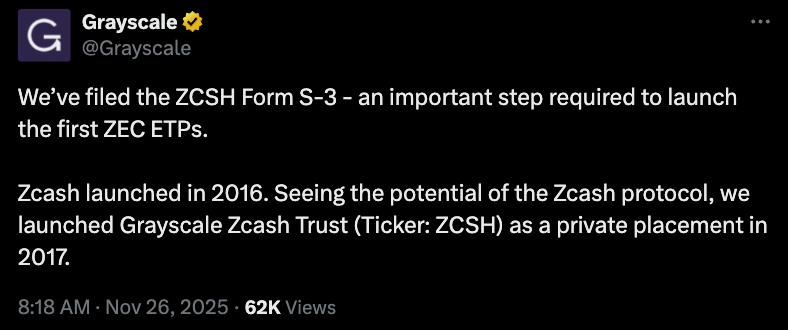

Grayscale Files With SEC to List Zcash ETF

- Grayscale has filed to convert its Zcash Trust into a spot ETF.

- The ETF would be listed on NYSE Arca, becoming the first tied to a privacy coin.

- Zcash (ZEC) has surged over 50% in 30 days and 1,050% in 12 months.

- The filing follows Grayscale’s expansion into other crypto spot ETFs, including Bitcoin, Ether, Dogecoin, and XRP.

- Analysts are debating whether privacy-focused investors are shifting away from Bitcoin toward Zcash.

Grayscale has taken a major step toward launching the first U.S. spot exchange-traded fund linked to a privacy coin. In a new filing submitted Wednesday, the company lodged a Form S-3 registration statement with the U.S. Securities and Exchange Commission, aiming to convert its existing Zcash Trust into a fully tradable spot Zcash ETF. If approved, the new fund would be listed on the NYSE Arca exchange.

The move comes as Grayscale continues expanding its suite of crypto-based ETFs. Since the SEC approved spot Bitcoin ETFs in January 2024, asset managers—including Grayscale, BlackRock, and Bitwise—have accelerated efforts to list ETFs tied to a wider range of cryptocurrencies. Grayscale has already launched spot ETFs for Bitcoin, Ether, Dogecoin, and XRP, with the company’s newly listed DOGE ETF recording $1.4 million in trading volume on its opening day this week.

Zcash’s steep price appreciation has added momentum to the filing. Data from Nansen shows that ZEC climbed more than 50% over the last month and soared more than 1,000% in the past year, bringing the token to around $519 at the time of the filing. The privacy coin’s strong performance has drawn growing attention from both retail traders and institutional investors who value encryption-based financial privacy.

The potential introduction of a Zcash ETF has also reignited ongoing debates within the crypto community. Earlier this month, Leap Therapeutics revealed plans to use a $50 million investment from Winklevoss Capital to acquire ZEC as part of its long-term digital asset strategy. Following the announcement, ETF analyst Eric Balchunas suggested that the rising interest in Zcash could shift some investor demand away from Bitcoin as users seek stronger privacy protections. However, many industry participants remain skeptical, arguing that Bitcoin’s dominance and liquidity make such a transition unlikely.

If approved, Grayscale’s Zcash ETF would mark a significant milestone for privacy-focused digital assets, bringing one of the crypto sector’s earliest privacy coins into the regulated investment arena.

Final Thought

Grayscale’s latest filing signals growing institutional interest in privacy coins, an area of crypto that has historically faced regulatory pressure. If successful, the Zcash ETF could open a new chapter for privacy-focused assets, giving mainstream investors regulated access to a category of tokens rarely included in traditional finance products.