Ondo Finance Invests $25M in Figure’s YLDS Stablecoin to Strengthen Tokenized Treasury Fund

- Ondo Finance bought $25 million worth of Figure’s yield-bearing stablecoin YLDS.

- The stablecoin will be added to the reserves backing Ondo’s tokenized U.S. Treasury fund.

- OUSG currently holds products from major firms like BlackRock, Fidelity, and Franklin Templeton.

- Figure has originated over $19 billion in loans and recently completed a Nasdaq IPO.

- Crypto-backed lending is expanding globally across fintechs, lenders, and exchanges.

Ondo Finance has expanded its onchain Treasury reserves with a $25 million purchase of YLDS, a yield-bearing stablecoin issued by Figure Technology Solutions. The company announced that this investment will become part of the backing for its tokenized U.S. Treasurys fund, further diversifying the assets that support its products.

The addition of YLDS complements Ondo’s existing reserves, which already include tokenized Treasury products from major traditional asset managers such as BlackRock, Fidelity, Franklin Templeton, and WisdomTree. Ondo’s goal is to build a broad and resilient portfolio for its onchain offerings while giving institutional investors more transparent access to real-world assets on the blockchain.

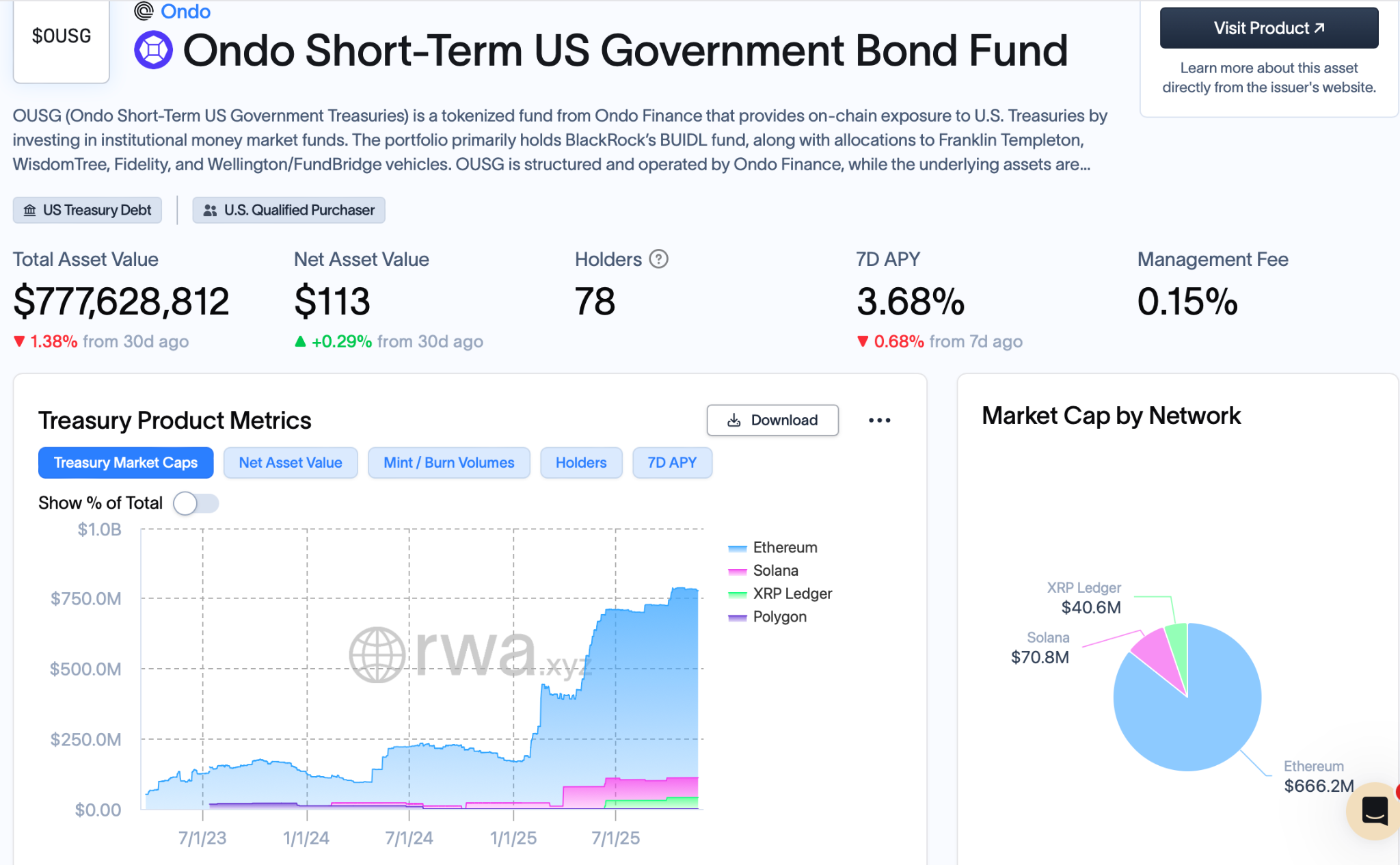

Ondo’s flagship product, the Ondo Short-Term US Government Bond Fund (OUSG), provides onchain exposure to short-term U.S. Treasurys. The fund offers 24/7 redemptions and an estimated annual return of 3.68%, making it one of the most notable tokenized Treasury products in the market. With approximately $777 million in total value locked, OUSG continues to attract growing institutional interest in tokenized real-world assets.

Figure Technology Solutions, the issuer of YLDS, operates a lending and capital-markets network on the Provenance blockchain. The company has originated over $19 billion in loans, including home-equity products, mortgages, and crypto-secured lending. Its recent Nasdaq IPO has strengthened industry confidence, and its stablecoin YLDS now holds a market cap of around $100 million, according to DefiLlama.

Since its launch in 2021, Ondo Finance has focused on bringing traditional finance products onchain. In October, the company expanded tokenized assets to BNB Chain, offering more than 100 stocks and exchange-traded funds in tokenized form. It also gained regulatory approval from the Liechtenstein Financial Market Authority (FMA) to offer tokenized stocks in Europe, marking another step toward global expansion.

The move comes at a time when crypto-backed lending is seeing renewed momentum worldwide. Fintechs, stablecoin issuers, and major exchanges are reviving crypto-collateralized loan services, driven by growing demand from both institutional and retail users. In Australia, Block Earner launched Bitcoin-backed home loans that allow customers to borrow up to half the value of a property. In the United States, Tether recently invested in Ledn, which originated over $390 million in Bitcoin-backed loans in the third quarter.

Centralized exchanges are also pushing deeper into this market. Coinbase rolled out Ether-backed loans for U.S. users, offering up to $1 million in USDC against ETH collateral. Since launching its onchain lending operations earlier this year, Coinbase has processed over $1.28 billion in loan originations, based on Dune data.

Together, these developments show a growing trend: tokenized assets and crypto-backed lending are becoming major pillars in the evolving digital finance ecosystem. Ondo’s investment in YLDS is another step in building a stronger infrastructure for tokenized real-world assets.

Final Thought

Ondo’s purchase of $25 million in YLDS is more than a diversification move — it reflects a larger shift in finance. As tokenized assets and crypto-secured lending gain momentum worldwide, traditional institutions and blockchain-native platforms are merging faster than ever. This trend is likely to accelerate through 2025 and beyond.