Bitcoin Faces Highest Sell Pressure Since 3AC Collapse: Key Insights for the Week

Bitcoin Confronts Major Sell Pressure Amid Tariffs and Market Dynamics

February 10, 2025 – Bitcoin (BTC) is currently grappling with substantial market challenges, including intensified sell-offs, the reintroduction of tariffs, and notably thin liquidity. Despite these hurdles, BTC continues to hover around the $100,000 mark, central to its established three-month trading range.

1. Thin Order Books Signal Potential Volatility

Recent observations indicate that Bitcoin’s order books are “very thin,” suggesting that even minor market movements could trigger significant price fluctuations. This precarious situation is exacerbated by the anticipation of upcoming U.S. macroeconomic data releases, notably the Consumer Price Index (CPI) figures for January, scheduled for February 12. Traders are bracing for potential volatility following these announcements.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

2. Upcoming CPI Data and Federal Reserve Testimonies

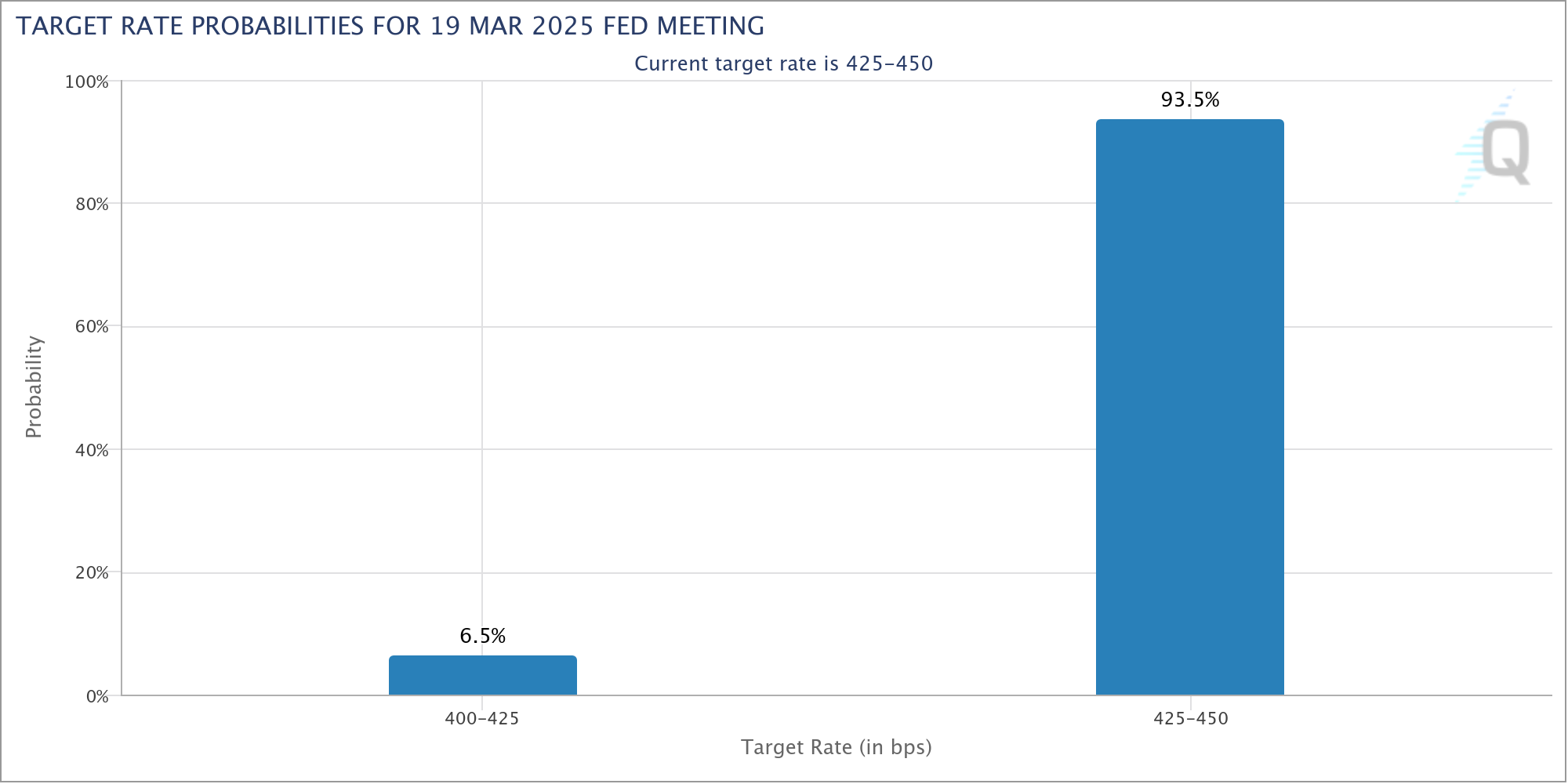

The financial community is keenly awaiting the CPI data, which will provide insights into inflation trends and potential monetary policy adjustments. Additionally, Federal Reserve Chair Jerome Powell is set to testify before both the Senate Banking Committee and the House Financial Services panel on February 11. His statements are expected to shed light on the Fed’s stance regarding interest rate policies and economic outlooks, factors that could significantly influence Bitcoin’s price trajectory.

BTC/USDT 1-hour chart. Source: CrypNuevo/X

3. Reintroduction of Tariffs and Market Reactions

The U.S. government’s recent decision to reintroduce tariffs on various trading partners has added another layer of complexity to the market landscape. While these tariffs have primarily impacted traditional financial markets, Bitcoin’s price has shown resilience, maintaining its position within the current trading range. However, the long-term effects of these trade policies on the cryptocurrency market remain uncertain.

BTC/USDT 4-hour chart. Source: CrypNuevo/X

4. Whale Activity Indicates Continued Distribution

On-chain analytics have revealed that large Bitcoin holders, commonly referred to as “whales,” have been actively distributing their holdings since late last year. This trend has now reached levels not seen since the collapse of the crypto hedge fund Three Arrows Capital (3AC) in mid-2022. The sustained distribution by whales raises questions about underlying market sentiments and potential future price movements.

BTC/USD 1-week chart with 21EMA. Source: Cointelegraph/TradingView

5. Divergent Market Predictions Emerge

Despite the prevailing challenges, some market analysts maintain a bullish outlook for Bitcoin. Notably, Bill Barhydt, founder and CEO of crypto asset manager Abra, has projected that Bitcoin could reach a price of $700,000, with this upward journey potentially commencing in the current quarter. Such predictions highlight the diverse perspectives within the crypto community regarding Bitcoin’s future valuation.

Fed target rate probabilities. Source: CME Group

Conclusion

As Bitcoin navigates this complex interplay of market forces, stakeholders are advised to stay informed and exercise caution. The convergence of thin liquidity, significant sell pressure, macroeconomic developments, and varying market predictions underscores the importance of diligent market analysis and strategic decision-making.