Bitcoin Investors Chasing Quick Gains Are Setting Themselves Up for Failure: Expert Analysis

Key Takeaways:

- Bitcoin investors expecting immediate gains are approaching the market with wrong expectations

- Long-term Bitcoin holders (2+ years) have significantly outperformed recent buyers

- Bitcoin remains the best performing asset against currency debasement over extended periods

- Current price movements shouldn’t be compared to traditional assets like stocks and gold hitting new highs

- Historical data shows Bitcoin’s average annualized return of 82.4% over the past decade

BitMEX co-founder Arthur Hayes has issued a stark warning to Bitcoin enthusiasts: those expecting overnight wealth are setting themselves up for disappointment and potential liquidation.

In a recent interview, Hayes addressed the growing frustration among recent Bitcoin buyers who question why the cryptocurrency hasn’t reached projected highs like $150,000. His message was clear – patience is essential in the Bitcoin investment strategy.

The Wrong Mindset: Instant Gratification vs. Long-Term Vision

“If you thought you were buying Bitcoin and the next day you were buying a Lamborghini, you’re probably getting liquidated because it is not the right way to think about things,” Hayes explained during the interview.

The cryptocurrency veteran emphasized a crucial reality check for newcomers: while recent buyers may feel disappointed with current performance, those who invested two, three, five, or ten years ago are experiencing substantial gains. This stark contrast highlights the importance of timeline perspective in Bitcoin investment strategy.

Hayes stressed that investors need to fundamentally readjust their expectations about Bitcoin’s price movements and performance timeline.

