Pump.fun Cashes Out $436M as Memecoin Trading Weakens After Market Crash

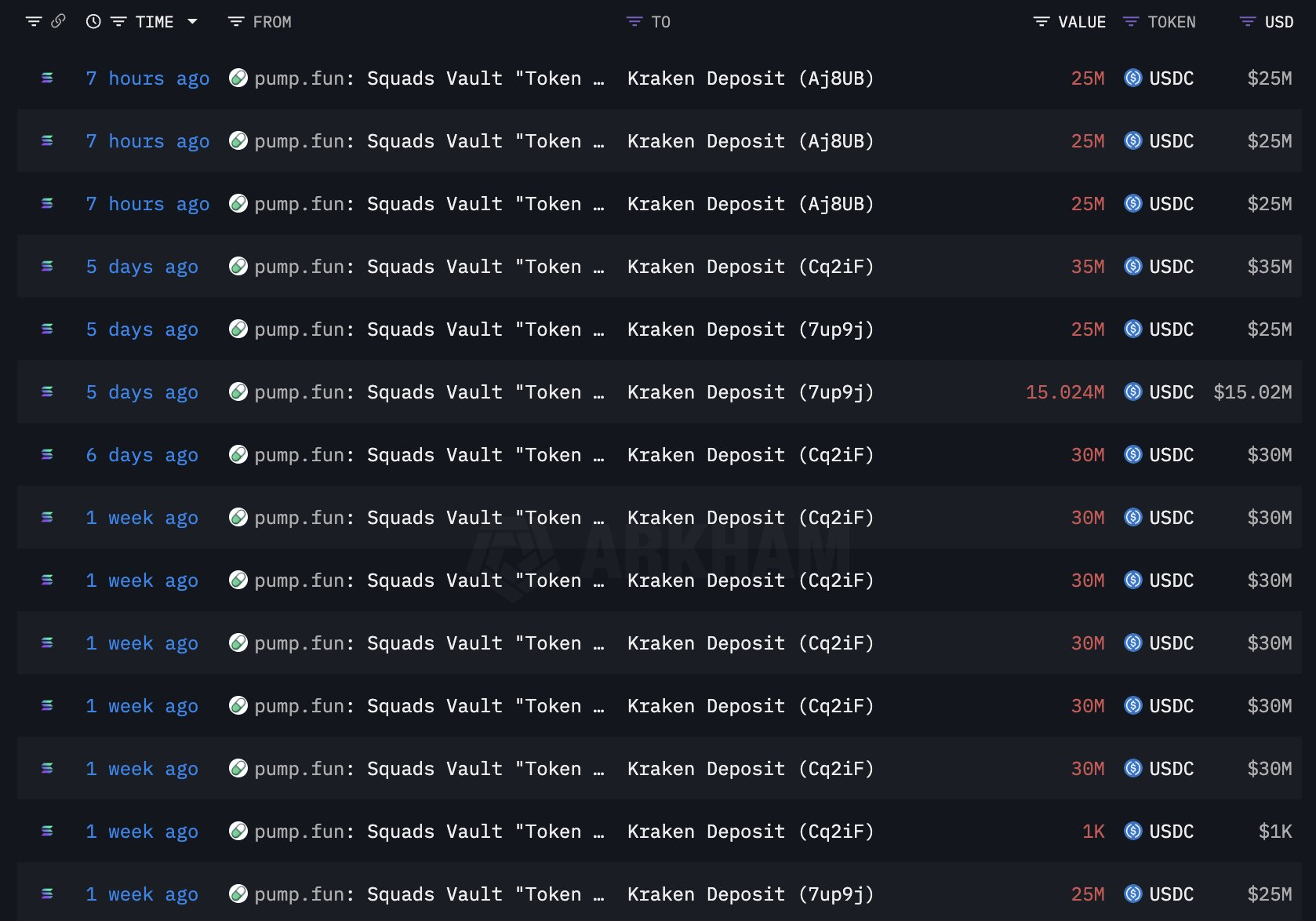

- Pump.fun transferred over $436M in USDC to Kraken since mid-October.

- The cash-out follows a massive $19B market crash that reduced memecoin trading activity.

- Pump.fun’s revenue fell by 53% from September to November.

- Investors worry the transfers signal more selling pressure.

