Beginner’s Guide: What is a Smart Contract in Blockchain?

Key Takeaways

- Smart contracts are self-executing agreements on the blockchain.

- They cut out middlemen, boost efficiency, and enforce trust automatically.

- From Nick Szabo’s 1994 vision to Ethereum today, smart contracts evolved into trillion-dollar infrastructure.

- They work on simple if-then logic: once conditions are met, execution is automatic.

- Use cases span DeFi, NFTs, supply chains, real estate, insurance, and governance.

- While transformative, challenges remain: coding bugs, scalability, and legal uncertainty.

Imagine a world where agreements carry themselves out automatically. Your rent deposit returns the moment you hand back the keys. Insurance money appears in your account the second your flight gets canceled. No paperwork, no disputes, no middlemen standing in the way.

This is a smart contract's promise. They run quietly on blockchains, acting as digital engines that enforce trust with pure code. For newcomers, smart contracts are not just another crypto buzzword; they are the reason decentralized finance works, why NFTs hold real value, and why digital ownership is finally possible.

To understand Web3, smart contracts are one of the very first concepts to grasp - they are the foundation that makes a trustless digital economy run.

What is a Smart Contract?

A smart contract is simply a program on the blockchain that runs itself when conditions are met. Unlike traditional contracts, which depend on lawyers, banks, or brokers to enforce them, smart contracts cut out the middlemen. The rules are written in code, and the blockchain makes sure they are followed exactly.

Think of it like a vending machine. Insert the right amount, press the right button, and you get your item automatically. No one negotiates, no one interferes, the machine just does its job. Smart contracts take that logic and apply it to money, property, art, and even governance.

Smart contracts run on simple logic: when one condition is met, the next action follows automatically. That simplicity is what powers decentralized finance, NFT markets, gaming economies, and much more. For anyone new to Web3, understanding smart contracts is the first step to seeing how the entire system works.

History of Smart Contracts

We have to go back to 1994 to see where it all began. That’s when cryptographer Nick Szabo first coined the term “smart contract.” His idea was simple but bold: agreements could be turned into digital code that executed automatically. To explain it, he used a vending machine. Drop in the right coins, press a button, and the machine delivers: no clerk, no oversight, just logic.

The concept stayed mostly theoretical until 2009, when Bitcoin appeared. Bitcoin wasn’t built for complex contracts, but it showed the world that a decentralized system could enforce rules without banks or governments. For the first time, digital trust didn’t need human intermediaries.

Then came Ethereum in 2015, and everything changed. Vitalik Buterin and his team designed Ethereum as a platform where developers could write smart contracts directly into the blockchain. This opened the floodgates. Suddenly, it was possible to create decentralized applications that could manage money, ownership, and governance without a single central authority.

The following years turned theory into reality. By 2017, smart contracts were powering the ICO boom, raising billions in funding. Soon after, they gave rise to DeFi, a financial system that lives entirely on-chain. By 2021, they were the backbone of NFTs and DAOs, fueling new ways for creators and communities to organize.

And here we are in 2025. Smart contracts are no longer just crypto-native tools. Governments are testing blockchain for land registries, supply chains are tracked in real time, and insurance payouts are triggered by on-chain data. What began as Szabo’s thought experiment has become one of the most important technological shifts of our time.

Types of Smart Contracts

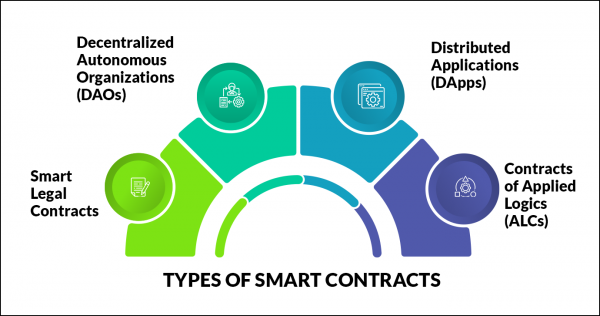

If you think all smart contracts are the same, you’re mistaken. They’ve evolved into distinct categories, each serving a different purpose. Here are the four main types:

Smart Legal Contracts

These are contracts designed to have legal weight. They’re written in code but also backed by legal frameworks. For example, a rental agreement or loan contract could be executed on-chain while still enforceable in court. The idea is to combine blockchain automation with traditional law.

