How the Alvara × DEXTools AMA Unlocks DeFi Multi‑Asset Basket Tools

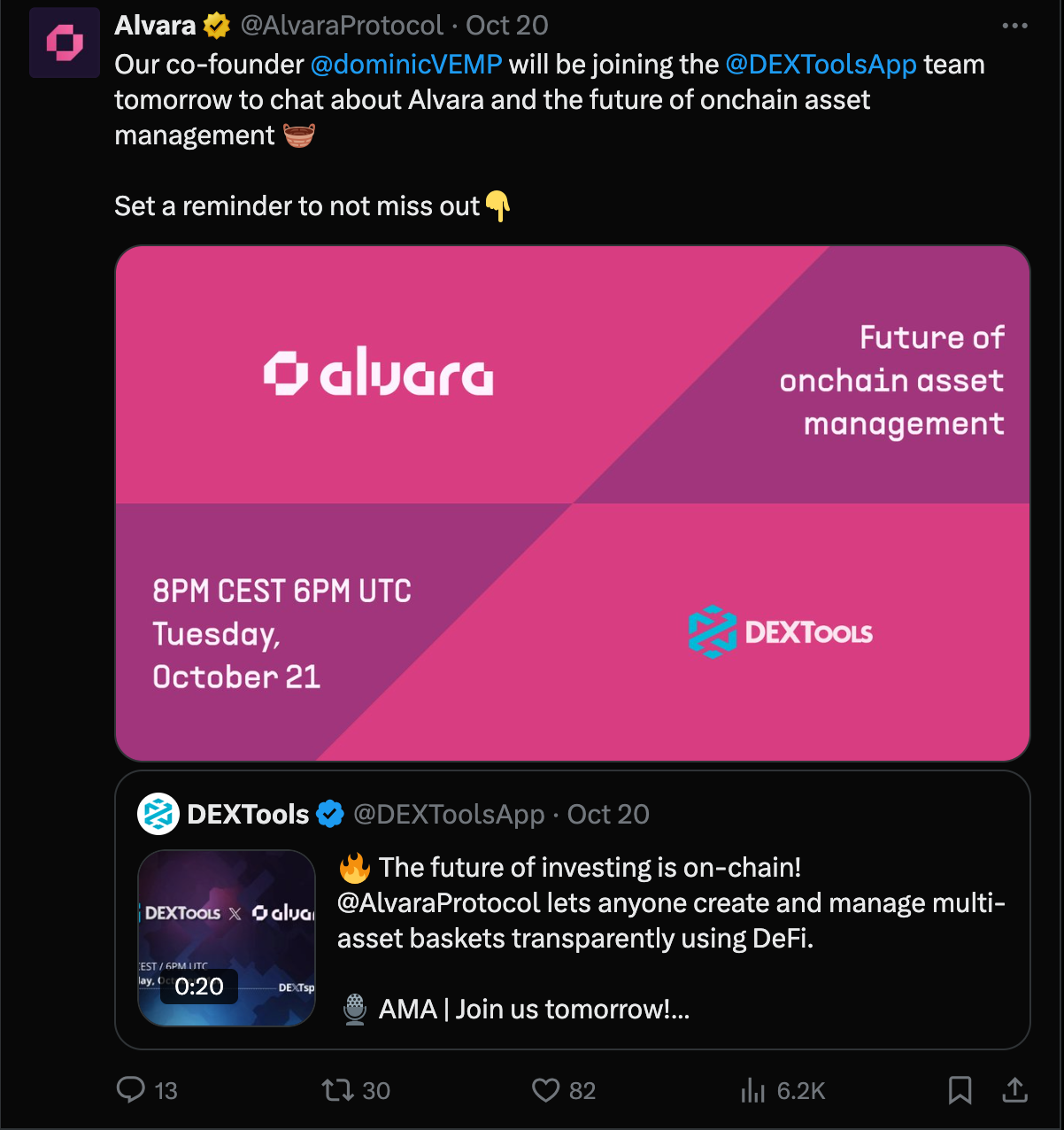

On October 21, 2025, DEXTools hosted a live AMA with the co‑founder of the Alvara Protocol, exploring the evolution of decentralized finance through multi‑asset baskets. This collaboration showcased how Alvara’s on-chain basket framework is reshaping portfolio management, offering traders, analysts, and builders new ways to diversify, track, and monetize their assets while staying fully on-chain.

Alvara functions as a “basket factory” protocol using the ERC‑7621 Basket Token Standard, which allows users to mint tokens representing entire multi-asset portfolios. Anyone can become a basket manager by designing a portfolio of ERC‑20 tokens. Once deposited, the system purchases, weights, and wraps the tokens into a single basket token (BSKT), which represents the combined portfolio. Beyond holding the value of the underlying assets, BSKTs allow managers to earn revenue through fees while providing governance rights to token holders, who can vote on strategy, rebalancing, and access rules.

Integration with DEXTools and Implications for Traders

For DEXTools, basket tokens represent a natural extension of its real-time analytics, token-pair tracking, and multi-chain monitoring capabilities. Traders can now follow not only individual tokens or liquidity pools but also entire tokenized portfolios. This integration provides insights into performance, liquidity, and activity, enabling a more sophisticated approach to portfolio tracking.

DEXTools x Alvara Protocol AMA

The AMA emphasized practical considerations for users. Basket composition, manager performance, underlying token liquidity, and fee structures are critical to evaluate. Performance tracking includes monitoring token weights, rebalancing schedules, and accrued management fees. Redemption options allow baskets to be converted back into ETH or underlying tokens, providing liquidity flexibility. DEXTools’ analytics infrastructure enables users to track basket positions, observe large flows, and monitor overall performance, much like with traditional token pairs or LPs.

Moreover, baskets democratize fund management. Users, not just institutional managers, can create and launch baskets, allowing the community to invest while maintaining full transparency on-chain. Basket tokens introduce a new tradable asset class in DeFi, offering exposure to thematic portfolios such as Web3 infrastructure, DeFi ecosystems, or gaming/metaverse sectors, all in a single token.

Strategic Outlook and the Road Ahead

The AMA highlighted the broader significance of multi-asset baskets in DeFi. Transparency, modularity, and permissionless access are core to Alvara’s design, enabling wider participation in basket management and opening new avenues for analytics integration with DEXTools. Tokenized baskets facilitate deeper insights into performance, liquidity, and market trends while offering users diversified exposure in a single, tradable asset.

Looking forward, basket tokens are likely to evolve with features such as dynamic rebalancing, thematic strategies, and automated management incentives. DEXTools will play a crucial role in tracking these innovations by providing basket ranking systems, liquidity monitoring, and performance dashboards. This shift encourages users to move beyond single-token trading toward portfolio-token strategies, deepening engagement with the growing DeFi ecosystem.

Conclusion

The Alvara × DEXTools AMA marks a pivotal step for decentralized finance. Multi-asset baskets are more than tokenized portfolios; they represent a new paradigm for building, tracking, and trading diversified on-chain exposure. By integrating these baskets into its analytics and monitoring tools, DEXTools empowers traders, portfolio managers, and ecosystem builders to navigate the next generation of DeFi with clarity, efficiency, and confidence.