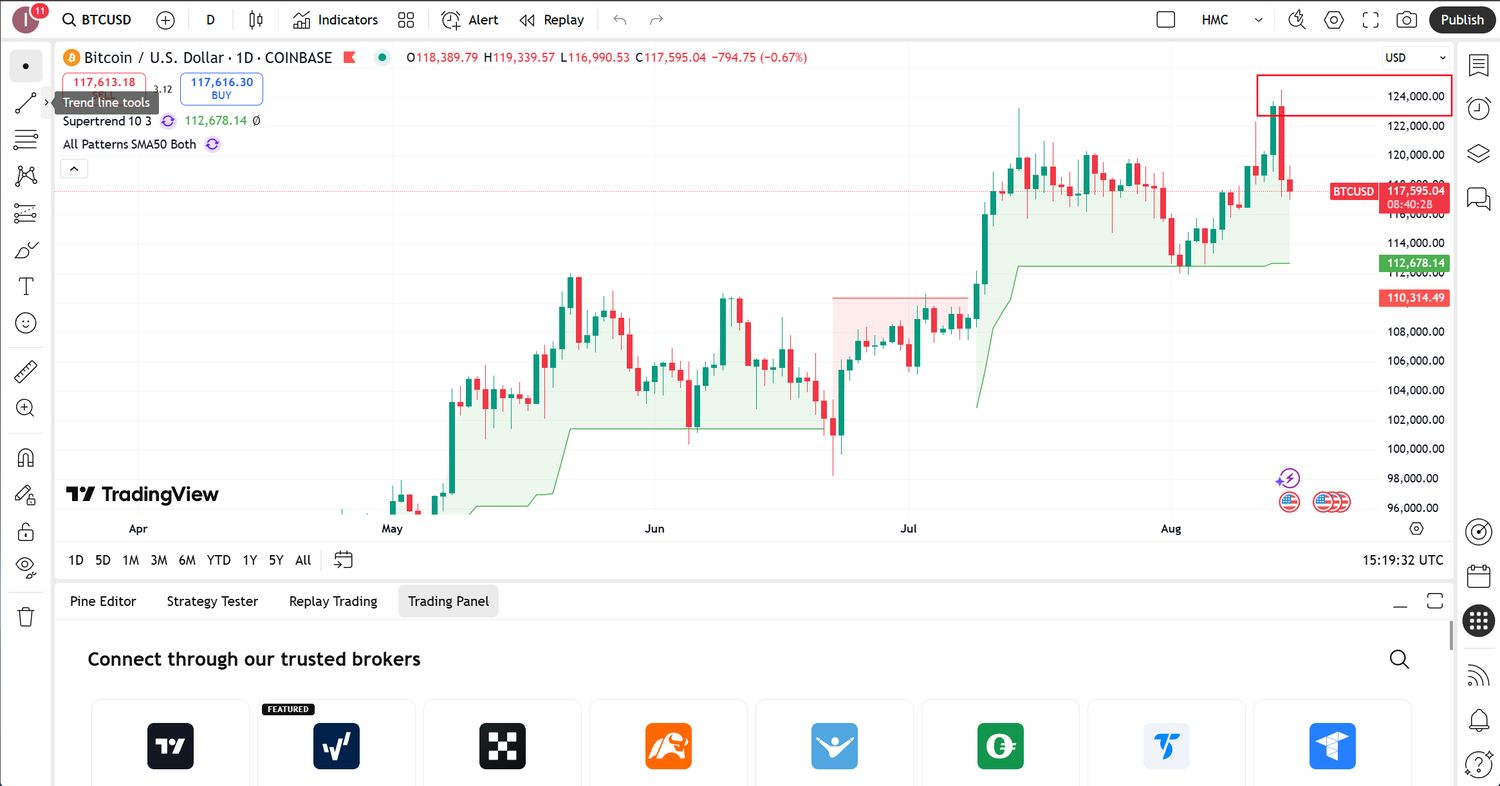

Bitcoin’s Current Market Position

Bitcoin’s historical price journey over time | Source: Investopedia

Currently trading around $115,890, Bitcoin remains below its all-time high of $124,100 reached in August. This has led to concerns among some investors, particularly as traditional assets have been setting new records.

Gold recently achieved a new all-time high of $3,674, while the S&P 500 set a record closing high of 6,587. These developments have prompted questions about Bitcoin’s relative performance and whether it’s lagging behind other asset classes.

However, Hayes strongly disputed this narrative, arguing that such comparisons miss the fundamental point about Bitcoin’s unique value proposition.

Challenging Traditional Performance Metrics

Hayes dismissed concerns about Bitcoin underperforming relative to stocks and gold, calling the premise of such comparisons “flawed.” He argued that Bitcoin represents the best performing asset against currency debasement in history.

When examining traditional assets through different lenses, Hayes pointed out significant revelations:

- The S&P 500, while up in dollar terms, hasn’t recovered to 2008 levels when measured against gold

- The housing market remains well below historical peaks when deflated by gold prices

- Only major US technology companies have shown strong performance when adjusted for gold

“If you deflate things by Bitcoin, you can’t even see it on the chart; it is just so ridiculous about how well Bitcoin has performed,” Hayes stated, emphasizing Bitcoin’s exceptional long-term performance.