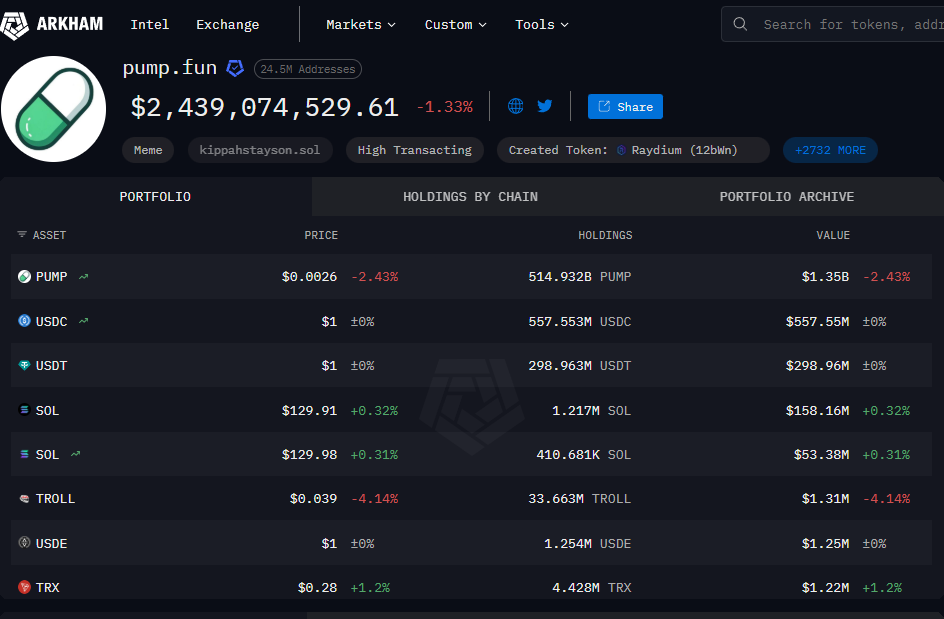

- The platform still holds around $855M in stablecoins and $211M in SOL.

Pump.fun, the popular Solana-based memecoin launchpad, is drawing attention after moving more than $436 million in stablecoins to crypto exchange Kraken. These transfers began shortly after the major $19 billion crypto market crash in mid-October, which weakened speculative trading and sharply reduced activity across memecoin markets.

Blockchain analysts from Lookonchain first spotted the transfers, noting that Pump.fun started sending large amounts of USDC to Kraken beginning October 15. The timing suggests the platform’s operators may be cashing out during a period of falling revenue and declining investor appetite. After the October crash wiped out speculative confidence, memecoin traders became more cautious, leading to lower volume and fewer launches.

Data from DefiLlama shows Pump.fun’s monthly revenue dropped to $27.3 million in November, marking a 53% decline from September’s $58.9 million. It is the first time since July that revenue has fallen below the $40 million mark. The slowdown reflects a broader trend across the crypto market, where retail traders have been hit by repeated losses and are now participating far less aggressively than earlier in the year.

The large transfers have sparked debate among investors who fear that more selling may follow. Some see the move as a sign that the platform could reduce its holdings or liquidate additional assets, adding further pressure to the market. Others argue that the transactions may not be direct sell-offs but rather internal repositioning or preparation for future treasury actions.

Nicolai Sondergaard, a research analyst at Nansen, said memecoin activity had already been declining before the October crash, but the market wipeout “accelerated the slowdown.” He noted that retail traders have been burned multiple times recently, so it is not surprising to see less enthusiasm across the sector. Sondergaard also pointed out that this is not the first time Pump.fun has been associated with large sell-offs, so investors expect the possibility of continued selling.

Onchain data adds more context. According to Arkham Intelligence, Pump.fun’s wallet still holds around $855 million in stablecoins and about $211 million in Solana (SOL). This means the platform still manages a significant treasury even after the $436 million transfer. Analyst EmberCN wrote that the funds likely come from institutional private placements of the $PUMP token conducted in June at a price of $0.004, suggesting the transfer may be part of a long-planned process rather than a panic-driven liquidation.

Still, the move has caught the attention of traders across X (formerly Twitter). Some users warn that Pump.fun is behaving like a “full-time liquidation machine,” while others say it highlights the fading momentum behind memecoins after months of hype-driven growth. With trading volumes shrinking and market sentiment shifting, the platform’s future revenue may depend on whether speculative appetite returns or continues to fade through the end of the year.

Pump.fun has not yet provided a full explanation for the large cash-out, though a spokesperson said the team will comment when they have time. For now, the transfers reflect the current uncertainty in the memecoin sector and the broader crypto landscape following the October crash.

Final Thought

Pump.fun’s $436 million stablecoin transfer marks one of the largest treasury moves in the memecoin ecosystem this year. Whether it signals a long-term trend or a simple internal shift, the platform’s falling revenue and weakened trader sentiment show that the memecoin mania is losing steam as the market adjusts after the October crash.