NFT Market Drops 46% in One Month as Top Collections Lose Value

- NFT market cap fell from $6.6B to $3.5B in 30 days.

- Sales volume increased, but prices fell across major collections.

- Ethereum, Solana, and Polygon NFT values declined.

- BAYC, CryptoPunks, and Pudgy Penguins floor prices dropped.

- Market shows high sensitivity to sentiment and speculation.

The NFT market has seen a sharp decline in value over the past month. Despite an increase in trading activity, overall NFT prices have continued to fall. Data from CoinGecko shows that the total NFT market cap dropped from about $6.6 billion on October 5 to around $3.5 billion by early November. This represents a 46% decrease within 30 days, suggesting that the market is still heavily influenced by speculative trading and changing investor confidence.

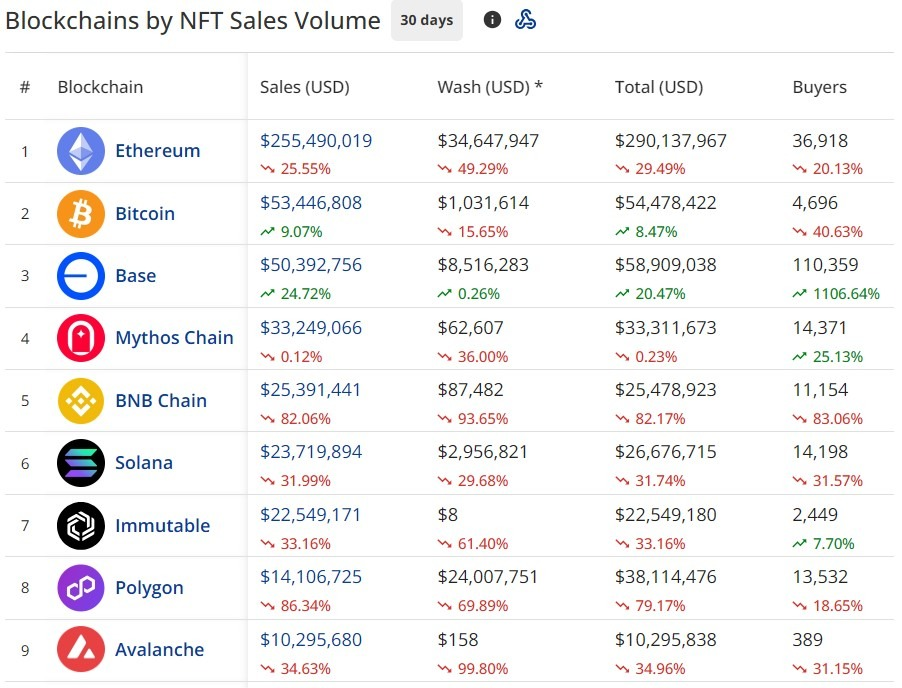

Interestingly, the drop in value came even as total NFT sales increased. CryptoSlam data indicates that NFT sales reached approximately $631 million in October, up 13% from September. More NFTs were being traded, but many were sold for lower prices. This means trading activity was driven by short-term movement rather than new capital entering the market.

The decline affected multiple blockchains, though some were hit harder than others. Bitcoin and Base-based NFTs managed to show small gains, but chains like BNB Chain and Polygon experienced deep losses. Ethereum, which still leads the NFT space in trading volume, also saw noticeable price declines across many collections. The correction suggests that the market is adjusting after months of speculative momentum with limited real utility growth.

Even major NFT collections that once held strong reputations have felt the pressure. Collections such as CryptoPunks, Moonbirds, Bored Ape Yacht Club, and Pudgy Penguins all saw significant drops in their floor prices over the past month. In some cases, trading volume increased while the average price fell, suggesting that holders were either selling quickly or repositioning amid uncertainty. This pattern highlights how fragile NFT valuations are, especially during periods of broader crypto market caution.

While the market cools, key players in the NFT industry are shifting their strategies. OpenSea, one of the leading NFT marketplaces, announced plans to expand into a broader on-chain trading hub rather than focusing only on NFT collectibles. Meanwhile, Animoca Brands reaffirmed its intention to list on Nasdaq, signaling confidence in the long-term future of Web3, gaming, and digital ownership. These developments show that major companies are still investing in the space, even as market prices fluctuate.

Final Thought

The recent NFT market decline emphasizes how strongly prices are tied to sentiment and momentum. While demand for high-value collectibles has weakened, industry leaders are continuing to build beyond simple NFT trading. The market may now be moving toward a phase where utility, real-world use cases, and practical applications will determine long-term value rather than hype alone.