Bank of America Endorses 1%-4% Crypto Allocation, Opens Access to Bitcoin ETFs

- Bank of America recommends a 1%–4% crypto allocation for wealth clients.

- Over 15,000 advisers can now officially recommend Bitcoin ETFs.

- Starting Jan. 5, clients get access to BITB, FBTC, BTC, IBIT.

- Shift aligns with similar moves from BlackRock, Fidelity, Vanguard, Morgan Stanley.

- Signals accelerating institutional normalization of Bitcoin exposure.

Bitcoin just received another major nod from Wall Street. Bank of America — the second-largest bank in the United States — is officially recommending that its wealth management clients maintain a 1% to 4% allocation to cryptocurrencies, marking one of the bank’s strongest endorsements of digital assets to date.

The guidance, shared with Yahoo Finance, applies across the bank’s full wealth ecosystem, including Merrill, Bank of America Private Bank, and Merrill Edge. According to Bank of America Private Bank CIO Chris Hyzy, a small but deliberate allocation can make sense for investors who are interested in innovation and can tolerate higher levels of volatility:

“For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate,” Hyzy said.

Bitcoin ETFs Now Fully Available to Wealth Clients

Beginning January 5, Bank of America’s wealthiest clients will be able to invest in four highly demanded Bitcoin ETFs directly through their accounts:

- Bitwise Bitcoin ETF (BITB)

- Fidelity Wise Origin Bitcoin Fund (FBTC)

- Grayscale Bitcoin Mini Trust (BTC)

- BlackRock iShares Bitcoin Trust (IBIT)

Previously, clients could only access Bitcoin ETFs by request, and even more notably, the bank’s 15,000+ wealth advisers were not allowed to recommend any crypto products.

That barrier is now gone.

This shift dramatically expands Bitcoin’s reach within traditional investment portfolios, allowing advisers to integrate regulated digital asset products into retirement plans, long-term strategies, and broader wealth management frameworks.

The bank emphasized that its guidance focuses on regulated vehicles, portfolio discipline, and a balanced understanding of both the upside potential and the market risks associated with digital assets.

A Sign of Rising Institutional Appetite

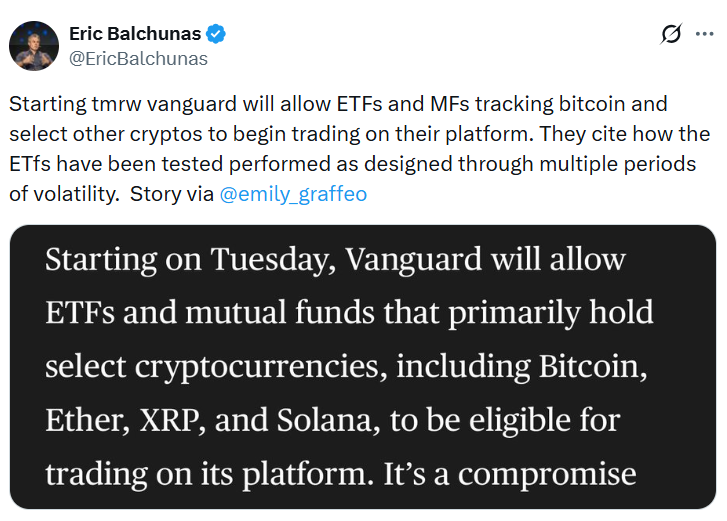

Bank of America’s move comes during a wave of institutional repositioning toward Bitcoin exposure. Just one day earlier, Vanguard — the world’s second-largest asset manager — reversed course by enabling crypto ETF trading for its clients after years of opposition.

With Bank of America now joining the fold, the shift toward mainstream Bitcoin acceptance appears to be accelerating across institutional finance.

Bank of America, with $2.67 trillion in assets and more than 3,600 branches across the U.S., is a cornerstone of American banking — meaning its stance carries significant influence. Opening the door to Bitcoin ETFs across its wealth platforms signals growing confidence that regulated, transparent exposure is now suitable for high-net-worth and mass affluent clients.

BlackRock Set the Allocation Standard

BlackRock has played a major role in shaping crypto allocation guidelines across the financial sector. In December 2024, BlackRock recommended a 1%–2% Bitcoin allocation, arguing the risk profile was similar to a typical exposure to the “Magnificent 7” tech giants — Amazon, Apple, Microsoft, Alphabet, Tesla, Meta, and Nvidia.

Fidelity followed with its own 2%–5% recommendation, while Morgan Stanley suggested 2%–4%, building toward what now looks like a unified institutional playbook:

Modest, risk-managed Bitcoin exposure inside regulated financial wrappers.

Final Thought

With Bank of America aligning itself with BlackRock, Vanguard, Fidelity and Morgan Stanley, the message is clear: Bitcoin is no longer fringe — it is becoming a standard component of modern diversified portfolios.

The institutional era of BTC is gaining speed, one allocation guideline at a time.