Bitcoin Mining Difficulty Expected to Rise in December as Hashprice Stays Near Record Lows

- Bitcoin mining difficulty is expected to rise again on Dec. 11.

- Hashprice remains near historic lows, putting pressure on miners.

- Difficulty recently dropped but the relief is likely temporary.

- Rising energy costs, regulations, and geopolitical tensions add more stress to the mining sector.

- A U.S. investigation into Bitmain could cause major hardware supply issues.

Bitcoin miners may be heading into a challenging December as key metrics suggest that mining conditions will tighten once again. The next Bitcoin difficulty adjustment, expected on December 11, is forecast to push difficulty slightly higher, even though miners just experienced a rare moment of relief from a recent difficulty drop.

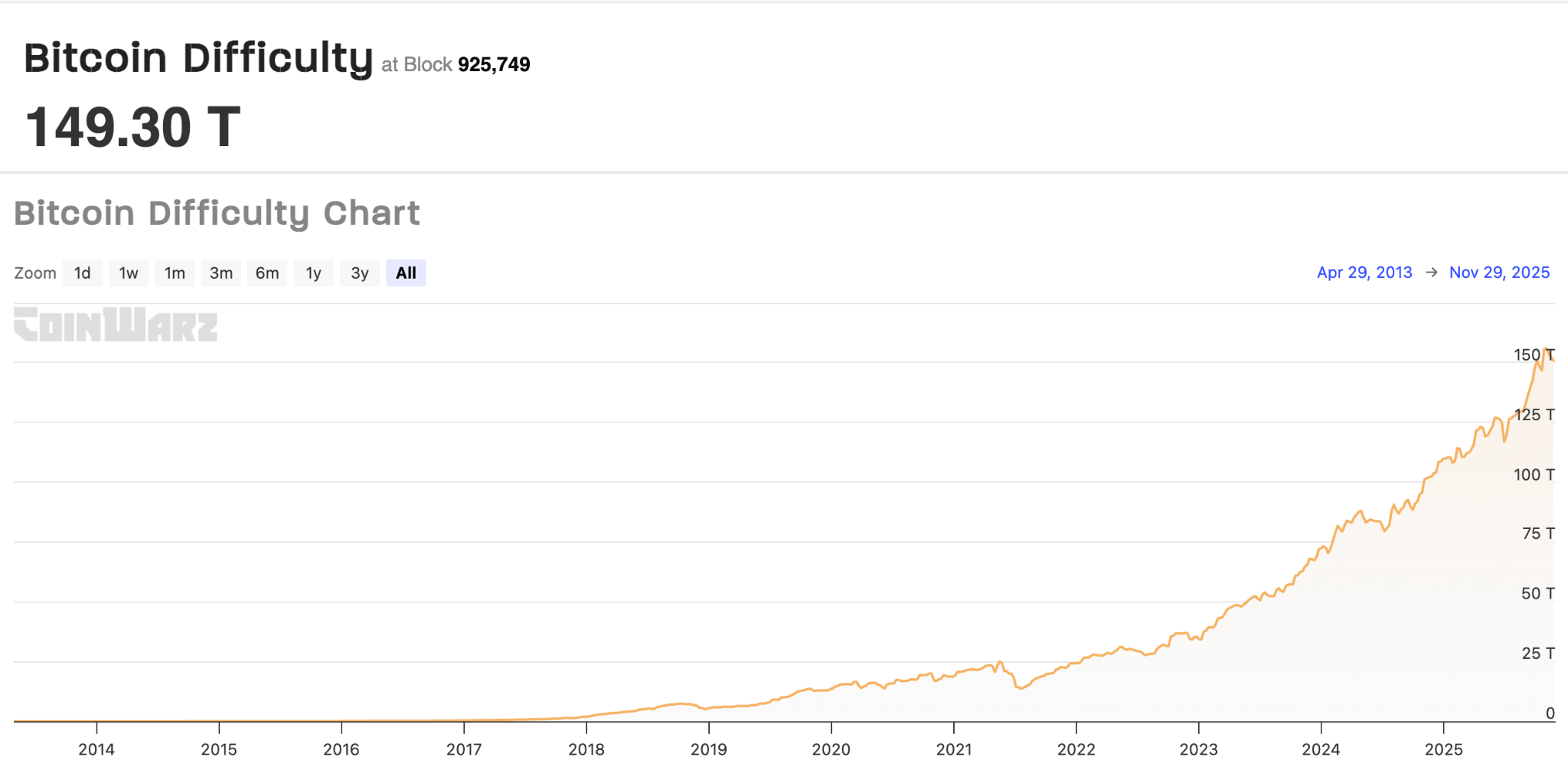

According to CoinWarz, the upcoming adjustment at block 927,360 is projected to increase difficulty from 149.30 trillion to around 149.80 trillion. While the increase is small, it comes at a time when hashprice — a major indicator of miner profitability — is hovering close to all-time lows.

During the latest adjustment on Thursday, difficulty fell from 152.2 trillion to 149.3 trillion, and block times averaged 9.97 minutes, slightly faster than Bitcoin’s 10-minute target. However, the benefit of this drop is being overshadowed by weak hashprice levels.

Hashprice is currently around $38.3 per PH/s per day, recovering slightly from the record lows below $35 seen on November 21, according to Hashrate Index. Miners typically see $40 PH/s as the break-even point — meaning that at current prices, many miners are operatingBitcoin’s mining difficulty from 2014-2025. Source: CoinWarz with extremely thin margins or considering shutting down unprofitable machines.

Beyond the raw metrics, broader challenges continue to weigh on the mining industry. Rising energy prices, pressure from local regulators, and geopolitical tensions between the United States and China all create uncertainty for mining operations. These risks could intensify in the coming months, especially if difficulty continues to rise while miner revenue remains historically weak.

Adding to the pressure, the U.S. Department of Homeland Security is investigating Bitmain, the largest global supplier of ASIC mining hardware. The investigation aims to determine whether Bitmain’s machines can be remotely accessed or used for espionage — a claim raised in 2024 by U.S. Senator Elizabeth Warren.

Bitmain controls about 80% of the ASIC market, according to the University of Cambridge. Any potential sanctions, tariffs, or restrictions on the company could spark severe supply chain disruptions, making it harder and more expensive for miners to upgrade equipment. Such a scenario would further squeeze miners already struggling with low profitability.

With a rising difficulty forecast and hashprice near the lowest levels in Bitcoin’s history, December could bring fresh challenges for miners worldwide.

Final Thought

Bitcoin miners are entering December with growing uncertainty. Difficulty is expected to rise again, hashprice remains near historic lows, and external pressures — from regulations to geopolitical risks — are piling up. The industry may need stronger Bitcoin price performance or major cost reductions to avoid deeper stress in the coming months.