Decentralized Autonomous Organizations (DAOs)

DAOs are communities or organizations that run entirely on smart contracts. Rules about funding, decision-making, or governance are written into code. Members vote using tokens, and the contract automatically enforces the outcome. Instead of a CEO, the organization runs on code.

Distributed Applications (DApps)

These are applications that use smart contracts as their backend. A DApp might look like a regular website or mobile app, but instead of relying on servers, it connects directly to blockchain contracts. Examples include Uniswap for trading, Axie Infinity for gaming, or OpenSea for NFTs.

Contracts of Applied Logics (ALCs)

These are advanced contracts designed for specific logic-based tasks. They can handle more complex workflows, such as conditional payments, supply chain triggers, or multi-step agreements. Think of them as programmable engines that can adapt to different industries and needs.

How Smart Contracts Work

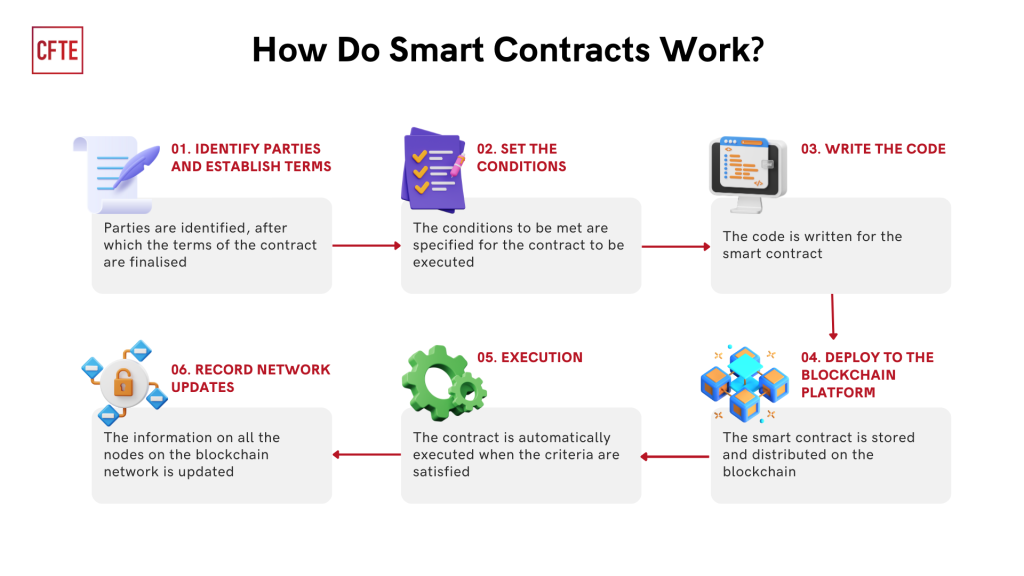

A smart contract is an automated agreement written into blockchain code. The rules are defined in advance, and once the right conditions are met, the contract executes itself without anyone needing to step in.

For example, the code might say: if Alice sends one ETH, then Bob’s NFT is transferred to her wallet. When Alice makes the payment, the blockchain verifies the condition and triggers the transfer instantly. No delays, no negotiations, no chance for either side to back out.

The entire process is secured by the blockchain’s network of validators. They confirm every detail of the transaction and make it permanent on-chain. Because the contract lives on a decentralized ledger, it cannot be altered or deleted, even by the person who wrote it.

This is what makes a smart contract powerful. It guarantees outcomes with mathematical certainty, removing the need for lawyers, brokers, or banks to oversee the deal. Every step is transparent, every action is traceable, and the result is enforced automatically.

In essence, a smart contract transforms promises into code and code into results. That’s how agreements in Web3 are carried out: reliably, efficiently, and without middlemen.

