Over 8% of Bitcoin Supply Moved in One Week as Markets Balance on a ‘Knife’s Edge’

- Over 8% of all Bitcoin moved on-chain in the past week — one of the largest shifts ever

- Analysts say this mirrors historic market bottoms like 2018 and 2020

- Up to half of the movement may be linked to Coinbase’s wallet migration

- Crypto markets remain tense ahead of the Federal Reserve’s December rate decision

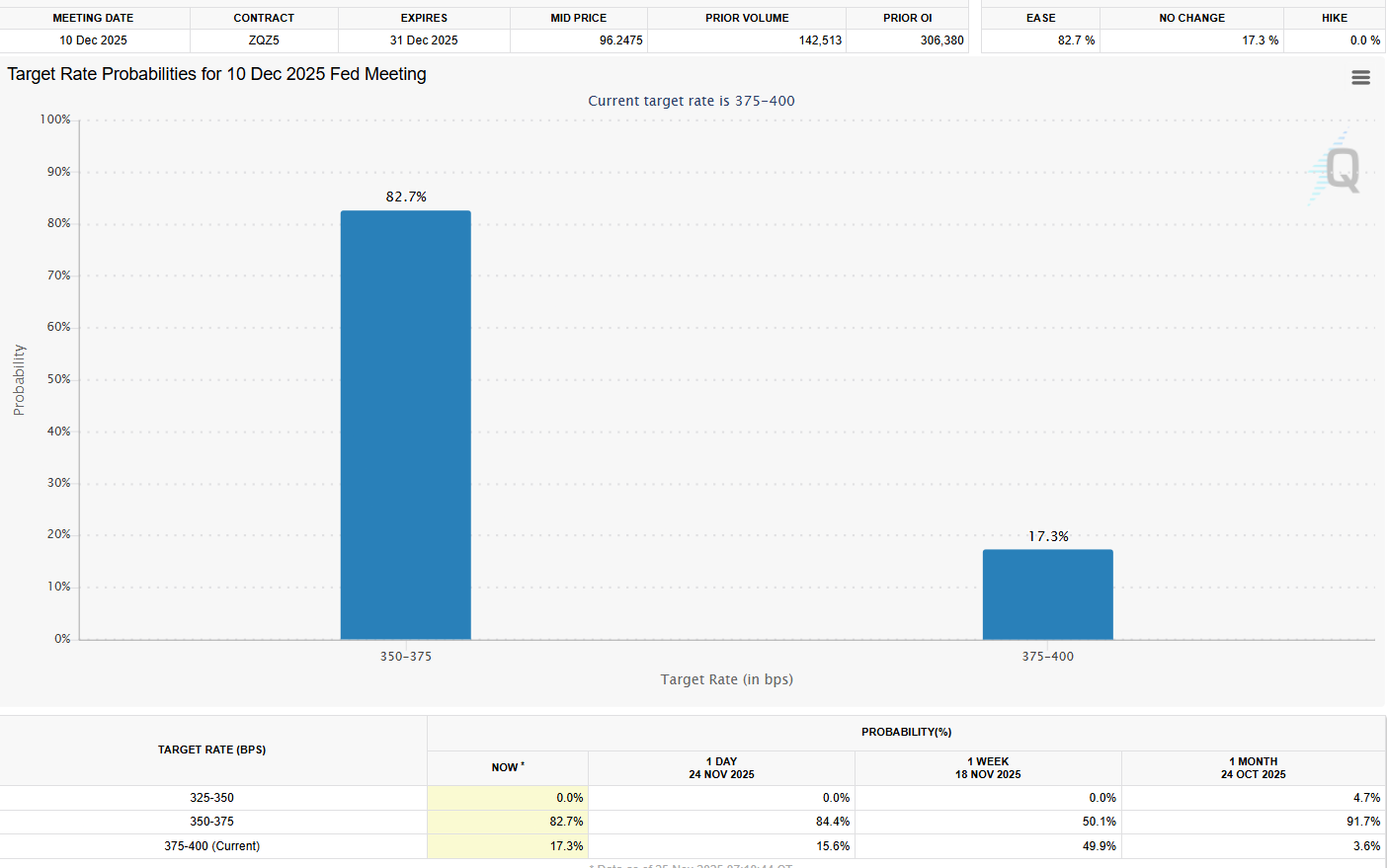

- Rate cut expectations surged from 50% to 82% within a week

The Bitcoin market experienced one of its largest on-chain movements in history this week, with over 8% of the entire Bitcoin supply changing hands during the recent market pullback. The unusual level of activity coincided with rising uncertainty across the crypto market, as traders anxiously watched shifting expectations around a potential interest rate cut at the United States Federal Reserve’s December meeting. According to Semler Scientific analyst Joe Burnett, this level of supply migration places the current downturn among the most significant on-chain events Bitcoin has ever seen.

Burnett explained that previous large supply shifts took place during major market lows, such as in March 2020 when Bitcoin traded near $5,000, and in December 2018 when it bottomed around $3,500. Both moments marked the beginning of strong accumulation phases that later pushed Bitcoin to new all-time highs. While some analysts see this week’s activity as a similar signal, Burnett also noted that as much as half of the movement may be linked to Coinbase’s recent wallet migration, which was publicly announced and expected to create unusual transaction volume across the blockchain.

At the same time, market sentiment remains extremely fragile. Nic Puckrin, digital asset analyst and co-founder of The Coin Bureau, described Bitcoin’s current positioning as being on a “knife’s edge.” With mixed signals coming from the Federal Reserve, traders are unsure whether December will bring relief or further volatility. Puckrin said the Fed’s upcoming rate decision will likely determine whether markets enjoy a year-end rally or face renewed selling pressure. As the Dec. 10 meeting approaches, he expects anxiety to increase, with the Fed’s press conference becoming a focal point for traders hoping for clarity.

Expectations of a rate cut have shifted dramatically over the past week. Just days ago, markets assigned only a 50% probability to a 25 basis point cut. That figure has now climbed to around 82%, according to the CME Group’s FedWatch tool. The rising confidence in a rate reduction helped Bitcoin rebound from the $81,000 range back to around $87,000, but analysts caution that the market remains highly sensitive to any change in the Fed’s stance.

With historically large Bitcoin movements occurring alongside rising macroeconomic uncertainty, investors are preparing for a volatile stretch leading into the end of the year. Whether this marks the beginning of a new accumulation phase or simply another moment of heightened turbulence will depend largely on the Federal Reserve’s next move.