Bitcoin Breaks $112K as Fed Rate Cut Odds Surge Past 98%

Key Takeaways

• Bitcoin breaks above $112,000 resistance, signaling bullish continuation before the weekly close

• Traders aim for the $118K to $123K zone as momentum grows

• The Federal Reserve is expected to cut rates by 0.25 percent this week

• Global rate cuts reach their highest level since 2020, boosting risk sentiment

• A breakout above $113K could open the path toward $130K and higher

Bitcoin Pushes Higher Before the Weekly Close

Bitcoin started the week strong, moving above $112,000 as buyers regained control before Sunday’s close. The move followed renewed optimism around the Federal Reserve’s upcoming policy decision and a burst of weekend volatility.

Data from Cointelegraph Markets Pro and TradingView showed Bitcoin trading in a tight range before breaking out late in the weekend. The rally gained momentum after positive US inflation data boosted confidence across risk assets.

Trader Crypto Caesar highlighted $112,000 as the key resistance level. “A clean break and close above it could confirm a bullish continuation toward $123K,” he wrote on X.

Investor Ted Pillows agreed, pointing out that Bitcoin has printed four consecutive green daily candles, showing steady accumulation. “Someone is consistently buying Bitcoin here,” he noted, adding that reclaiming the $112K to $114K zone could drive a fast move toward $118,000.

Analytics account Frank A. Fetter emphasized the importance of $113,000, the current cost basis for short term holders who have held BTC for less than six months. “If Bitcoin can reclaim $113K, a move toward $130K to $144K feels likely,” the account posted, suggesting a strong weekly close could shift market momentum decisively upward.

Fed Rate Cut Expectations Fuel Market Optimism

Beyond price charts, macro factors are giving Bitcoin another tailwind. The US Federal Reserve is widely expected to lower interest rates by 0.25 percent at its October 29 meeting after a series of softer inflation reports.

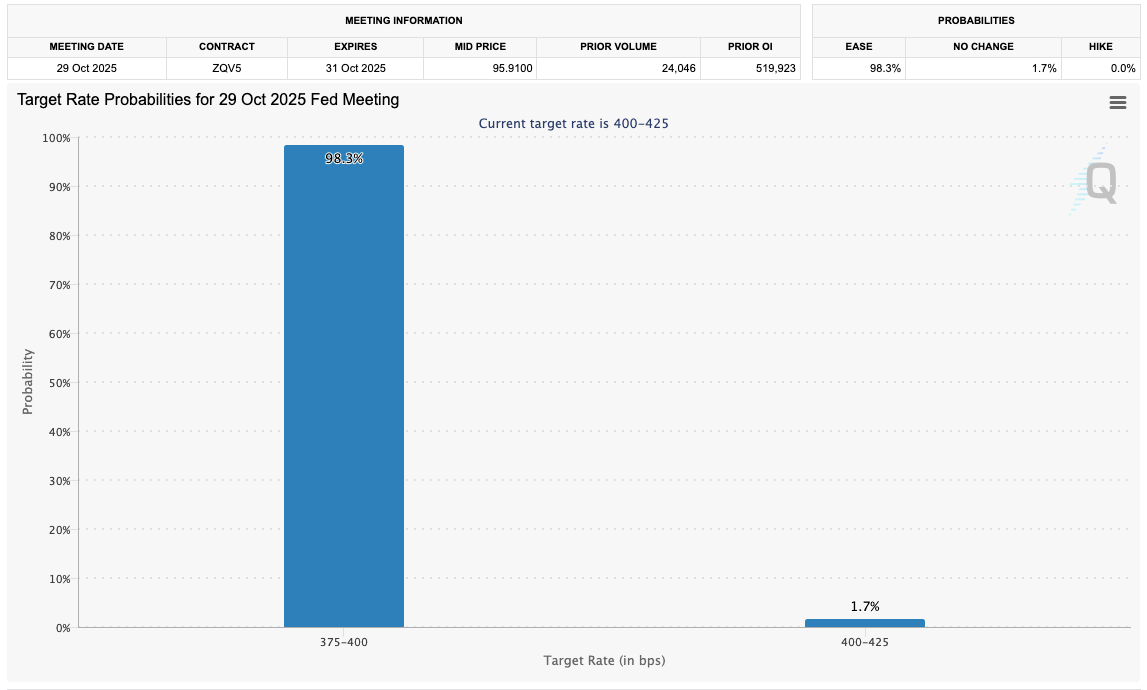

CME Group’s FedWatch Tool shows a 98 percent probability of a rate cut, reflecting almost complete confidence that the Fed will pivot toward easier monetary policy.

This move is part of a larger global trend. Data from The Kobeissi Letter reveals that 82 percent of central banks worldwide have reduced rates during the past six months, the highest share since 2020. “Global monetary easing is in full swing,” the post said, noting that such rapid cuts usually happen during recessions.

For Bitcoin, lower rates mean cheaper capital and more liquidity, both of which historically support higher prices. The market often sees increased inflows into digital assets when central banks inject liquidity into the system.

Traders Watch for the Next Breakout

With Bitcoin approaching $113,000, traders are watching for a decisive breakout that could push prices to $123,000 and beyond. Momentum remains strong as the combination of technical strength and macro optimism fuels bullish sentiment.

Still, analysts note that volatility often increases around Fed decisions, meaning short term pullbacks are possible before any sustained move higher.

For now, buyers are in control. With global rate cuts accelerating and institutional demand building, Bitcoin’s rise above $112,000 could mark the beginning of another major rally in this market cycle.