Advantages of Smart Contracts

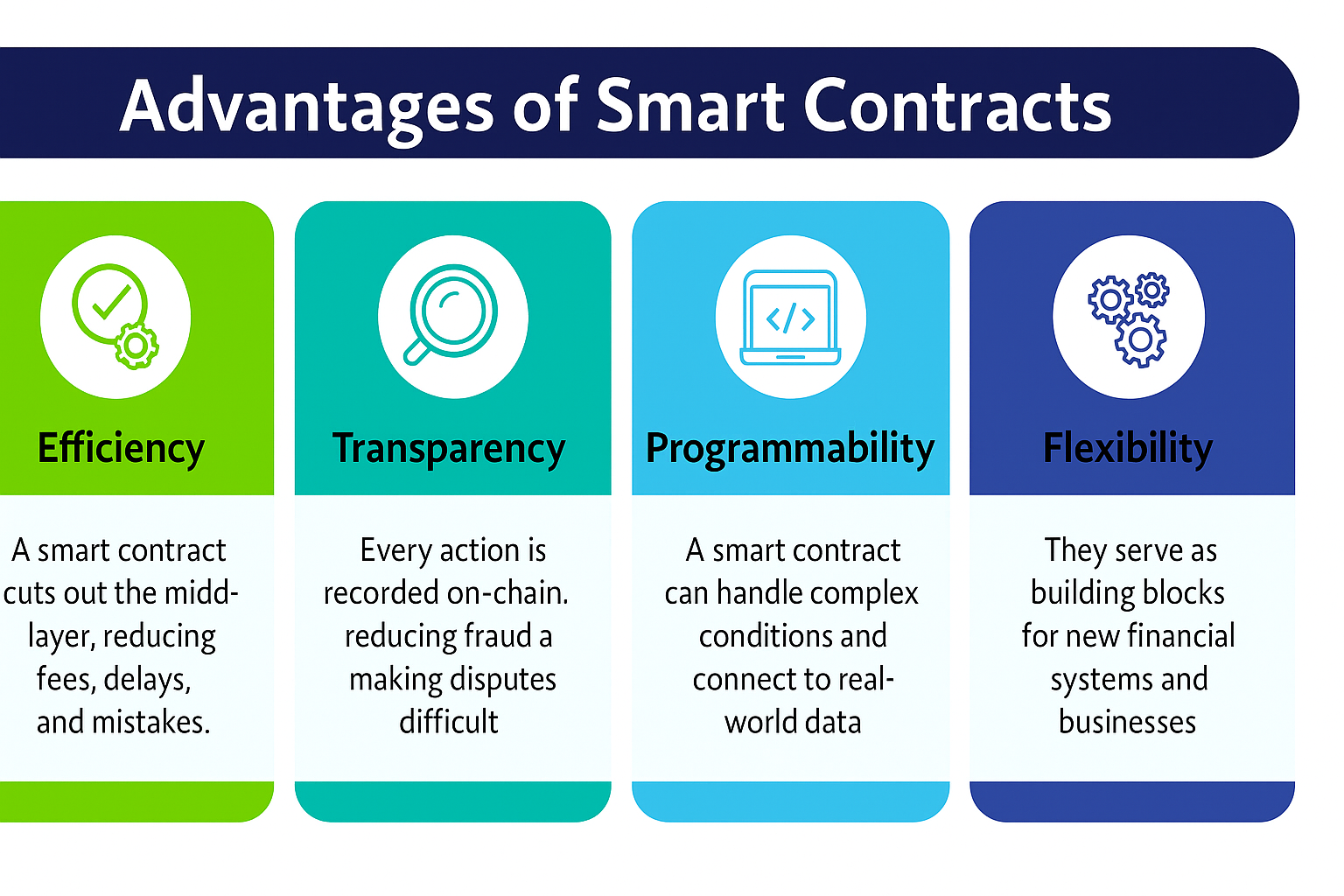

Smart contracts matter because they change how trust is built in the digital world. Instead of relying on lawyers, banks, or institutions to enforce agreements, the blockchain does it automatically. This shift opens up possibilities that traditional systems simply can’t match.

The first advantage is efficiency. A smart contract cuts out the middle layer, which means fewer fees, fewer delays, and fewer mistakes. Transactions that used to take days can now settle in minutes.

They also bring transparency. Every action is recorded on-chain for anyone to verify. That level of openness reduces fraud and makes disputes almost impossible, because the contract’s logic is visible to all.

Another reason they matter is programmability. Unlike traditional contracts, a smart contract can be designed to handle complex scenarios. It can release funds gradually, distribute royalties automatically, or connect to real-world data through oracles. This flexibility turns them into building blocks for new financial systems, digital marketplaces, and even entire organizations.

