Bitcoin ETPs Control 7% of Total Supply Amid Waning Demand

Bitcoin exchange-traded products (ETPs) now collectively hold over 1.47 million BTC — about 7% of the asset’s capped 21 million supply.

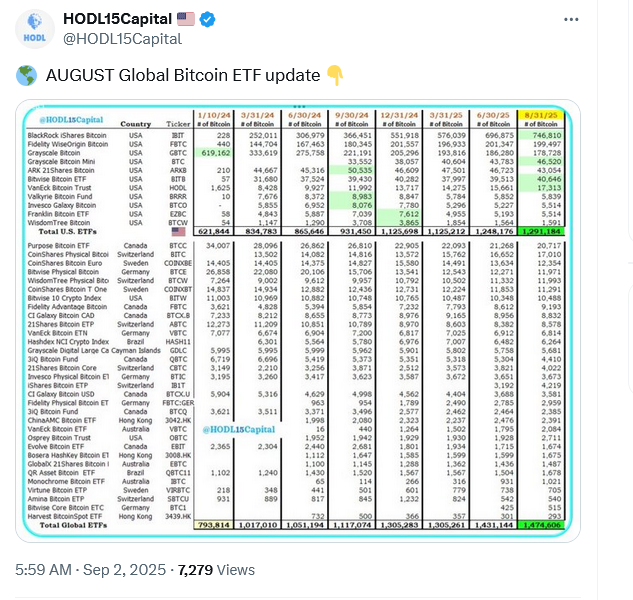

U.S.-based spot Bitcoin ETFs account for the bulk of this, with more than 1.29 million BTC spread across 11 funds as of Aug. 31, according to HODL15Capital. BlackRock’s iShares Bitcoin Trust leads with 746,810 BTC, followed by Fidelity’s FBTC, which holds just under 199,500 BTC.

Since the end of 2024, global Bitcoin ETPs have accumulated an additional 170,000 BTC, valued around $18.7 billion. However, momentum appears to be cooling: August saw net outflows of $301 million from Bitcoin ETPs, while Ethereum products attracted nearly $4 billion in inflows, per CoinShares.

Investor behavior reflects this trend. A major Bitcoin whale reportedly offloaded 4,000 BTC within 12 hours, swapping it for 96,859 Ether and bringing their ETH holdings to $3.8 billion. Arkham data further shows nine whales collectively shifted $456 million from BTC into ETH, locking in Bitcoin profits and favoring Ethereum exposure.