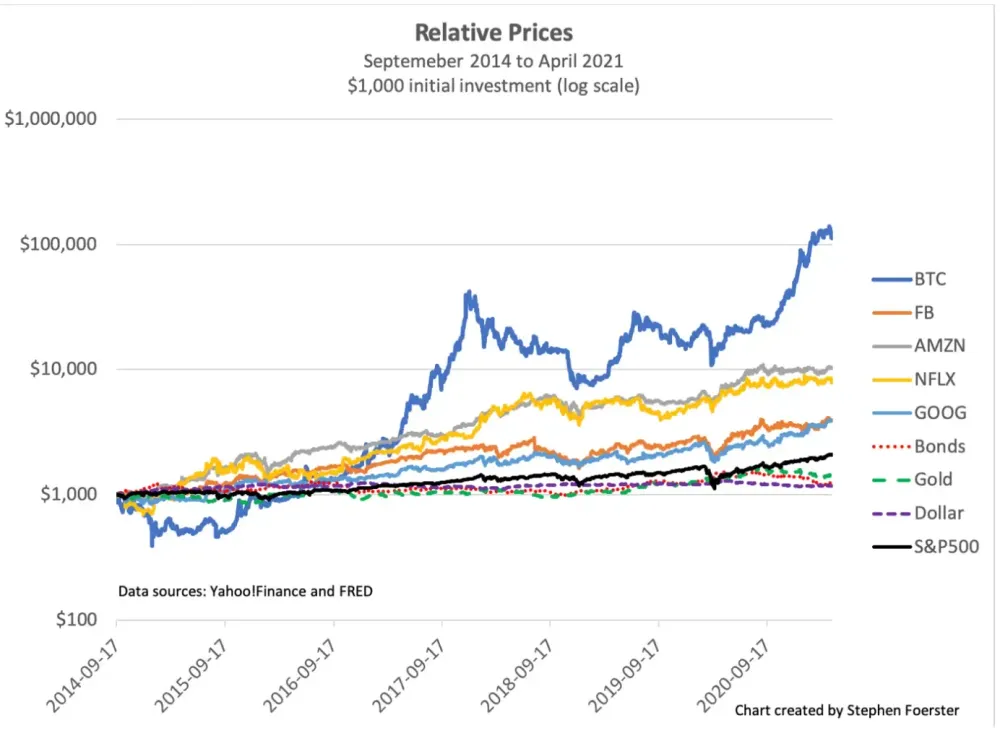

Historical Performance Validates Patience

Bitcoin outperforms traditional asset classes significantly | Source: Smart Valor

Supporting Hayes’s argument for patience, historical data demonstrates Bitcoin’s impressive track record. Over the past decade, Bitcoin has delivered an average annualized return of 82.4%, far exceeding most traditional investment vehicles.

This performance metric underscores why Hayes advocates for long-term thinking rather than short-term speculation. The data suggests that investors who maintain patience and resist the urge for immediate gains are more likely to benefit from Bitcoin’s growth trajectory.

Market Psychology and Investor Behavior

The interview highlighted a common psychological trap in cryptocurrency investing: the expectation of immediate, extraordinary returns. This mindset, often fueled by social media narratives about luxury purchases and instant wealth, can lead to poor investment decisions and significant losses.

Hayes’s commentary reflects a broader industry concern about speculative behavior and unrealistic expectations among newer market participants. The emphasis on “Lambo culture” – referring to expensive Lamborghini purchases as symbols of crypto success – represents exactly the type of thinking that can lead to financial disaster.

Future Outlook and Price Predictions

Despite advocating for patience, Hayes hasn’t abandoned optimistic long-term projections for Bitcoin. Previous forecasts from industry experts, including Hayes himself, have suggested Bitcoin could reach $250,000, though such predictions come with inherent uncertainty and should be viewed within appropriate risk contexts.

The key message remains consistent: sustainable Bitcoin investment requires patience, proper risk management, and realistic timeline expectations rather than hopes for immediate wealth creation.

Investment Strategy Implications

For current and prospective Bitcoin investors, Hayes’s insights suggest several important considerations:

Timeline Expectations: Understanding that Bitcoin investment benefits compound over years, not days or months, is crucial for success and mental well-being.

Risk Management: Avoiding overleveraging or investing money needed for short-term expenses helps prevent forced selling during unfavorable market conditions.

Market Perspective: Focusing on Bitcoin’s unique properties rather than comparing short-term performance with traditional assets provides better investment framework.

Historical Context: Recognizing Bitcoin’s exceptional long-term performance helps maintain conviction during temporary market downturns.

Conclusion

Arthur Hayes’s message to the Bitcoin community is both sobering and encouraging. While he warns against unrealistic short-term expectations that can lead to financial ruin, he simultaneously reinforces Bitcoin’s exceptional long-term performance and potential.

The cryptocurrency market’s volatility will continue to test investor patience and discipline. However, historical data and expert analysis suggest that those who approach Bitcoin investment with proper timeline expectations and risk management are more likely to benefit from its continued adoption and growth.

For Bitcoin investors, the path to success appears to require patience, perspective, and a fundamental understanding that sustainable wealth building takes time – regardless of social media narratives suggesting otherwise.