Analyst Cautions Investors on Bitcoin Stock-to-Flow Model

Meta Description:

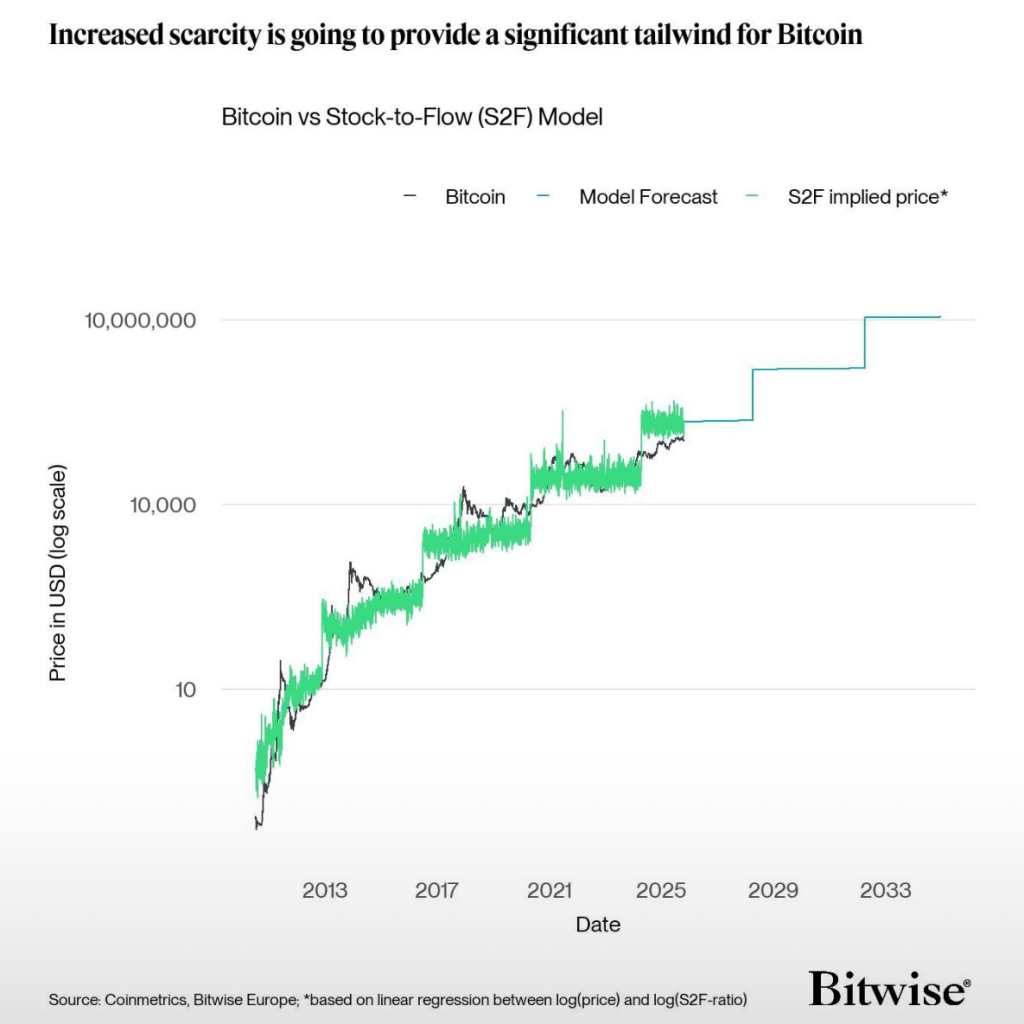

Bitwise analyst André Dragosch warns that the popular Bitcoin Stock-to-Flow model may not accurately predict BTC prices, arguing that institutional demand now plays a much larger role in driving the market.

Key Takeaways

• Bitwise analyst André Dragosch says the Bitcoin Stock-to-Flow model overlooks demand-side dynamics.

• Institutional demand now exceeds the recent halving’s supply cut by seven times.

• The model forecasts a $222,000 BTC peak, but experts say investors should remain cautious.

• Analysts remain split, with price targets ranging from $200,000 to $500,000 through 2026.

• Some industry leaders warn that Bitcoin could still face a major correction.

Stock-to-Flow Model Faces Growing Scrutiny

The Bitcoin Stock-to-Flow (S2F) model, once a favorite among long-term investors, is coming under renewed criticism. According to André Dragosch, head of research for Europe at Bitwise Asset Management, the model may no longer offer an accurate picture of how Bitcoin’s price behaves in today’s market.

Speaking in a recent analysis, Dragosch said the S2F framework fails to include one of the most powerful price drivers, institutional demand. While the model focuses on Bitcoin’s programmed supply halving every four years, it overlooks how new capital inflows through exchange-traded products and institutional holdings now shape the market.

Actual BTC prices vs the implied price from the S2F model. Source: André Dragosch

“Today, institutional demand via Bitcoin ETPs and treasury holdings outweighs the annualized supply reduction from the latest Halving by more than seven times,” Dragosch explained.

The Stock-to-Flow model has long predicted a potential peak price of $222,000 for Bitcoin in this market cycle, based on the asset’s decreasing issuance rate. However, the growing influence of ETFs and corporate accumulation has shifted the balance of power. Dragosch believes these forces now act as a price floor, supporting BTC well above the $100,000 level but also limiting the explosive rallies once seen in earlier cycles.

Institutional Demand Reshapes the Market

The rise of Bitcoin ETFs, ETPs, and other investment products has dramatically altered the asset’s behavior. Institutional investors now control a significant share of circulating BTC, creating stability but also dampening the extreme volatility that the S2F model once captured.

This dynamic has divided analysts. Some still see the model as a useful long-term indicator, while others argue it is outdated in a market driven by liquidity flows, macroeconomic policy, and institutional strategies.

Despite the skepticism, optimism remains. Geoff Kendrick, head of digital asset research at Standard Chartered Bank, expects Bitcoin to reach $200,000 by the end of 2025, noting that recent market pullbacks could create prime entry points for investors.

The flash crash in October that briefly sent BTC below $104,000, Kendrick said, may prove to be a short-term buying opportunity before the next leg up.

Bold Predictions and Cautious Voices

Some analysts are even more bullish. Several forecast Bitcoin could reach $500,000 by 2026, fueled by an expanding M2 money supply, a measure of total global liquidity. Rising M2 typically supports asset prices, as more money flows into investment markets.

However, not everyone agrees. Industry veterans like Tom Lee, CEO of FundStrat, and Mike Novogratz, CEO of Galaxy Digital, have issued warnings against excessive optimism. Novogratz said Bitcoin hitting $250,000 by 2025 would require “crazy stuff” to happen, while Lee cautioned that a 50% drawdown is still possible, even with growing institutional adoption.

A Model Under Pressure

The Stock-to-Flow model was once seen as a blueprint for Bitcoin’s long-term trajectory, but the market has evolved. With ETFs, institutional funds, and global liquidity now driving the narrative, analysts say it’s time to rethink what truly defines Bitcoin’s value.

Dragosch’s message is clear: the halving still matters, but demand matters more. Investors betting solely on the S2F model may be missing the bigger picture, a market shaped by forces far beyond supply reduction.