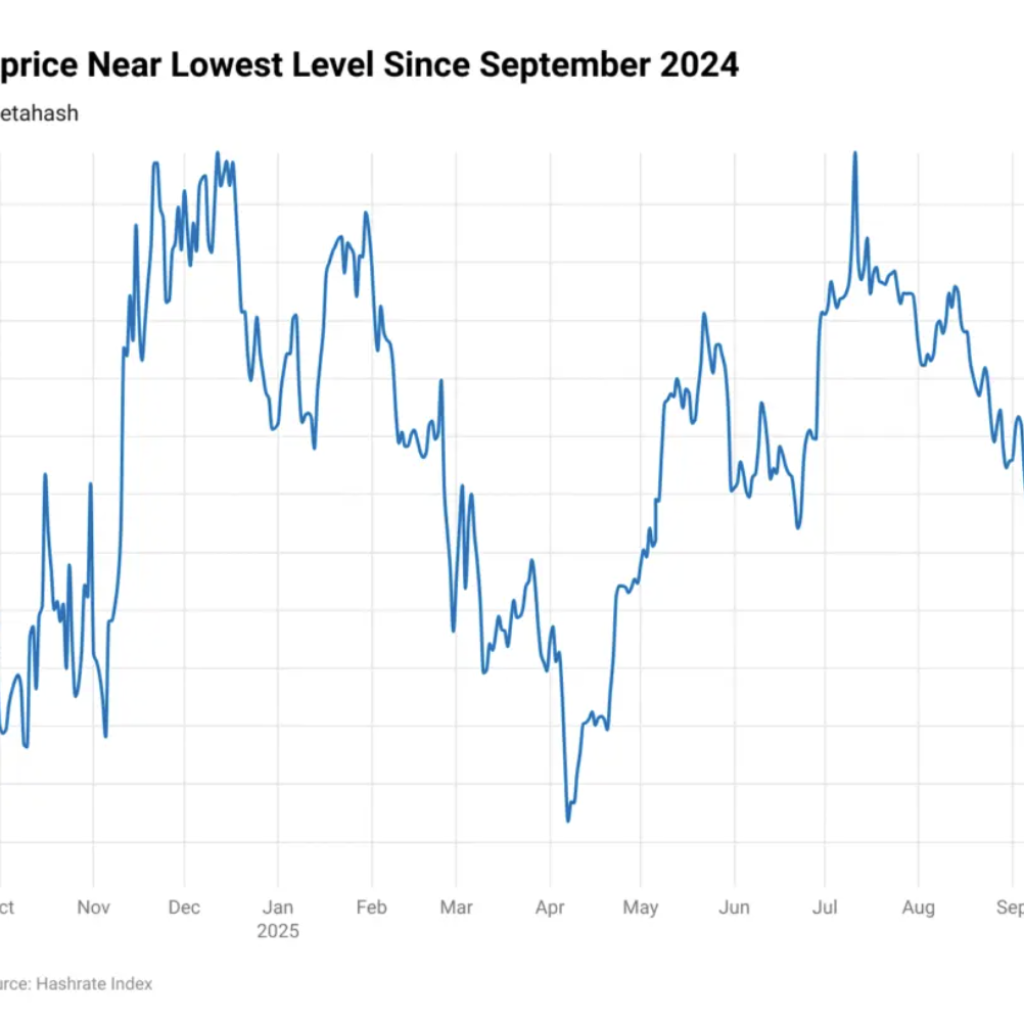

Bitcoin Miner Hashprice Nears Critical $40 Level as Industry Re-Enters Survival Mode

- Bitcoin hashprice is approaching $40 per PH/s, putting miner profitability under pressure.

- Declining BTC prices and rising operational costs are squeezing margins.

- Mining hardware suppliers and broader supply chain are also feeling the strain.

- Many miners are shifting toward AI and high-performance computing to stay afloat.

Bitcoin’s mining industry is once again navigating a difficult environment as hashprice, a key profitability metric, continues to slide. Hashprice represents the expected revenue a miner earns per unit of computing power. According to data from TheMinerMag, this figure has now fallen to around $42 per petahash per second (PH/s), after peaking above $62 in July. With hashprice nearing the $40 threshold, miners are experiencing renewed financial stress, particularly smaller operators who operate with tighter margins.

For many mining firms, profitability has become increasingly fragile. When hashprice drops, the revenue earned from mining blocks and transaction fees may no longer cover energy costs, maintenance expenses, and equipment financing. As a result, some miners are evaluating the possibility of shutting down rigs, reducing operations, or relocating to cheaper energy regions. The cascading effects of this downturn extend beyond mining companies themselves and into the broader supply chain.

Mining hardware manufacturers have begun to feel the pressure as well. Demand for new equipment has slowed significantly as miners hesitate to upgrade or expand capacity under current conditions. Some hardware providers have resorted to self-mining as a way to maintain revenue streams in the face of weakening sales and lower BTC-denominated earnings following October’s price decline. This shift reflects a growing struggle across the industry to preserve economic stability while market conditions remain uncertain.

The environment has been made more challenging by Bitcoin’s broader structural changes. Every four years, Bitcoin undergoes a halving that reduces block rewards by 50%. Following the April 2024 halving, the reward dropped to 3.125 BTC per block, intensifying competition among miners. In the early days of Bitcoin, mining could be done using regular home computers. Now, specialized ASIC hardware and massive industrial-scale energy resources are required, pushing smaller miners further to the margins.

Facing rising costs, competitive pressure, and inconsistent revenue, many mining firms are turning toward new business models. One of the most notable shifts is the pivot into artificial intelligence and high-performance computing data centers. These sectors offer more predictable and often higher-margin revenue opportunities. Major mining companies have already begun forming long-term infrastructure partnerships to capitalize on this shift. For example, Cipher Mining secured a $5.5 billion agreement with Amazon Web Services in October to supply compute power over 15 years. Similarly, IREN struck a $9.7 billion deal with Microsoft to provide GPU computing resources.

This transition reflects a broader transformation within the mining ecosystem. As Bitcoin mining becomes tougher and more expensive, firms are diversifying their operations in order to survive. Whether this marks a temporary adaptation or a lasting structural shift will depend on future crypto price movements, energy market dynamics and regulatory developments.

Final Thought

The mining industry has entered another phase of consolidation, where only the most efficient operators can withstand the economic pressures. As hashprice falls and block rewards shrink, the future of mining hinges on innovation, diversification, and securing cheaper energy sources. The next wave of winners may be those who adapt fastest to this evolving landscape.