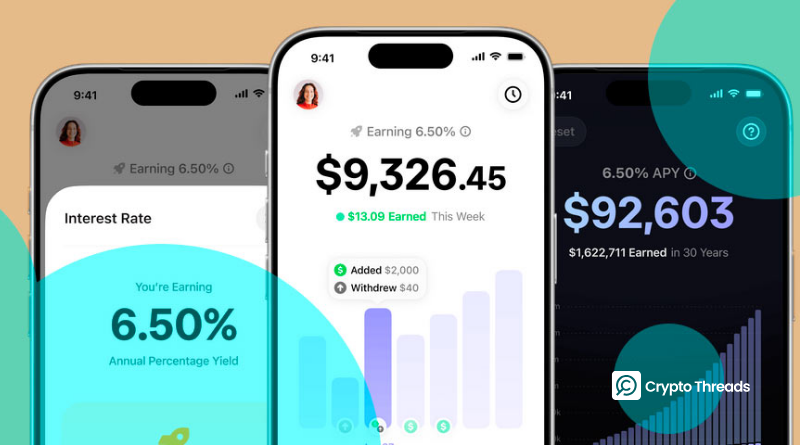

Aave Launches Retail Savings App With Up to 9% APY to Compete With Banks

- Aave launches a new retail savings app offering 5%–9% APY

- Real-time interest tracking and instant withdrawals

- Supports bank transfers, debit cards, and stablecoins

- Includes up to $1 million in balance protection

- Targets users frustrated with low bank savings rates

- Part of a broader trend where crypto platforms challenge traditional banks

- Comes during a period of rising inflation and higher demand for better savings tools

Aave, one of the leading decentralized finance (DeFi) protocols, has expanded into consumer banking with the launch of its new Aave App, a savings product designed for everyday users. The app offers 5% to 9% APY, significantly higher than what most banks currently provide. Traditional savings accounts often offer between 0.4% and 4% APY, and many users struggle to beat rising inflation with those returns. Aave’s new tool aims to offer a better alternative.

A savings experience built for normal users

The new Aave app focuses on simplicity. Users can deposit money directly from thousands of banks, debit cards, or supported stablecoins. The app also tracks interest in real time, allowing users to see exactly how much they earn each moment. Unlike many financial platforms, Aave also offers instant withdrawals, meaning users can access their money at any time without waiting periods or delays.

To make the app more appealing to mainstream users, Aave introduced up to $1 million in balance protection. This level of protection is uncommon in DeFi and shows Aave’s goal of attracting users who want the security of traditional banking with the strong returns of crypto.

