Bitcoin Retests Golden Cross – Analysts Say Break Above $110K Could Trigger Major Rally

Bitcoin is retesting its golden cross, a historically bullish pattern that has often preceded major rallies. Analysts believe that if BTC can break and hold above $110,000, it could spark the next leg of a parabolic bull run.

- Bitcoin is retesting the golden cross, a bullish signal that triggered 2,200% and 1,190% rallies in past cycles.

- Analysts say holding above $110,000 could lead to another explosive move.

- The Money Flow Index (MFI) is deeply oversold, suggesting a possible short-term bounce.

- Fundstrat’s Tom Lee sees market volatility as a sign of a temporary bottom.

- Trump’s 100% tariffs on China rattled markets but may set up a short-term rebound.

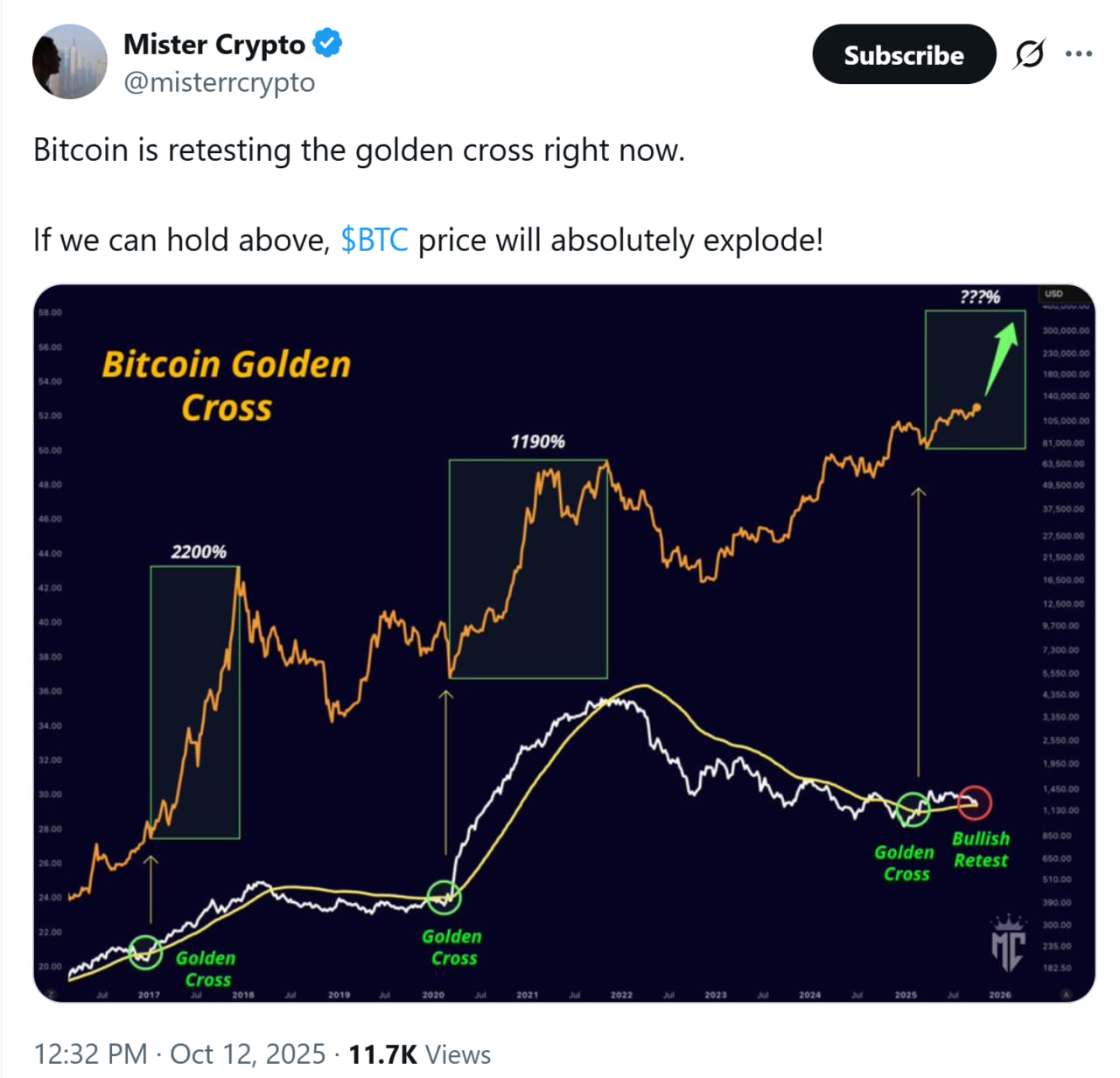

Bitcoin is once again testing the golden cross, one of the most closely watched bullish indicators in technical analysis. The pattern occurs when the 50-day moving average crosses above the 200-day moving average, signaling a shift in long-term momentum from bearish to bullish. Historically, this formation has preceded some of Bitcoin’s most dramatic price surges.

According to crypto analyst Mister Crypto, the last two golden crosses — in 2017 and 2020 — led to gains of 2,200% and 1,190%, respectively. With Bitcoin currently hovering around $110,000, he believes the setup is “incredibly strong” and could spark another massive rally if the price sustains above that level. “A confirmed breakout could absolutely explode Bitcoin’s price in the coming weeks,” he wrote on X.

However, not all analysts are ready to declare a breakout just yet. Market watcher Mac warned that Bitcoin must hold the $110K support to avoid ending its current market cycle prematurely. He noted that Bitcoin’s 4-hour Money Flow Index (MFI) is “deeply oversold,” suggesting the potential for a short-term recovery. Still, he expects more sideways action in the near term, adding that the “risk-to-reward setup looks favorable.”

Meanwhile, Fundstrat co-founder Tom Lee weighed in on broader market conditions, noting that Friday’s stock market drop — the biggest in six months — was likely an “overdue correction.” He pointed out that volatility levels, measured by the VIX index, spiked sharply, calling it one of the top 1% largest jumps in history. Lee said this surge in volatility could signal a short-term bottom, as investors rush to hedge rather than sell off risk assets.

“Markets have risen 36% since April,” Lee explained. “When volatility spikes like this, it’s usually the setup for a bounce rather than a breakdown.”

Still, Bitcoin faces external headwinds. On Friday, U.S. President Donald Trump announced a 100% tariff on all Chinese imports, effective Nov. 1, in retaliation for Beijing’s new export restrictions on rare earth minerals. China controls nearly 70% of the global rare earth supply, and its new export rules have reignited trade war fears that could impact both traditional markets and crypto assets.

Despite the turbulence, many analysts believe Bitcoin remains on track for further upside — as long as the golden cross holds. The next few days will likely determine whether the world’s largest cryptocurrency confirms a bullish breakout or stalls under macroeconomic pressure.

Final Thought

The golden cross has historically marked the beginning of Bitcoin’s most powerful bull runs — and the latest retest could be no different. If BTC successfully holds above $110,000, analysts expect a surge in momentum that could carry prices to new all-time highs, cementing Bitcoin’s dominance in the next market cycle.