Bitcoin OGs Shift to ETFs for Major Tax Benefits as Market Matures

- Long-term Bitcoin holders (“OGs”) are selling some of their BTC to reallocate into spot Bitcoin ETFs.

- ETFs offer significant tax advantages under current U.S. rules, analysts say.

- Some OGs are also diversifying into blockchain and alternative crypto projects.

- Bitcoin’s growth rate and volatility are declining, signaling a shift into a more mature asset phase.

- The narrative of Bitcoin vs. altcoins is fading as the broader blockchain ecosystem evolves.

Many early Bitcoin adopters are reducing their direct BTC holdings to move into regulated financial products like spot Bitcoin exchange-traded funds (ETFs), according to Dr. Martin Hiesboeck, head of research at digital finance platform Uphold.

Hiesboeck says the trend is driven primarily by tax efficiency. Spot Bitcoin ETFs allow investors to capture Bitcoin’s upside while benefiting from favorable tax treatment not available when holding BTC directly. “OG holders are selling to buy back in ETF form because ETFs offer incredible tax advantages under current rules, especially in the United States,” he explained.

Another motivation is portfolio diversification. Hiesboeck argues that veteran crypto investors now view blockchain technology as the broader innovation, with multiple sectors using distributed ledgers for real-world applications. As a result, some believe returns from emerging blockchain projects may exceed Bitcoin’s future upside.

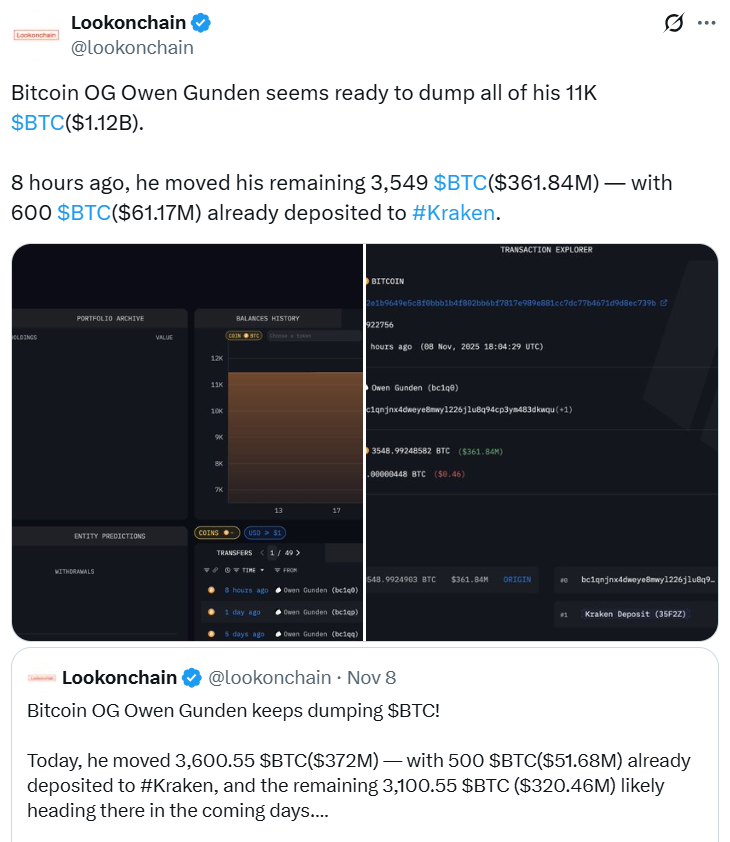

One notable case is early Bitcoin arbitrage trader Owen Gunden, who reportedly spent years accumulating BTC and recently transferred the last portion of his 11,000 Bitcoin stack to an exchange, likely signaling intent to liquidate or reposition. On-chain analytics show several dormant Bitcoin wallets from the Satoshi era have also reawakened this year, including one holding 80,000 BTC.

Bitcoin’s performance profile is evolving as well. Its four-year compound annual growth rate (CAGR) has steadily declined and is currently around 13%, marking a shift away from high-growth speculation toward use as a macro hedge. Hiesboeck attributes this trend to institutional adoption, including the launch of spot BTC ETFs, which introduces more stable capital and dampens volatility.

Analysts suggest Bitcoin is now in a distribution phase, where early concentrated holders sell into a growing pool of new investors — a typical milestone in the evolution of financial assets.Hiesboeck also dismissed the old rivalry between Bitcoin and altcoins, arguing that the crypto industry has broadened. He believes the next phase is about identifying impactful blockchain projects rather than defending ideological camps:

“We are in an exciting tech space with room for many projects,” he said.