American Bitcoin Corp Stock Crashes 50% as Crypto Proxy Trade Unravels

- American Bitcoin Corp (ABTC) plunges over 50% in early trading.

- Shares now down 78% from September post-listing high.

- Drop follows sharp BTC correction from $126K to below $80K.

- Sell-off hits crypto miners and Bitcoin treasury-heavy companies.

- ABTC reported Q3 profitability and added 3,000 BTC to reserves.

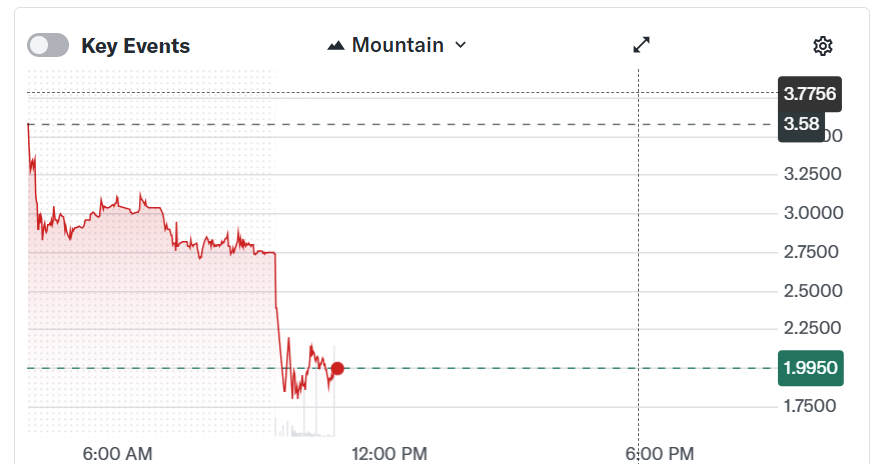

Shares of American Bitcoin Corp (ABTC), the Bitcoin mining and treasury company led by Eric Trump, collapsed on Tuesday as worsening market conditions dragged crypto-linked equities sharply lower. ABTC, which began trading on Nasdaq in early September following its reverse merger with Gryphon Digital Mining, sank more than 50% in early trading. The stock hit an intraday low of $1.75 — a 51% drop on the day — according to Yahoo Finance data.

The decline extends a relentless downtrend for the company, whose shares are now down roughly 78% from their post-listing peak of $9.31 on Sept. 9. The sell-off reflects a broader unwinding across the digital asset sector, with miners and Bitcoin treasury companies facing intense pressure as the crypto market recoils.

While Tuesday’s crash lacked a single clear trigger, crypto-exposed equities have been volatile in recent weeks amid a widespread pullback in digital assets and profit-taking across technology stocks. American Bitcoin’s business remains tightly correlated with Bitcoin’s price action — and BTC has just endured one of its steepest retracements on record, falling from near $126,000 in mid-October to below $80,000 in November.

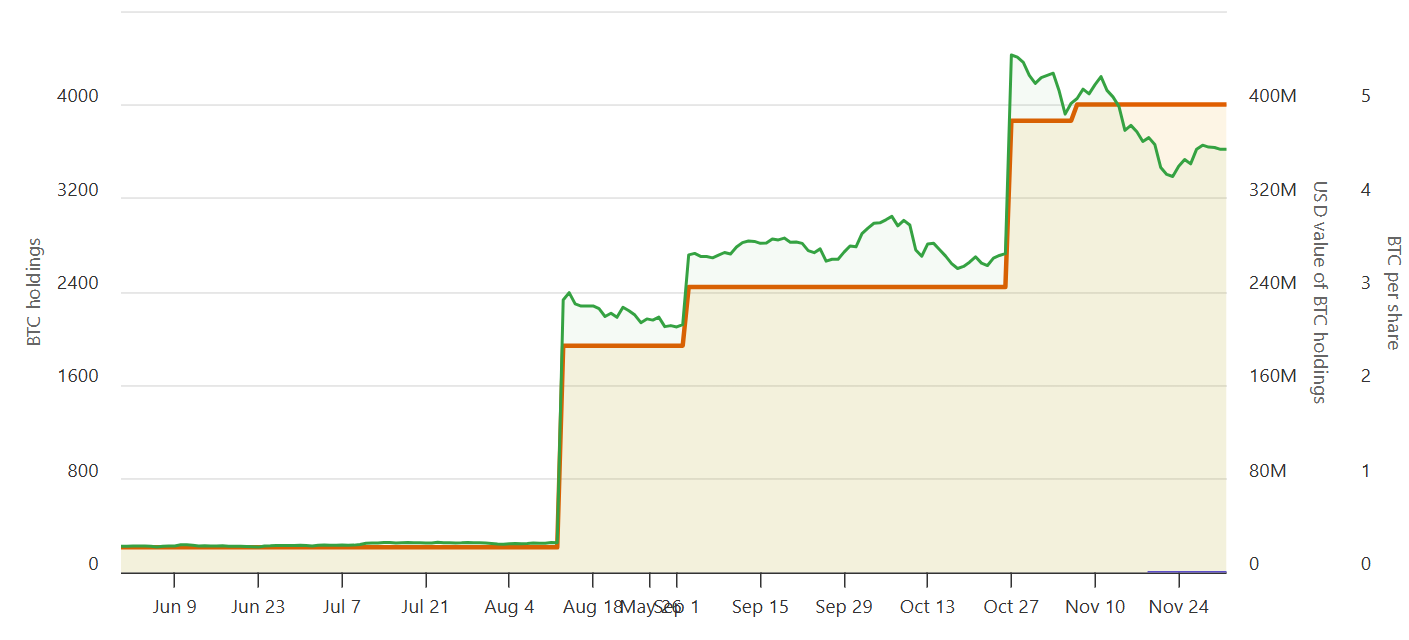

Despite the share-price collapse, ABTC recently posted strong third-quarter results. The company swung to a net profit of $3.47 million, reported $64.2 million in revenue, and expanded its Bitcoin reserves by 3,000 BTC, bringing total holdings to more than 4,000 BTC.

The pain, however, is widespread. Shares of MicroStrategy (MSTR), the largest corporate Bitcoin holder, have plunged more than 50%, pushing its market value below the worth of its BTC treasury. Other miners and Bitcoin-exposed firms have seen similar repricing as investors adjust to the new market reality.

Eric Trump, in comments last month, said he remains unfazed by market volatility, describing it as the “friend” of long-term investors who seek to accumulate assets at lower prices.

Final Thought

ABTC’s dramatic sell-off highlights the fragility of Bitcoin proxy trades during sharp market corrections — even profitable miners with large BTC treasuries are not immune when Bitcoin sentiment breaks.