Bitcoin Mining Stocks Surge Past BTC as Investors Back AI Diversification

Bitcoin mining stocks are crushing Bitcoin’s own price performance in September, fueled by investor excitement over miners pivoting into artificial intelligence and high-performance computing despite ongoing profitability pressures.

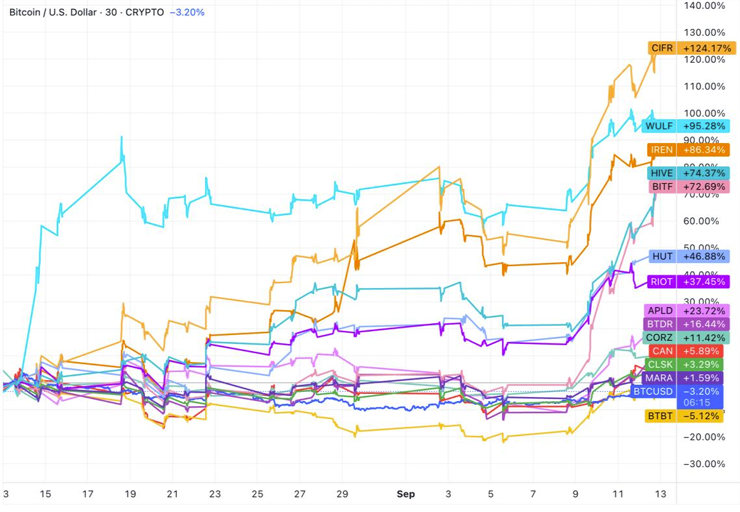

- Shares of major miners surged 73%–124% in September while Bitcoin dipped over 3%.

- Cipher Mining, Terawulf, Iris Energy, Hive Digital, and Bitfarms lead the rally.

- Network difficulty climbs above the 1 zetahash mark, squeezing mining profitability.

- Miners pivot to AI data centers and GPU computing to diversify revenue streams.

- Treasury strategy gains traction as miners hold more Bitcoin amid rising costs.

Bitcoin mining stocks have staged an impressive rally in September, dramatically outpacing Bitcoin itself even as mining economics remain challenging. According to The Miner Mag, shares of Cipher Mining, Terawulf, Iris Energy, Hive Digital Technologies, and Bitfarms climbed between 73% and 124% over the past month, while Bitcoin prices slipped by more than 3%. Several of these companies are now trading near yearly or even all-time highs, underscoring strong investor confidence in their evolving business models.

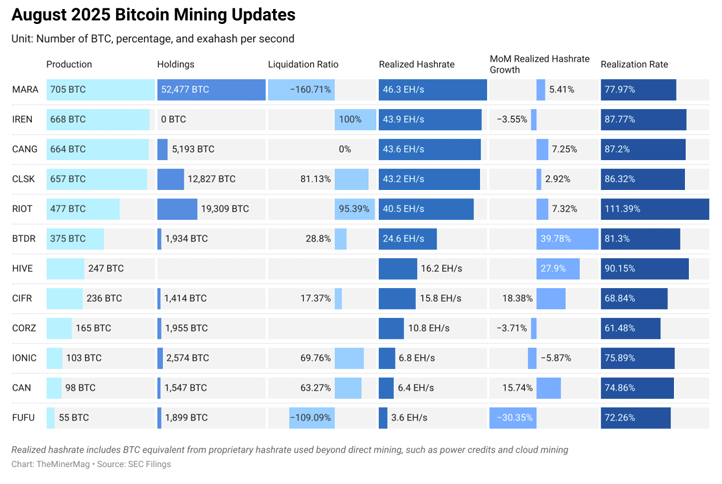

This bullish momentum comes despite tightening industry fundamentals. Bitcoin’s next difficulty adjustment is projected to rise another 4.1%, signaling that the network’s average hashrate is surpassing the one-zetahash milestone for the first time. Yet miners are not enjoying greater profitability. Hashprice remains stuck below $55 per petahash per second, and monthly transaction fees have dropped below 0.8% of rewards, reflecting weaker onchain activity and lower fee income.

Several Bitcoin mining stocks are trading at yearly or all-time highs. Source: The Miner Mag

Investors are instead rewarding miners that are diversifying into artificial intelligence and high-performance computing. Hive Digital is accelerating its transition into AI-driven data center infrastructure, Iris Energy is ramping up operations with Nvidia Blackwell GPUs, and Terawulf is benefiting from a partnership with Google to expand its high-performance computing capabilities. These strategic pivots are viewed as a hedge against the cyclical nature of Bitcoin mining and as a path to higher-margin revenue streams outside of pure crypto mining.

At the same time, many miners are pursuing a long-term treasury strategy, holding onto more of their mined Bitcoin rather than selling it into the market. This accumulation trend, first noted in early 2024, has gained steam, with Glassnode reporting rising wallet balances for three consecutive weeks. On September 9, miner net inflows reached 573 BTC, the largest daily increase since October 2023. By retaining their Bitcoin reserves, miners are positioning themselves to benefit if Bitcoin prices rebound while also signaling confidence in the asset’s long-term value.

Final Thought

The sharp rally in mining stocks highlights how investor enthusiasm for AI and high-performance computing can overshadow short-term headwinds in the mining sector. As miners diversify revenue streams and build Bitcoin reserves, their resilience and evolving business models may offer more upside than the cryptocurrency they help secure.