Bitcoin Leads $2 Billion Crypto Investment Inflows Despite Bearish Sentiment

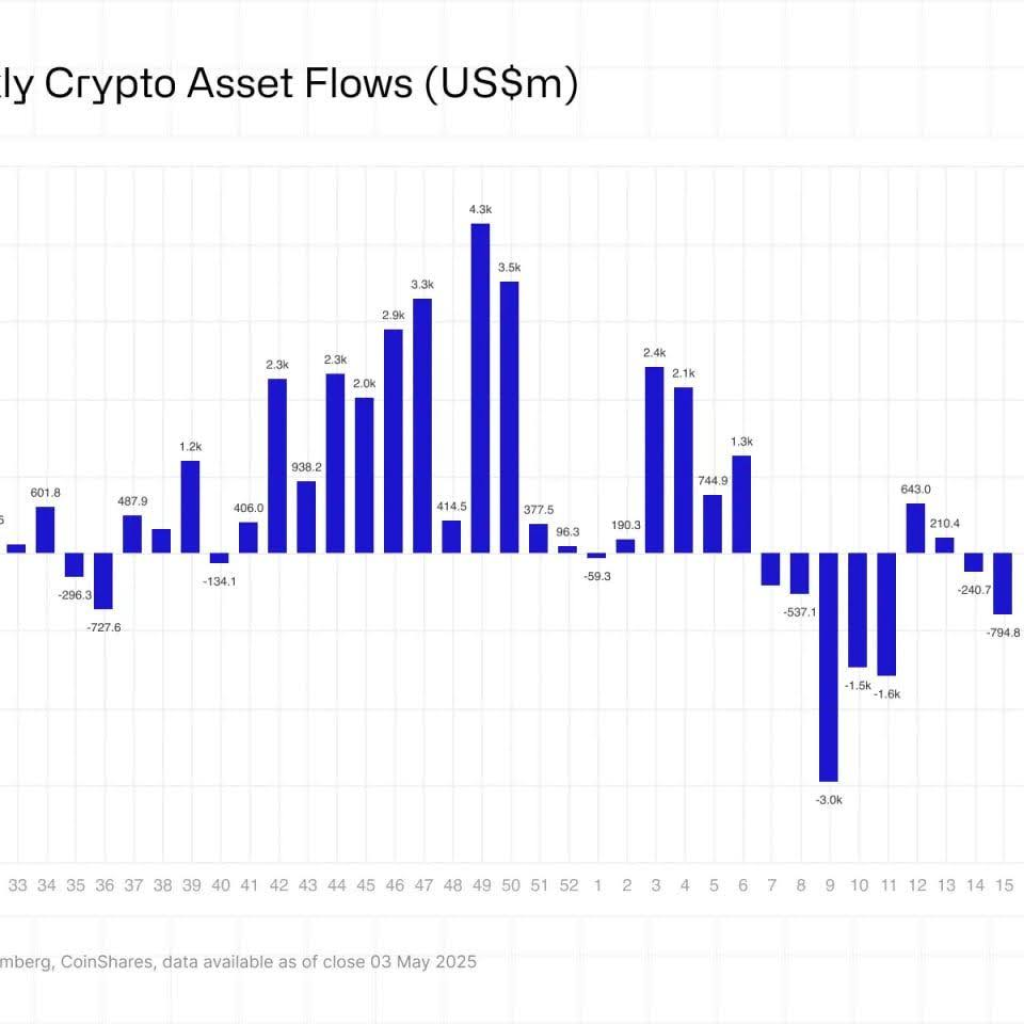

Digital asset investment products witnessed robust capital inflows last week, with a total of $2 billion entering the crypto market despite persistent bearish sentiment from some investors.

Bitcoin Dominates Investment Landscape

Bitcoin remained the undisputed leader in attracting institutional capital, accounting for approximately $1.8 billion of the total inflows. This impressive figure comes despite $6.4 million flowing into short-Bitcoin products from bearish investors, highlighting the mixed market sentiment currently surrounding the leading cryptocurrency.

The continued strong interest in Bitcoin investment products suggests institutional confidence remains high, even as some traders position themselves for potential downside.

Market Implications

This substantial influx of capital indicates that institutional investors are increasingly viewing digital assets as a viable investment class, particularly Bitcoin. The divergence between long and short positions reflects the maturing market dynamics where varying investment strategies can coexist.

Industry analysts suggest that this level of investment activity, particularly in a single week, signals growing mainstream acceptance of cryptocurrencies as both a store of value and a hedge against traditional market volatility.

Broader Cryptocurrency Market

While Bitcoin dominated the investment landscape, other digital assets also attracted institutional interest, though at significantly lower volumes. The remaining $200 million was distributed across various altcoins and multi-asset investment products.

Market observers note that this pattern of investment reinforces Bitcoin’s position as the “gateway cryptocurrency” for institutional investors looking to gain exposure to digital assets.

What’s Next for Crypto Investments

As regulatory frameworks continue to evolve and institutional-grade custody solutions improve, analysts expect this trend of significant capital inflows to continue throughout 2025. However, the presence of bearish positioning indicates that market participants remain cautious about short-term price volatility.

Investors should monitor upcoming regulatory developments and macroeconomic factors that could influence institutional sentiment toward digital asset investments in the coming months.