AI Security Upgrades for Cross-Chain Protection

The rapid growth of decentralized finance has expanded far beyond single-network ecosystems. Traders move seamlessly across Ethereum, BNB Chain, Polygon, and dozens of others. Liquidity shifts are increasingly multi-chain, and new bridges are the arteries of DeFi. But as this activity grows, so does the risk: bridge exploits, malicious tokens, and scam contracts have siphoned billions from users.

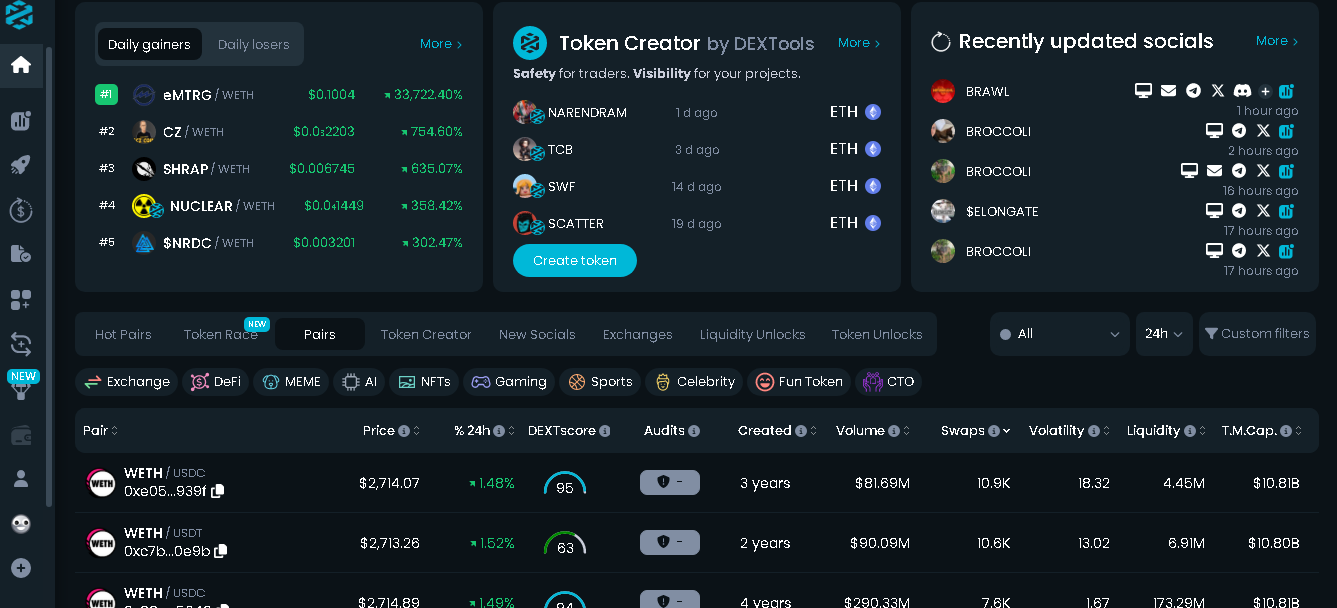

For a platform like DEXTools, which serves as the trusted hub for real-time DeFi trading analytics, providing cross-chain protection has become just as critical as delivering price charts and pool data. That’s why DEXTools has steadily expanded its AI-enhanced security features, giving traders new tools to stay ahead of threats while operating across chains.

The Challenge of Multi-Chain Risk

Trading on-chain is inherently different from trading on centralized platforms. Each trade involves interacting with smart contracts, liquidity pools, and often cross-chain bridges. While this transparency is powerful, it also exposes users to risks:

- Malicious contracts designed to drain wallets

- “Honeypot” tokens that allow buys but block sells

- Sudden liquidity withdrawals that collapse a pool

- Fake tokens mimicking legitimate projects

- Exploits in cross-chain bridges that break liquidity routes

Without protection, these risks make multi-chain DeFi intimidating even for experienced traders. DEXTools has positioned itself as a safety layer, providing not just data but actionable insights powered by AI and integrated security partnerships.

AI-Powered Contract Analysis

At the core of DEXTools’ security approach is intelligent contract scanning. The platform integrates with partners like GoPlus Security to analyze tokens in real time. These tools look for suspicious code patterns, liquidity anomalies, and developer wallet activity, flagging tokens that may be unsafe.

For the everyday trader, this translates into immediate risk signals inside the DEXTools App. A token that carries red flags—such as a hidden mint function, a high concentration of supply in one wallet, or unusual liquidity lock behavior—will be marked before a trader commits funds.

Instead of forcing traders to manually audit contracts, DEXTools’ AI layer brings those checks directly into the interface.

Rug Check and Token Security Attributes

DEXTools’ Rug Check tool is one of the most widely used features in its ecosystem. By applying AI models and security partner feeds, Rug Check evaluates whether a token exhibits common scam patterns.

This includes analyzing:

- Liquidity status (is liquidity locked or unlockable by the developer?)

- Sellability (are users able to sell freely, or is it a honeypot?)

- Holder concentration (is one wallet holding the majority of supply?)

- Contract privileges (can the contract change fees or block wallets?)

When paired with GoPlus Security’s real-time attribute database, these checks create a layered defense. Traders don’t have to guess; they see clear warnings that help them avoid fraudulent assets before interacting.

Multi-Chain Visibility and Safer Navigation

One of DEXTools’ strengths has always been its multi-chain support. Users can track tokens and pools across Ethereum, BNB Chain, Polygon, Arbitrum, and more. With each added network, the complexity of safe navigation grows—scammers often exploit bridges and token wrappers to trick users.

Here again, DEXTools enhances protection with cross-chain visibility. By embedding AI-driven analysis directly into its dashboards, traders can verify whether a token on one chain is genuine, trace its liquidity, and spot inconsistencies across networks.

Instead of jumping blindly between chains, users gain a consolidated view, making it easier to identify safe routes and avoid duplicates or fakes.

The Role of AI in Real-Time Alerts

Another layer of DEXTools’ security upgrade is its focus on real-time anomaly detection. The AI models that power token scanning don’t just provide one-time audits; they continuously monitor trading behavior.

If sudden liquidity is pulled, or a contract begins acting in unexpected ways, DEXTools can flag these shifts instantly. This live feedback loop is crucial for cross-chain trading, where markets can move within seconds.

For traders, the benefit is simple: don’t get caught by surprise. With DEXTools, they can see warning signals as conditions change, rather than after losses occur.

Why This Matters for Cross-Chain Protection

The rise of multi-chain DeFi has created new opportunities but also new attack surfaces. A single weak contract or exploited bridge can compromise millions in value. By integrating AI-powered scanning, risk flags, and partner security feeds into its platform, DEXTools helps traders navigate this environment with confidence.

These upgrades aren’t about eliminating all risk—that’s impossible in DeFi—but about tilting the odds back in the trader’s favor. With better information, real-time warnings, and trustworthy contract analysis, users can make smarter, safer moves across chains.

Conclusion

As DEXTools continues to evolve, its mission remains clear: to be more than a charting tool. It is becoming a security-aware trading assistant, where AI doesn’t just analyze prices but also protects users from malicious actors.

For traders exploring the expanding world of cross-chain DeFi, this means one thing: the DEXTools App is not just where you trade—it’s where you trade safer.