Investors Urged to Be Cautious With Bitcoin Stock-to-Flow Model, Says Bitwise Analyst

- Bitwise’s André Dragosch warns investors to be “cautious” when relying on the Bitcoin Stock-to-Flow (S2F) model.

- The model forecasts BTC at $222,000 this cycle, but ignores demand-side factors, says Dragosch.

- Institutional demand now exceeds Bitcoin’s latest halving supply cut by more than 7x.

- Analysts remain divided, projections range from $200K to $500K, while some warn of a potential 50% correction.

- Rising M2 money supply could still act as a bullish catalyst for BTC.

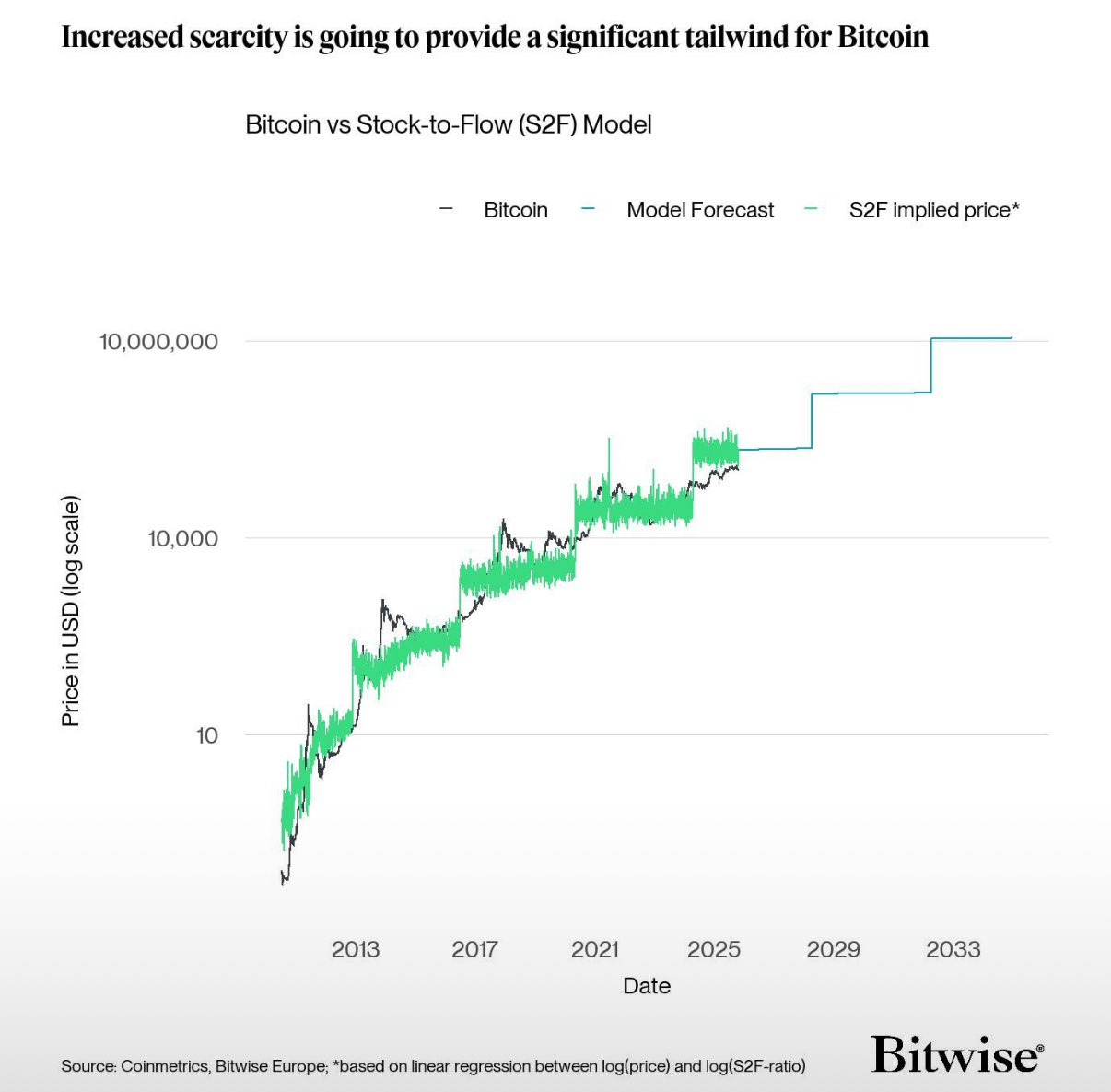

The Bitcoin Stock-to-Flow (S2F) model, one of the most famous valuation frameworks in the crypto space, has come under renewed scrutiny. According to André Dragosch, head of research at Bitwise, investors should be “cautious” when using it to predict Bitcoin’s price trajectory.

The S2F model, popularized by analyst PlanB, predicts that Bitcoin could peak around $222,000 in the current market cycle. However, Dragosch argues that the model fails to consider demand-side dynamics, focusing solely on Bitcoin’s supply halvings, which reduce new BTC issuance every four years.

“Today, institutional demand via Bitcoin exchange-traded products (ETPs) and treasury holdings outweighs the annualized supply reduction from the latest Halving by more than seven times,”

said Dragosch.

Why the Stock-to-Flow Model Falls Short

The Stock-to-Flow (S2F) model links Bitcoin’s scarcity to its value, assuming that as supply decreases, price naturally increases. But Dragosch points out that this framework oversimplifies Bitcoin’s market behavior, as it doesn’t account for institutional inflows, ETF adoption, and macroeconomic factors like liquidity and interest rates.

Data from Bitwise suggests that ETPs and institutional demand now play a dominant role in shaping Bitcoin’s price – creating a price floor above $100,000 and reducing volatility.

As a result, relying on S2F alone could mislead investors about future price potential, especially in a market increasingly influenced by financial products and global liquidity trends.

Despite concerns, analysts remain split on Bitcoin’s long-term targets:

- Geoff Kendrick of Standard Chartered expects BTC to reach $200,000 by the end of 2025, citing growing institutional participation.

- Some bullish forecasts predict $500,000 by 2026, driven by a potential M2 money supply expansion, which could flood markets with liquidity and push up asset prices.

- On the other hand, Galaxy Digital CEO Mike Novogratz believes such high valuations are unlikely without “crazy” macro events.

- FundStrat’s Tom Lee also cautioned that Bitcoin could still see a 50% drawdown, even amid institutional adoption.

Liquidity, Not Scarcity, May Drive the Next Cycle

While Bitcoin’s halvings historically preceded bull runs, analysts now suggest that global liquidity conditions, not just supply cuts, could determine BTC’s next move.

An expanding M2 money supply, which tracks the total U.S. dollar liquidity in circulation, is often seen as a bullish driver for Bitcoin and other risk assets. As more liquidity enters markets, it tends to push capital into stores of value like BTC.

However, the balance between institutional inflows, macroeconomic factors, and supply-side mechanics remains complex and fluid.

The Stock-to-Flow model remains a useful heuristic for understanding Bitcoin’s scarcity — but not a crystal ball for price forecasting.

As Bitwise’s Dragosch notes, demand dynamics now outweigh halving effects, meaning investors should treat S2F as a reference, not a roadmap.

With institutional adoption, monetary policy shifts, and global liquidity cycles shaping the market, Bitcoin’s price may continue to surprise, both to the upside and the downside.