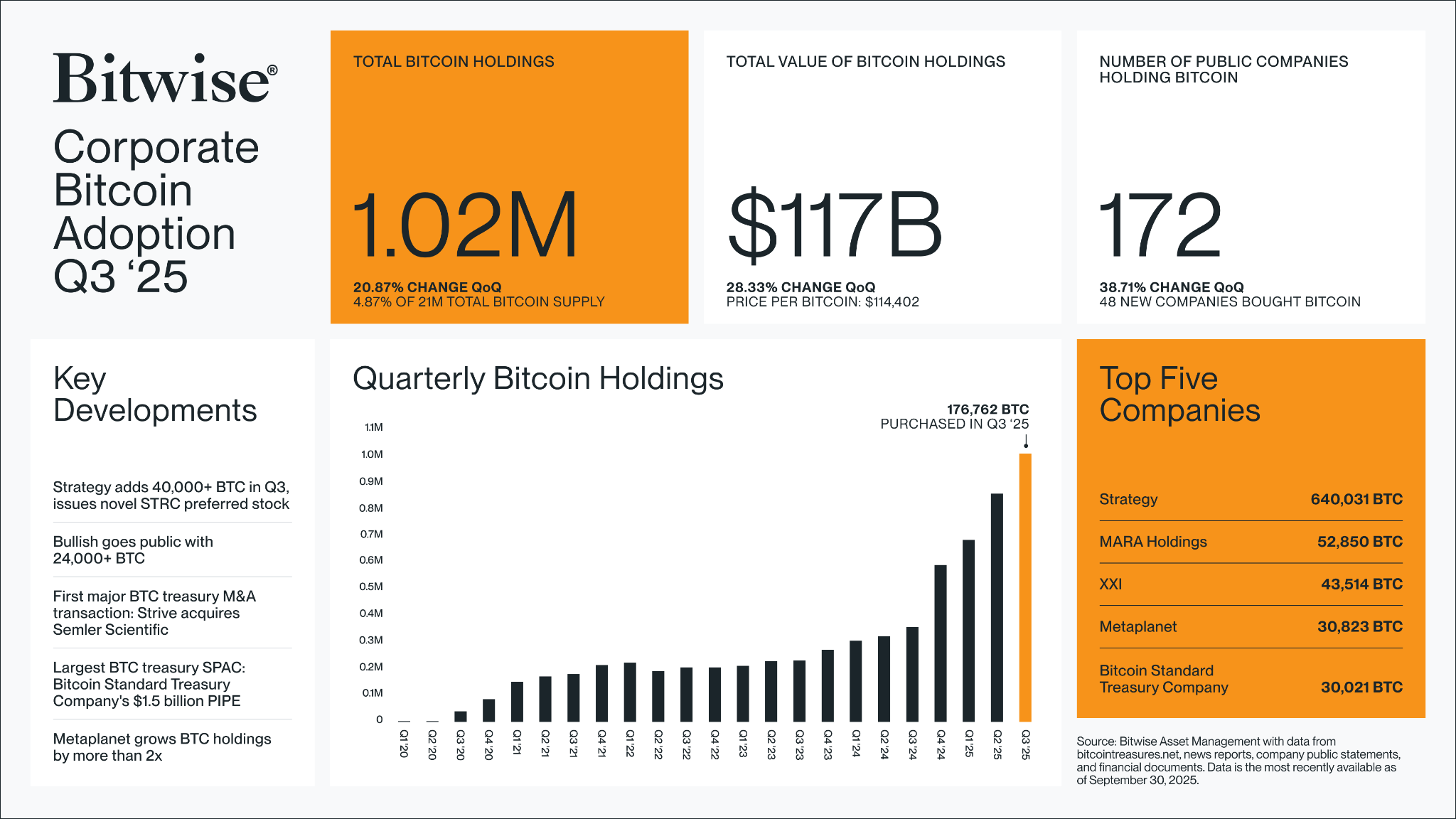

48 New Bitcoin Treasuries Emerge in 3 Months as Corporate Adoption Grows, Report Shows

- 48 new public companies entered the Bitcoin treasury space between July and September, according to Bitwise.

