Australia’s Financial Regulator Could Gain Power to Ban Crypto ATMs

- Draft legislation would grant AUSTRAC authority to restrict or ban high-risk financial products, including crypto ATMs.

- Minister Tony Burke says the proposal targets money laundering risks, not an outright ban on crypto ATMs.

- Australia now ranks as the third-largest hub for crypto ATMs, with over 2,000 active machines.

- Providers argue they already comply with strict KYC and blockchain monitoring rules.

- New powers would allow AUSTRAC to decide how to handle high-risk technologies on a case-by-case basis.

Australia’s government is preparing legislation that would give its financial intelligence agency, the Australian Transaction Reports and Analysis Centre (AUSTRAC), the power to restrict or ban cryptocurrency ATMs across the country. The initiative, spearheaded by Minister for Cybersecurity and Home Affairs Tony Burke, aims to address growing concerns over the role of crypto ATMs in facilitating money laundering and other illicit activities.

Speaking at the National Press Club on Thursday, Burke said the draft bill would allow AUSTRAC to take a more proactive role in policing “high-risk products,” including crypto ATMs. He clarified that while the government is not seeking a blanket ban, the new powers would ensure regulators can respond to evolving threats.

“I’m not pretending for a minute that everybody who goes in and uses a crypto ATM is a problem,” Burke said. “But proportionately, what’s happening is a significant problem in an area which is much harder for us to trace.”

The proposal comes amid a surge in the number of crypto ATMs across Australia. Once a slow adopter, the country has seen exponential growth since late 2022, jumping from just 67 machines in August 2022 to over 2,000 today. This rapid expansion has made Australia the third-largest crypto ATM market in the world, trailing only the United States and Canada.

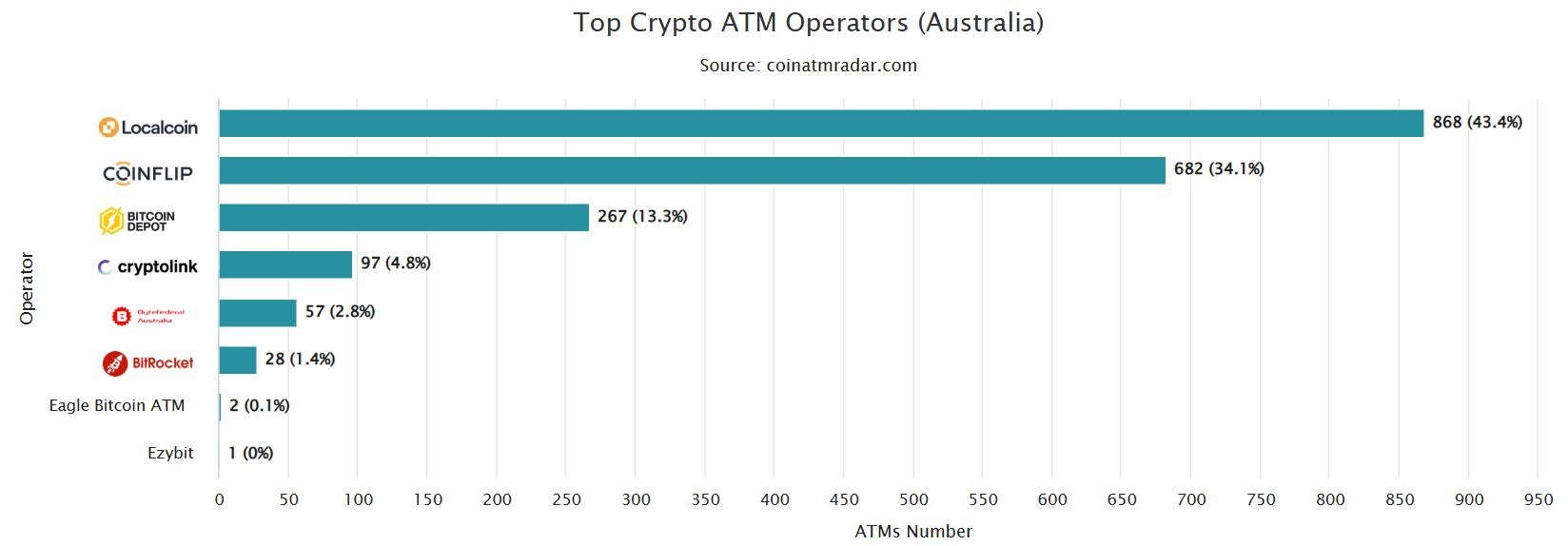

According to data from Coin ATM Radar, three major providers dominate the Australian market: Localcoin (868 ATMs), Coinflip (682), and Bitcoin Depot (267). Representatives from Coinflip told Cointelegraph that crypto ATMs already operate under stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, which include government-issued ID verification before any transaction can occur.

Coinflip added that the machines employ multiple security measures, including real-time blockchain analytics, camera surveillance, and scam alerts. “Crypto ATMs are an important bridge between the physical and digital world,” the spokesperson said, emphasizing that they help onboard new users through a familiar interface.

AUSTRAC has already taken several steps to regulate crypto ATMs. Earlier this year, it imposed new operational rules and transaction limits as part of a wider crackdown on high-risk financial instruments. However, Burke’s proposal would expand AUSTRAC’s mandate further, allowing it to impose bans or restrictions at its discretion if it deems certain products too risky.

Burke made it clear that these powers would be optional rather than prescriptive: “The government won’t be pushing for an outright ban or recommending a specific course of action for AUSTRAC because that might lead to legal challenges,” he said. “Instead, we’re giving them the power to decide whether to ban, restrict, or regulate these devices.”

The Minister noted that the flexibility of the framework is key, as it allows AUSTRAC to react quickly to emerging technologies or loopholes. “I’m not sure what the next thing is going to be,” Burke said. “That’s why they’ll be able to have this power with respect to high-risk products — to decide how best to deal with them as new challenges arise.”

Final Thought

Australia’s move to empower AUSTRAC highlights a growing global trend of tightening oversight on the intersection of crypto and physical finance. While not a direct attack on the crypto industry, the proposal signals the government’s intention to balance innovation with security. As Australia’s crypto ATM sector continues to expand, the outcome of this legislation could set a precedent for how regulators worldwide handle similar technologies.