Bitcoin Could Surge to $200,000 in Q4 as Demand Accelerates, Says CryptoQuant

Onchain analytics firm CryptoQuant predicts that Bitcoin (BTC) could reach between $160,000 and $200,000 by the end of 2025 if the current surge in demand continues. The firm highlights strong whale accumulation, ETF inflows, and growing market momentum as key drivers of a potential fourth-quarter rally.

- Demand for BTC has grown by over 62,000 BTC per month since July.

- Whale holdings are expanding faster than in previous bull markets.

- U.S. Bitcoin ETFs continue to increase purchases, signaling institutional demand.

- BTC recently broke above $116K, confirming a return to the bull phase.

- Other analysts, including Standard Chartered and Bitwise, see BTC hitting $200K or more this year.

According to CryptoQuant, Bitcoin has entered the fourth quarter under highly favorable market conditions that resemble previous bull phases. The onchain analytics firm said Bitcoin’s price could rise to between $160,000 and $200,000 before the end of 2025, as long as demand keeps increasing.

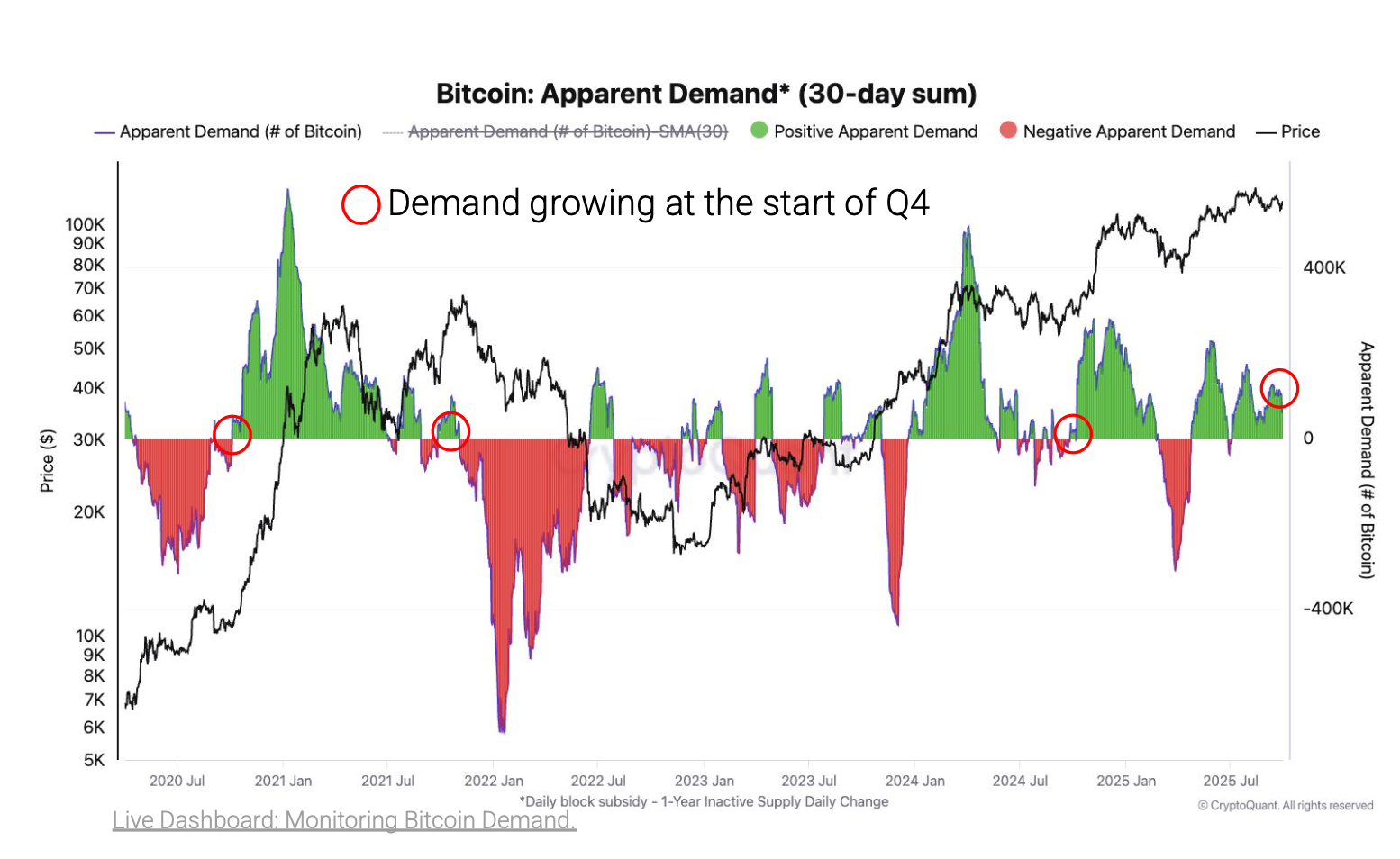

CryptoQuant’s data shows that spot demand for Bitcoin has been growing at a rate of over 62,000 BTC per month since July. Similar growth patterns were seen before major Q4 rallies in 2020, 2021, and 2024. The firm highlighted that such sustained accumulation often precedes sharp price movements.

Whales — large BTC holders — are also expanding their portfolios at a record pace. Their total holdings are increasing at an annualized rate of 331,000 BTC, compared to 255,000 in Q4 2024 and 238,000 in Q4 2020. In contrast, 2021 saw a contraction of nearly 200,000 BTC.

Meanwhile, U.S.-listed Bitcoin ETFs are buying aggressively. In Q4 2024, ETFs added 213,000 BTC, a 71% increase from the previous quarter. CryptoQuant’s head of research, Julio Moreno, said similar growth is expected in Q4 2025, pointing to rising institutional appetite for Bitcoin exposure.

On the technical side, Bitcoin has broken above its on-chain realized price level of $116,000, which CryptoQuant calls the “trader’s pivot point.” With BTC trading around $117,300, the firm believes the market has re-entered its bullish phase, opening the door to a potential move toward $200,000.

CryptoQuant’s Bitcoin Bull Score Index — which measures momentum and investor behavior — ranged between 40 and 50 at the end of Q3, matching conditions seen before Bitcoin’s surge from $70,000 to $100,000 in 2024. The firm says the index suggests “conditions are about to turn bullish,” supported by increasing demand, expanding stablecoin liquidity, and reduced selling pressure.

Several other institutions share similar optimism. Standard Chartered Bank, Bitwise, and Fundstrat’s Tom Lee have all forecast Bitcoin reaching $200,000 by year-end, while Standard Chartered projects BTC could even climb to $500,000 by 2028 as investor access improves and volatility declines.

Final Thought

Bitcoin’s market setup for Q4 2025 looks strikingly similar to past breakout periods. With strong onchain demand, growing institutional inflows, and a decisive move above key price thresholds, analysts believe the world’s largest cryptocurrency could soon set new all-time highs — potentially reaching the $200,000 mark if momentum continues.