Bank of England Moves Toward Stablecoin Regulation With Consultation Ahead of 2026 Final Rules

- The Bank of England has released a consultation proposal for regulating GBP-pegged “systemic stablecoins.”

- Issuers may be required to hold 40% of reserves at the Bank of England and up to 60% in short-term UK government debt.

- Proposed holding limits include £20,000 per individual and £10 million per business, with possible exemptions.

- Final regulatory framework is expected in the second half of 2026 after consultation ends on February 10, 2026.

- BoE continues reviewing risks tied to self-custody wallets, permissionless blockchains, and interest-bearing stablecoins.

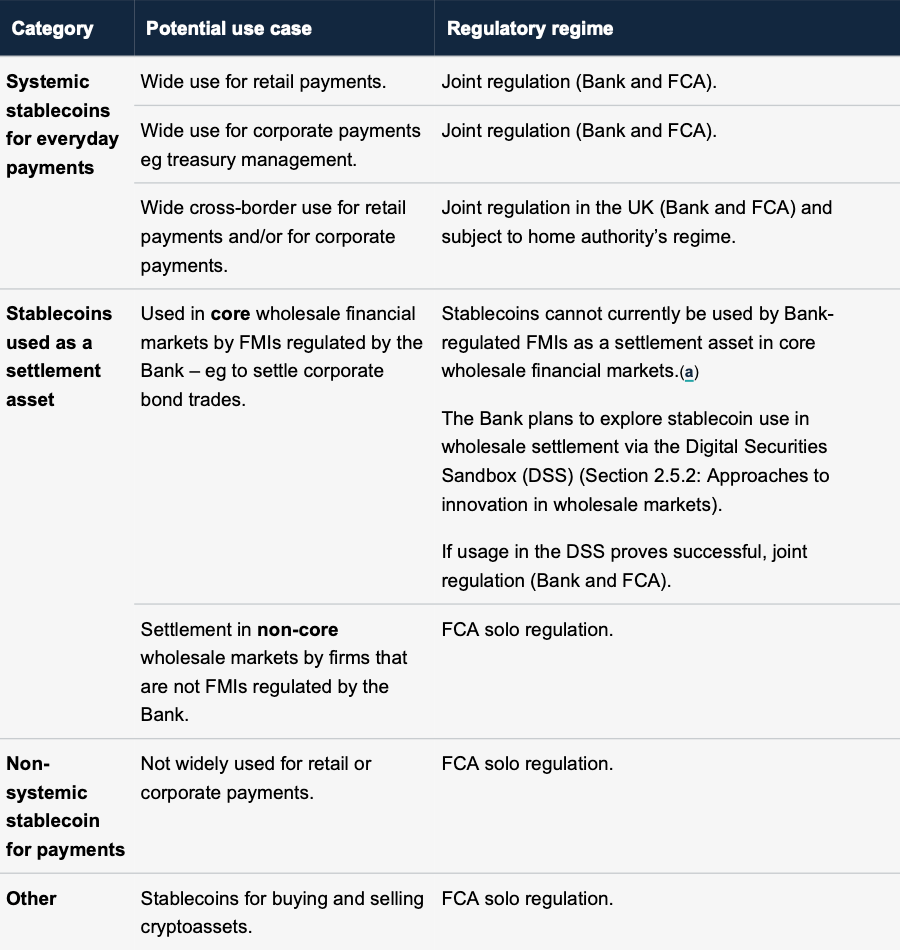

The United Kingdom is preparing to introduce a formal regulatory framework for stablecoins, with the Bank of England publishing a consultation paper outlining how GBP-denominated stablecoins should be governed if they achieve wide usage in payments. The proposal focuses specifically on “systemic stablecoins,” meaning tokens that could have material impact on financial stability if used broadly by retail users, businesses, or cross-border payment infrastructure.

Under the draft framework, stablecoin issuers would be expected to maintain strong backing standards. That includes holding at least 40% of liabilities in unremunerated deposits at the Bank of England, and up to 60% in short-term UK government debt. These requirements are designed to ensure liquidity and safeguard consumer holdings in the event of stress or issuer failure.

The consultation also proposes holding caps, limiting individuals to £20,000 per stablecoin and businesses to £10 million, although exemptions may be granted for commercial entities requiring higher balances to operate. The proposal emphasizes maintaining oversight proportional to systemic risk, noting that backing requirements may adjust as a stablecoin scales.

Importantly, the framework only applies to sterling-denominated stablecoins deemed systemically important by His Majesty’s Treasury. Non-GBP stablecoins, such as USDT and USDC, are not yet covered, though the Bank of England signaled that increasing adoption could lead to broader regulatory inclusion in the future.

Alongside the reserve and holding requirements, the Bank of England highlighted ongoing concerns about self-custody wallets and permissionless public blockchains. It argued that decentralized settlement environments lack clear accountability structures, which may complicate resilience, enforceability of holding limits, and the execution of payouts if an issuer fails.

The public consultation period runs until February 10, 2026, with the final regulatory structure expected in the second half of that year. The framework represents a significant step toward integrating stablecoins into the UK’s payments landscape while prioritizing systemic safeguards and consumer protection.

Final Thought

The consultation signals the UK’s move toward treating stablecoins as legitimate components of the financial system—while ensuring they operate under rules comparable to traditional payment and banking infrastructure. The next two years will determine how smoothly stablecoins can bridge into mainstream finance under clear oversight.