Of course, there are risks. Bugs in the code can be exploited, scalability remains a challenge, and regulators are still catching up. But even with these hurdles, the benefits are undeniable. Smart contracts are not just tools for crypto; they are foundations for a new kind of digital economy.

Applications of Smart Contracts

The real power of smart contracts shows in how they’re used. What started as an idea for digital agreements has grown into a foundation for industries far beyond crypto.

In finance, smart contracts drive Decentralized Finance (DeFi). They run lending platforms like Aave, decentralized exchanges like Uniswap, and stablecoin systems like MakerDAO. These contracts automate everything from loan approvals to liquidity pools, moving billions of dollars daily without banks or brokers.

In NFT’s world, smart contracts handle ownership and royalties. An artist can mint a digital painting, sell it online, and receive a percentage every time it’s resold. The contract enforces the rules automatically, making digital art and collectibles viable assets.

Supply chains are also being reshaped. With smart contracts, goods can be tracked from factory to store, and payments can be triggered once delivery is confirmed. This reduces fraud, speeds up logistics, and creates trust in global trade.

Insurance and healthcare show another layer of potential. Travel insurance can pay instantly if a flight is canceled, while medical records can be secured and shared through contracts that only release data with the patient’s approval.

Even real estate is being transformed. Property ownership can be tokenized, with contracts handling the transfer of titles once payment is made. Deals that used to take weeks of paperwork could be completed in minutes.

And governments are experimenting too. From blockchain-based voting systems to transparent welfare distribution and land registries, smart contracts are being tested as tools for more open and accountable public services.

Across every sector, the pattern is the same: smart contracts cut out the middleman, enforce trust through code, and unlock systems that run faster, cheaper, and more fairly.

Industry / Field | How Smart Contracts Are Used |

| Decentralized Finance (DeFi) | Automate lending, borrowing, and trading on platforms like Aave and Uniswap. Billions move daily without banks. |

| NFTs & Digital Art | Enforce ownership and royalties. Artists get paid automatically every time their work is resold. |

| Supply Chains | Track goods in real time, trigger payments on delivery, reduce fraud in global logistics. |

| Insurance | Instant payouts for events like flight cancellations. No claims process, just code. |

| Healthcare | Secure medical data sharing. Patients control who can access their records. |

| Real Estate | Tokenize property, automate title transfers after payment, cut down on paperwork. |

| Governments & Public Services | Enable blockchain-based voting, transparent welfare distribution, and land registries. |

FAQs

Are smart contracts legally binding?

In some places, yes. Courts in certain jurisdictions already recognize blockchain records as valid evidence. But the legal framework is still evolving, and recognition varies from country to country.

Can a smart contract be changed once it’s live?

No. Once deployed, the code is locked on the blockchain. Developers can create upgradeable frameworks, but the original contract itself remains immutable. This makes smart contracts reliable, but also risky if there’s a bug in the code.

Do I need to know programming to use smart contracts?

Not at all. Most people interact with them through apps like Uniswap, OpenSea, or wallets like MetaMask. The code runs in the background, you just see the results.

Which blockchains support smart contracts?

Ethereum is the pioneer, but many others, like Solana, Avalanche, Cardano, and Polygon, also support them. Each offers trade-offs in speed, cost, and security.

How do smart contracts connect to real-world events?

They use oracles. Oracles feed data like weather reports, stock prices, or flight information into the blockchain, allowing contracts to act on real-world events.

Conclusion: The Future of Smart Contracts

Smart contracts began as Nick Szabo’s idea of a “digital vending machine” back in 1994. Three decades later, they’ve become the backbone of DeFi, NFTs, DAOs, and now even government and enterprise systems.

What makes them powerful is simple: clear rules, automatic execution, and guaranteed results. They cut out the middleman, reduce costs, and bring transparency into systems that were once slow and opaque. From flight insurance payouts in seconds to billion-dollar decentralized economies, smart contracts are already changing how agreements are made and enforced.

The technology is not perfect. Bugs, scalability issues, and legal uncertainty remain. But the direction is clear. As more industries adopt blockchain, smart contracts will expand from niche use cases into the core of global business and governance.

In Web3, trust no longer rests in institutions, it rests in code. And that code is shaping the future of how we trade, create, and collaborate.