Bitcoin ETF Inflows Surge to $553M as Institutions Rotate Back to BTC

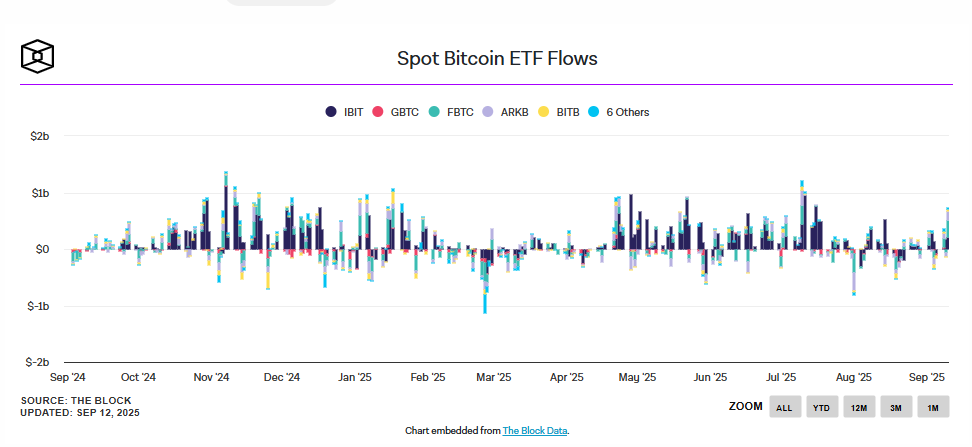

Spot bitcoin ETFs are seeing a wave of renewed institutional interest, with over half a billion dollars flowing in a single day. Capital appears to be rotating back to BTC as markets eye the upcoming Fed decision.

- Total net inflows hit $552.78M Thursday—the fourth straight day of positive flows.

- BlackRock’s IBIT led with $366.2M, followed by Fidelity’s FBTC with $134.7M.

- August saw $751M in BTC ETF outflows as ETH funds surged, but the trend is reversing.

- Investors expect a Fed rate cut next week, supporting the risk-on sentiment.

Data from SoSoValue shows major buying interest: BlackRock’s IBIT topped inflows with $366.2 million, while Fidelity’s FBTC added $134.7 million. Bitwise’s BITB brought in another $40.43 million, and smaller inflows came from VanEck, Invesco, and Franklin Templeton funds.

This marks the fourth consecutive day of positive flows, totaling $1.7 billion for the week. Vincent Liu, CIO at Kronos Research, says the activity signals “capital rotation back into Bitcoin,” reflecting macroeconomic stability and positioning ahead of the Fed’s rate decision.

Just last month, spot bitcoin ETFs suffered $751 million in outflows, their third-worst month since debuting in January. That coincided with Ethereum ETFs drawing a record $3.87 billion, fueling a BTC-to-ETH rotation narrative and driving Bitcoin to around $107,500 by August’s end.

Early September started soft for ether funds, but they bounced back with $113.12 million in inflows on Thursday. Meanwhile, Bitcoin has climbed 1.04% to $115,455, with the overall crypto market up 1.81% in the past day.

Investors are focused on the Federal Open Market Committee meeting set for September 16–17. The CME FedWatch Tool shows a 92.5% chance of a 25-basis-point rate cut and a 7.5% chance of a 50-point cut. Liu believes continued ETF inflows could push Bitcoin to new all-time highs if macro conditions stay supportive, tightening supply and boosting momentum across crypto markets.

Final Thought

With institutional capital flowing back and a possible Fed rate cut on deck, Bitcoin’s ETF-driven rally could set the stage for another breakout—assuming macro winds stay favorable.