- Total Bitcoin holdings across corporate treasuries now exceed $117 billion, up 28% from last quarter.

- Bitcoin’s corporate adoption is seen as a long-term strategy by institutional players, not just short-term speculation.

- Michael Saylor’s MicroStrategy remains the largest Bitcoin holder with over 640,000 BTC.

- Bitcoin’s price remains volatile, but institutional accumulation could drive upward pressure in the long term.

The corporate adoption of Bitcoin has seen a significant surge, with 48 new companies entering the digital asset treasury space between July and September, marking a 38% increase in the number of public companies holding Bitcoin. According to Bitwise’s Q3 Corporate Bitcoin Adoption report, data from BitcoinTreasuries.NET reveals that 172 companies now hold Bitcoin, collectively managing assets worth over $117 billion. This represents a 28% increase in value quarter-over-quarter, with the total number of Bitcoin held crossing the one million mark, which is approximately 4.87% of the total Bitcoin supply.

Bitwise CEO Hunter Horsley called the numbers “absolutely remarkable,” emphasizing the growing appetite for Bitcoin from both retail investors and large institutions. He noted that companies are increasingly looking to Bitcoin as a long-term treasury asset rather than a speculative investment. Rachael Lucas, an analyst at BTC Markets, shared the sentiment, explaining that this growing accumulation signals that “larger players are doubling down” on Bitcoin, not backing away. This trend underscores the deepening institutional adoption of Bitcoin as part of corporate treasury strategies.

The largest Bitcoin treasury is held by Michael Saylor’s MicroStrategy, which recently increased its holdings to over 640,000 BTC. Following MicroStrategy, crypto miner MARA Holdings holds the second-largest treasury, with 53,250 Bitcoin. As corporations and even sovereign entities begin to enter the space, the momentum of Bitcoin accumulation is expected to continue, especially as regulatory clarity improves and infrastructure for institutional crypto adoption matures. Lucas predicts that this participation will help legitimize Bitcoin as a mainstream asset class, paving the way for broader financial innovation, such as Bitcoin-backed loans and new derivative markets.

Despite the growing accumulation, Bitcoin’s price remains volatile. Lucas notes that corporations typically buy Bitcoin over-the-counter (OTC), a method that minimizes price slippage and volatility. However, this quiet form of accumulation doesn’t immediately impact the spot market price. Other factors, such as long-term holders taking profits, derivatives activity, and macroeconomic events like US-China trade tensions, can still cause sharp market corrections.

Edward Carroll, head of markets at blockchain investment company MHC Digital Group, believes that the surge in institutional interest will eventually lead to a supply-demand imbalance that could place upward pressure on Bitcoin’s price in the medium to long term. He expects the demand for Bitcoin to grow steadily, decoupling from broader market sentiment as institutional demand increases.

On average, Bitcoin miners generate around 900 Bitcoin per day, while corporate acquisitions are significantly higher. A report by River, released in September, found that businesses are acquiring an average of 1,755 Bitcoin per day in 2025. This increased institutional demand for Bitcoin, combined with growing investment products like Bitcoin exchange-traded funds (ETFs), indicates a maturation of the crypto market and a step toward mainstream adoption. Last week, US spot Bitcoin ETFs saw $2.71 billion in weekly inflows, marking another strong showing for Bitcoin as an investment vehicle.

Final Thought

The steady rise in Bitcoin accumulation by public companies signals that institutional interest in the cryptocurrency is growing, and this trend is likely to continue as regulatory clarity and infrastructure improve. As Bitcoin becomes an integral part of corporate treasury strategies, its role in the financial ecosystem will only expand, potentially driving upward pressure on its price in the medium to long term.