Australia Eases Stablecoin and Wrapped Token Rules as ASIC Reduces Licensing Requirements

- ASIC removes the need for separate licenses for stablecoin and wrapped-token intermediaries.

- Businesses can now use omnibus accounts with proper record-keeping.

- The update lowers compliance costs and supports digital asset innovation.

- Industry leaders say the rules create a fairer and clearer framework.

- Global stablecoin market hits over $300 billion, growing 48% in 2025.

Australia is making it easier for crypto businesses to operate by updating its rules on stablecoins and wrapped tokens. The Australian Securities and Investments Commission (ASIC) has finalized new exemptions designed to support growth in the digital assets and payments sector. These changes aim to reduce unnecessary regulatory burdens while still keeping important protections in place.

ASIC Removes Licensing Requirements

ASIC announced that it is granting “class relief” for intermediaries who deal with the secondary distribution of certain stablecoins and wrapped tokens. In simple terms, this means companies no longer need to apply for separate Australian Financial Services (AFS) licenses to offer services involving these assets.

This is a major shift because the old licensing system was often slow, costly, and complicated for businesses. Startups, especially, struggled with the high compliance expenses, which slowed down innovation. The new exemptions open the door for more competition and faster product development in the Australian digital asset market.

Under the update, intermediaries are now allowed to use omnibus accounts as long as they keep accurate records. Omnibus accounts combine many users’ assets into one account, which offers several advantages:

- Faster transaction processing

- Lower operational costs

- Improved risk management

- More efficient cybersecurity controls

ASIC noted that these account structures are already widely used in the global industry. By approving them locally, the regulator is helping Australian companies operate at the same level as international competitors.

Industry Leaders Support the Change

Many industry voices have praised the new rules. Drew Bradford, CEO of the Australian stablecoin issuer Macropod, said the update “levels the playing field for stablecoin innovation in Australia.”

According to him, the clearer and more flexible framework — especially around reserve management and asset-handling requirements — removes barriers and gives the sector more confidence to build and innovate.

Bradford also pointed out that this kind of regulatory clarity is important for real-world use cases, including:

- Payments

- Treasury and liquidity management

- Cross-border money flows

- On-chain financial settlement

He believes the changes show that Australia wants to stay competitive globally while still protecting consumers and institutions.

Angela Ang, head of policy and partnerships at TRM Labs, agreed. She said the new measures signal a positive direction for the country and that clearer digital asset rules next year will further boost innovation and growth.

Stablecoin Growth Continues Globally

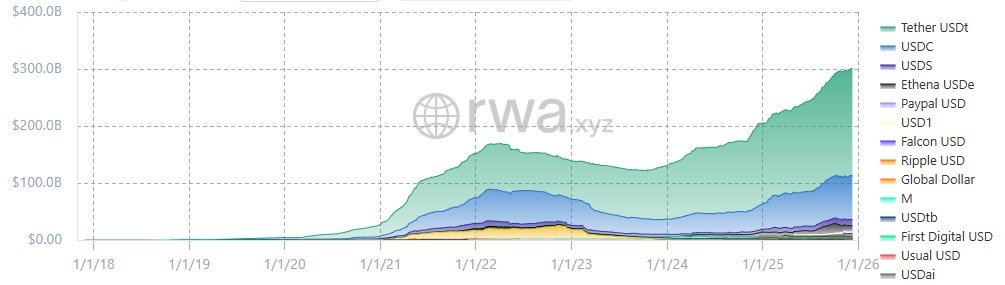

Australia’s updated rules come at a time when stablecoins are seeing massive adoption worldwide. Data from RWA.xyz shows the total stablecoin market cap has reached a new record of over $300 billion. This marks a 48% increase since the start of 2025.

Tether (USDT) continues to dominate the market, holding around 63% of the total supply. The rapid growth of the stablecoin sector highlights how important clear regulation is, especially as more real-world financial activity moves on-chain.

The new ASIC exemptions also fit into a bigger picture. Australia has been working on broader digital asset regulatory reforms for years, but progress has been slow. These stablecoin updates show that the government is willing to take practical steps now to support the industry while larger reforms are still in development.

Overall, the changes reduce friction for businesses, make compliance simpler, and allow companies to focus more on innovation rather than paperwork.

Final Thought

ASIC’s decision to ease stablecoin and wrapped-token rules is a major win for Australia’s digital asset sector. The clearer framework, lower compliance costs, and approved use of omnibus accounts all help the industry grow faster. As global stablecoin adoption rises, Australia is positioning itself as a competitive market ready to support the next wave of innovation.