Bitcoin Miners Face the “Harshest Margin Environment” Ever as Revenue Collapses

- Bitcoin miners are experiencing the worst economic conditions in the industry’s 15-year history.

- Hashprice has fallen to structural lows around $35 per PH/s.

- Mining revenue is dropping while costs rise, squeezing even top public miners.

- New mining machines now take over 1,000 days to break even.

- Major mining stocks like MARA, CLSK, RIOT and HIVE have seen steep declines.

The Bitcoin mining industry is now facing what analysts describe as its most severe profitability crisis to date. According to a new report from TheMinerMag, miners across the board are struggling as revenue sinks, operational costs surge and debt loads grow heavier. Even the largest and most efficient public mining firms are finding it harder to stay profitable.

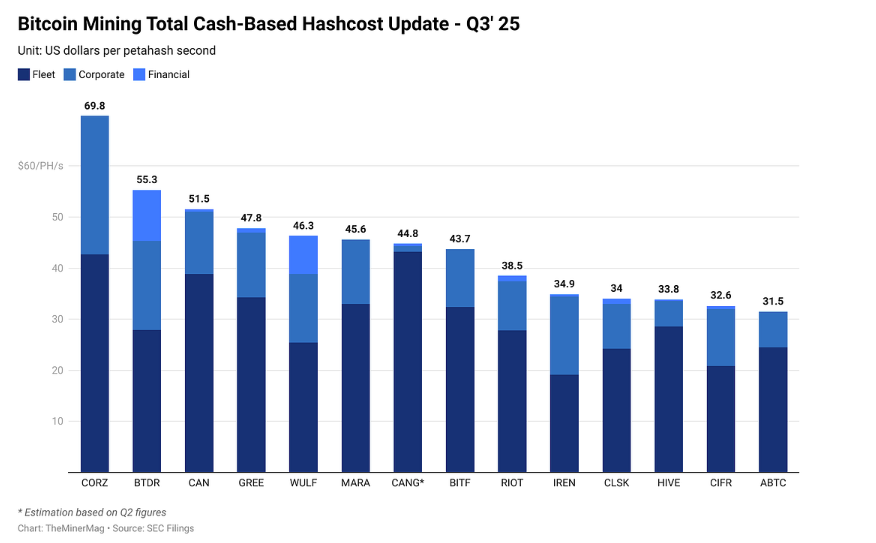

A major driver of the downturn is the collapse in hashprice, which measures how much revenue miners earn for each unit of computing power. During the third quarter, hashprice averaged around $55 per petahash per second, but has now dropped to roughly $35 — a level TheMinerMag calls a structural low, not just a short-term decline. This steep drop followed Bitcoin’s price correction from its near-record high of almost $126,000 in October to under $80,000 in November. With profits tied directly to market value, miners are now generating far less income from the same amount of computational effort.

Under these conditions, the cost-per-hash metric has become even more important. It reveals how well miners convert electricity and capital investments into computational output. The gap between efficient operators and weaker ones is widening fast. TheMinerMag notes that the latest generation of mining machines now require more than 1,000 days to repay their initial cost — an alarming figure given that the next Bitcoin halving is only about 850 days away. This means many miners may never recover their investment before rewards are cut again.

Signs of financial stress are already visible on balance sheets. TheMinerMag points to CleanSpark’s decision to fully repay its Bitcoin-backed credit line with Coinbase as part of a wider trend toward debt reduction and liquidity protection. Miners appear to be preparing for a long period of weak margins rather than expecting a quick recovery.

The pressure is also spilling into the stock market. Mining equities have fallen sharply since mid-October, accelerated by the decline in both Bitcoin’s price and broader traditional markets. MARA Holdings has dropped around 50% from its October peak, while CleanSpark has fallen 37% and Riot Platforms is down 32%. HIVE Digital Technologies has been hit the hardest, losing 54% of its value over the same period.

These conditions point to a challenging period ahead for the mining sector. With revenue low, costs rising and break-even periods extending beyond the next halving, only the most efficient and well-capitalized miners are likely to weather the storm.

Final Thought

Bitcoin mining is entering one of its toughest economic phases in history. As profits fall and costs rise, the industry is shifting toward efficiency, debt reduction and survival mode. Unless Bitcoin sees a strong recovery or mining conditions improve, many smaller or less efficient miners may struggle to stay in business.