10x Research Suggests Shorting Ether as a Smart Hedge Against Bitcoin

- 10x Research says shorting Ethereum (ETH) could hedge against Bitcoin (BTC) exposure

- Ethereum shows structural risks as institutional capital flows mostly to Bitcoin

- ETH price could drop below $3,000, possibly to $2,700 if support fails

- Report highlights BitMine’s ETH strategy and breakdown in PIPE transparency

- 15 Ether treasury firms hold a combined 4.7 million ETH

- Tom Lee remains bullish, predicting $10,000 ETH, but market sentiment stays cautious

Crypto market research firm 10x Research has suggested that shorting Ethereum (ETH) could be an effective hedge against Bitcoin (BTC), as institutional investors continue to favor Bitcoin over Ether.

In its latest report, 10x Research highlighted that Ethereum-focused firms are running out of liquidity, while Bitcoin remains the dominant choice for institutional treasuries. The analysts argued that Ethereum faces structural weaknesses, with less transparency in private investment in public equity (PIPE) funding and fewer new inflows from major capital sources.

“Digital asset treasury narratives around Ethereum are starting to break down,” the report stated. “Institutions once accumulated ETH and distributed it to retail investors — a cycle that’s now fading.”

The report pointed to BitMine, one of the largest ETH treasury firms, as an example. According to 10x Research, BitMine’s model allowed institutions to acquire ETH at par value and sell it to retail buyers at a premium, creating a positive feedback loop that boosted prices. However, that cycle appears to be slowing as market dynamics shift toward Bitcoin.

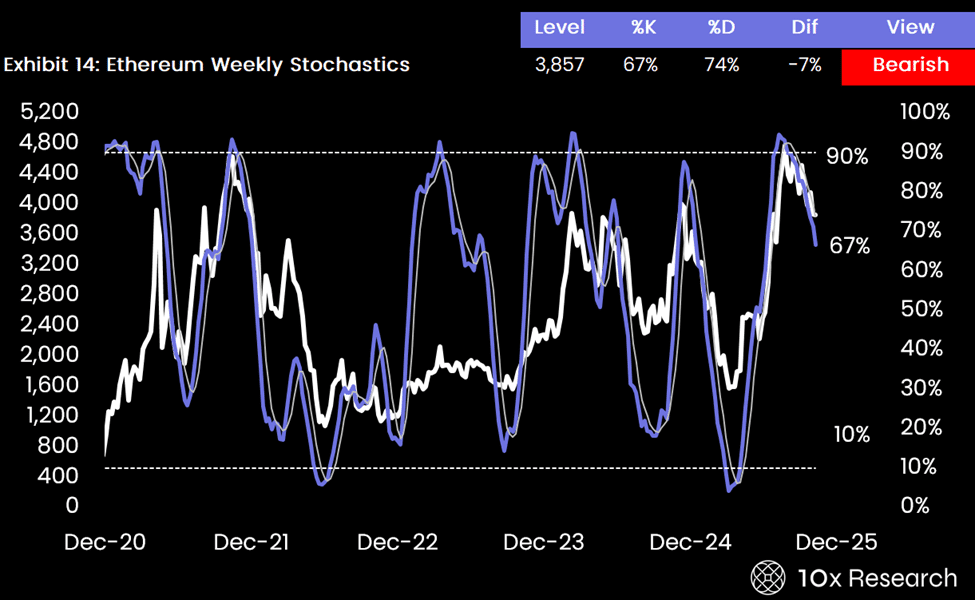

From a technical standpoint, 10x Research warned that Ether could see further downside if support around $3,000 breaks, potentially dropping to $2,700. The firm cited bearish stochastic signals and a false breakout pattern similar to the one observed earlier in 2025.

“The weekly stochastics are flashing a topping signal,” the researchers said. “Ether’s recent price action mirrors previous failed rallies, suggesting exhaustion.”

Meanwhile, data from CoinGecko shows there are currently 15 Ethereum treasury companies holding a total of 4.7 million ETH, with BitMine leading at 3.3 million ETH, followed by SharpLink and Bit Digital.

Despite recent volatility and waning ETF demand, BitMine chair Tom Lee continues to predict a major rebound, maintaining his $10,000 ETH price target. He argues that Ether has been consolidating since 2021 and remains fundamentally strong.

Still, broader market sentiment has turned cautious following the $19 billion crypto liquidation event on Oct. 10 — the largest in history. Since then, ETH and other major assets have struggled to recover, raising questions about whether institutional investors will return to Ethereum in the near term.

Final Thought

10x Research’s call to short Ether reflects a growing divide between Bitcoin’s institutional strength and Ethereum’s market uncertainty. While some remain optimistic about ETH’s long-term potential, near-term signals suggest traders may find better balance by hedging ETH against Bitcoin exposure amid cooling market confidence.