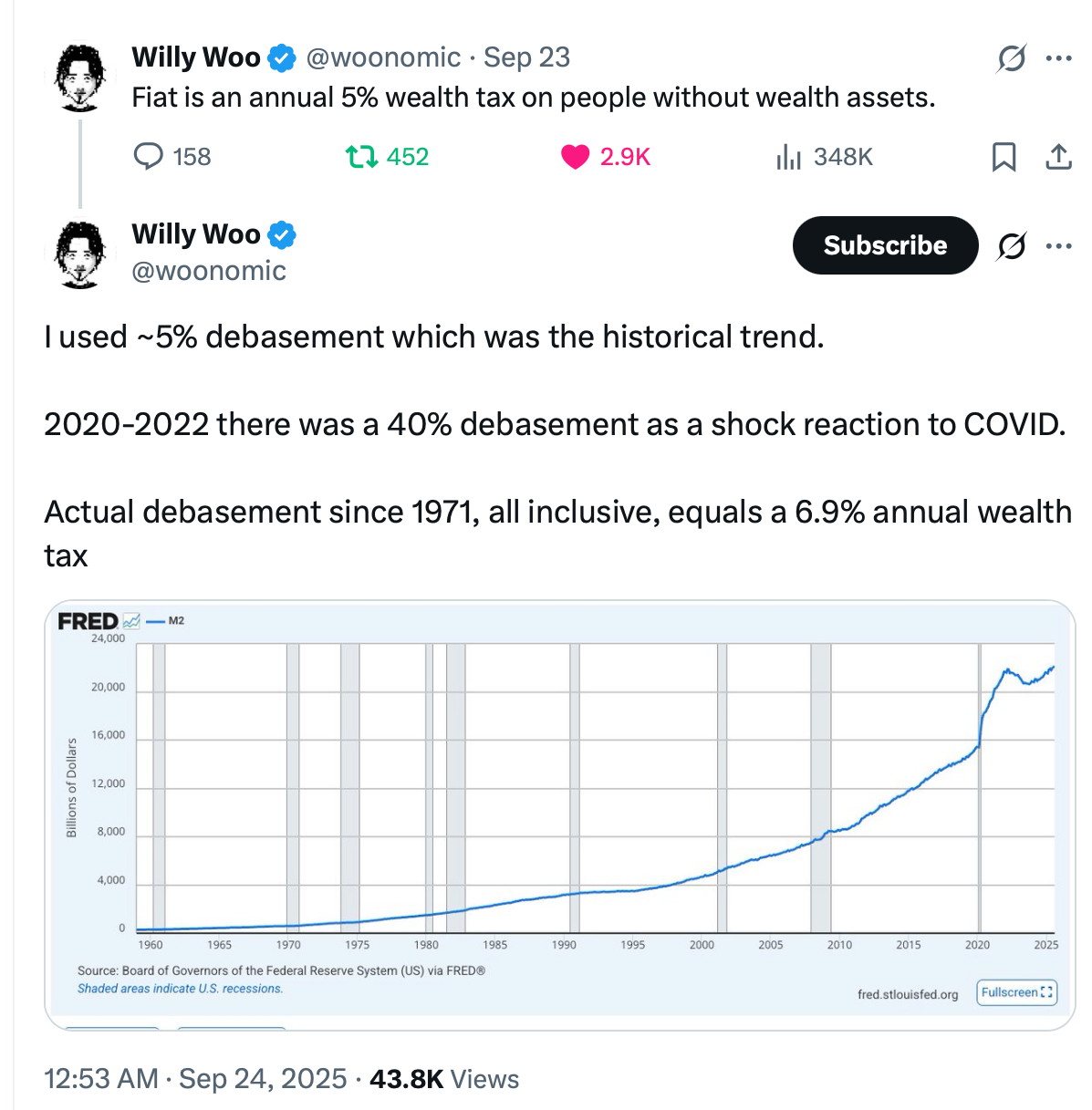

Why crypto yields matter right now

The launch comes at a time when inflation continues to affect people around the world. According to on-chain researcher Willy Woo, the traditional U.S. dollar system works like an annual “wealth tax.” He estimates the dollar loses around 6.9% of its value every year, and highlighted that the U.S. money supply increased by 40% between 2020 and 2022. This means money sitting in regular bank accounts often loses purchasing power over time.

This environment has pushed more users to look for higher-yield savings options. Cryptocurrency platforms—especially those offering stablecoin yields—have become a popular solution. Even though the U.S. GENIUS Act banned yield-bearing stablecoins directly from issuers, it did not stop third-party platforms from offering yield products built on top of stablecoins.

Crypto companies are stepping into banking territory

Aave is not the only company moving into this space.

- In September, Coinbase partnered with the Morpho DeFi protocol to offer users up to 10.8% APY on USDC deposits.

- Coinbase also gives 4.5% APY for holding USDC on its platform.

- Crypto.com joined the trend by offering stablecoin lending vaults through Morpho, allowing users to earn yield using wrapped ETH or BTC as collateral.

These moves show that crypto platforms are slowly taking over roles that traditional banks have held for decades—especially savings accounts. Many users now see crypto platforms as offering better returns, more flexibility, and faster access to funds.

Banks are reacting

Traditional financial institutions see these products as competition. On November 5, several major banking groups asked the U.S. Treasury to extend the stablecoin interest ban to crypto platforms such as exchanges and lending protocols. They want the same restrictions to apply across the entire digital asset sector to prevent users from leaving banks for higher-yield crypto options.

Still, demand for higher-yield savings tools continues to grow, and Aave’s new app enters the market at a time when consumers are actively searching for alternatives.

Final Thought

Aave’s new retail savings app could become one of the most attractive options for modern savers. With high yields, instant access, strong balance protection, and an easy-to-use interface, Aave is positioning itself as a real competitor to traditional banks. As inflation remains high and banking rates stay low, more users may move toward crypto-based savings solutions like Aave’s app. This launch shows how DeFi is merging with mainstream finance faster than ever before.