Aster’s Quiet Relisting on DefiLlama Sparks Transparency Concerns Over Missing Data

- Aster was quietly reinstated on DefiLlama after being delisted over disputed trading data.

- The relisting left significant gaps in historical data, raising concerns about transparency.

- DefiLlama founder 0xngmi called Aster’s data a “black box” and confirmed ongoing issues with verification.

- The incident sparked a broader debate on the role of data providers in decentralized finance (DeFi).

- Aster remains a top performer in certain metrics, despite missing historical data.

Decentralized finance (DeFi) data aggregator DefiLlama has quietly reinstated Aster, a decentralized exchange (DEX), to its platform, weeks after delisting the project due to disputed trading data. The relisting, which took place without a formal announcement, has raised significant questions about data transparency in DeFi, particularly regarding Aster’s reported trading volumes.

The relisting sparked a conversation about the integrity of Aster’s data. Dragonfly Capital managing partner Haseeb Qureshi flagged the return of Aster on X (formerly Twitter), highlighting “big gaps” in historical data. He questioned whether DefiLlama could now verify the authenticity of the numbers. In response, 0xngmi, the pseudonymous founder of DefiLlama, acknowledged the data issues, describing Aster’s data as a “black box.” He confirmed that while the platform is working on developing a more comprehensive system with better metrics, Aster had requested to be reinstated despite the ongoing challenges with verification.

Aster was initially delisted in early October after inconsistencies were discovered in its on-chain trading data. The platform had been unable to verify key information, such as who was making and filling orders, which led to concerns about the potential for wash trading—a form of market manipulation where traders buy and sell from themselves to create a false appearance of activity. On October 6, 0xngmi expressed frustration over the platform’s inability to distinguish legitimate trades from wash trades, further escalating concerns about the transparency of Aster’s operations.

The delisting incident sparked a broader debate within the DeFi community. Supporters of Aster accused DefiLlama of being overly centralized, while critics questioned whether Aster’s rise in prominence was truly organic or artificially inflated. The episode highlighted the challenges of achieving trust and verification in decentralized markets, where the lack of centralized oversight can leave room for ambiguity and manipulation.

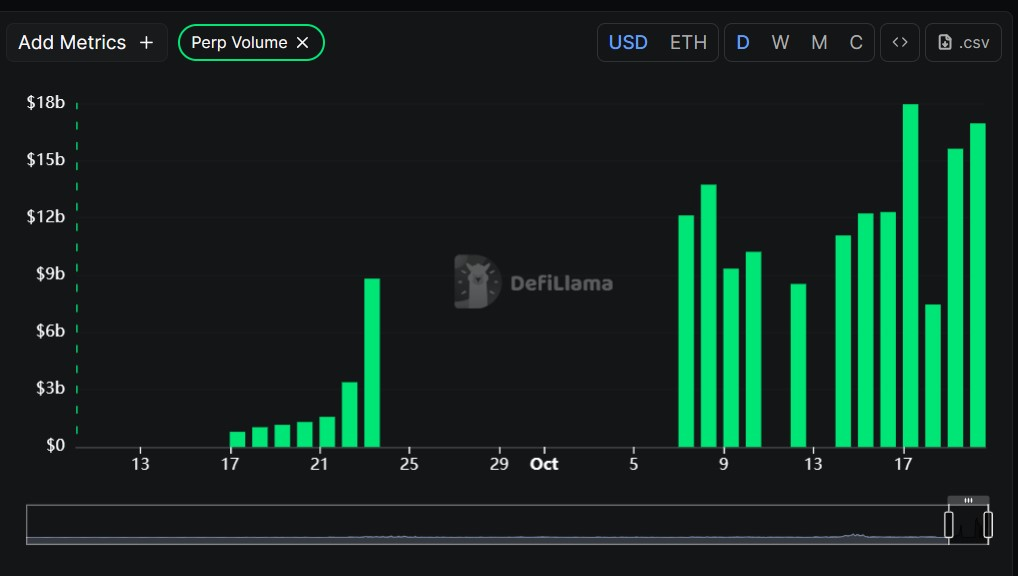

Now that Aster is back on DefiLlama, the data gaps left by the relisting have become a significant issue. Historical metrics such as market-share trends, fee leaderboards, and cumulative revenue charts are fragmented, making longitudinal comparisons difficult. This creates a challenge for traders, analysts, and model builders who rely on consistent data to make informed decisions. In essence, Aster’s historical footprint has been reset, and it remains unclear how the missing data will impact its future performance evaluations.

Despite the missing historical data, Aster continues to perform well in certain metrics. As of the relisting, Aster still leads in 24-hour perp volume and seven-day perp volume, followed by major rivals such as Hyperliquid and Lighter. This suggests that despite the transparency issues, Aster remains a dominant player in the market.

Final Thought

Aster’s quiet relisting on DefiLlama underscores ongoing concerns about transparency and data accuracy in the DeFi space. While the exchange remains one of the leaders in certain metrics, the missing historical data raises serious questions about the reliability of DeFi analytics platforms. As the sector continues to evolve, the need for verifiable, transparent data will only become more critical to maintaining trust and integrity in decentralized markets.