving legal landscape, as the government tries to balance investor protection with innovation and growth in the Web3 space.

Final Thought

Bybit’s pause on new registrations in Japan shows how quickly the country’s crypto laws are changing. As Japan’s FSA explores letting banks hold Bitcoin and operate exchanges, the move could reshape the entire financial system. For now, Bybit’s cautious approach highlights the ongoing tension between regulation and innovation in one of Asia’s most tightly governed crypto markets.