Bitcoin Treasury Growth Slows in Q4, but Major Companies Keep Accumulating BTC

- Bitcoin treasury adoption slowed sharply in Q4 2025.

- Only nine new companies added BTC to their balance sheets this quarter.

- Large corporations continue accumulating Bitcoin despite the slowdown.

- Over 1 million BTC (4.7% of total supply) is held by public companies.

- Ether and XRP treasury purchases also declined, showing weaker demand across digital assets.

Bitcoin treasury activity has slowed down during the fourth quarter of 2025, even though the largest corporate holders continue to quietly increase their Bitcoin positions. Data from CryptoQuant shows that fewer companies are adding Bitcoin to their balance sheets, reflecting more caution from smaller firms and retail investors.

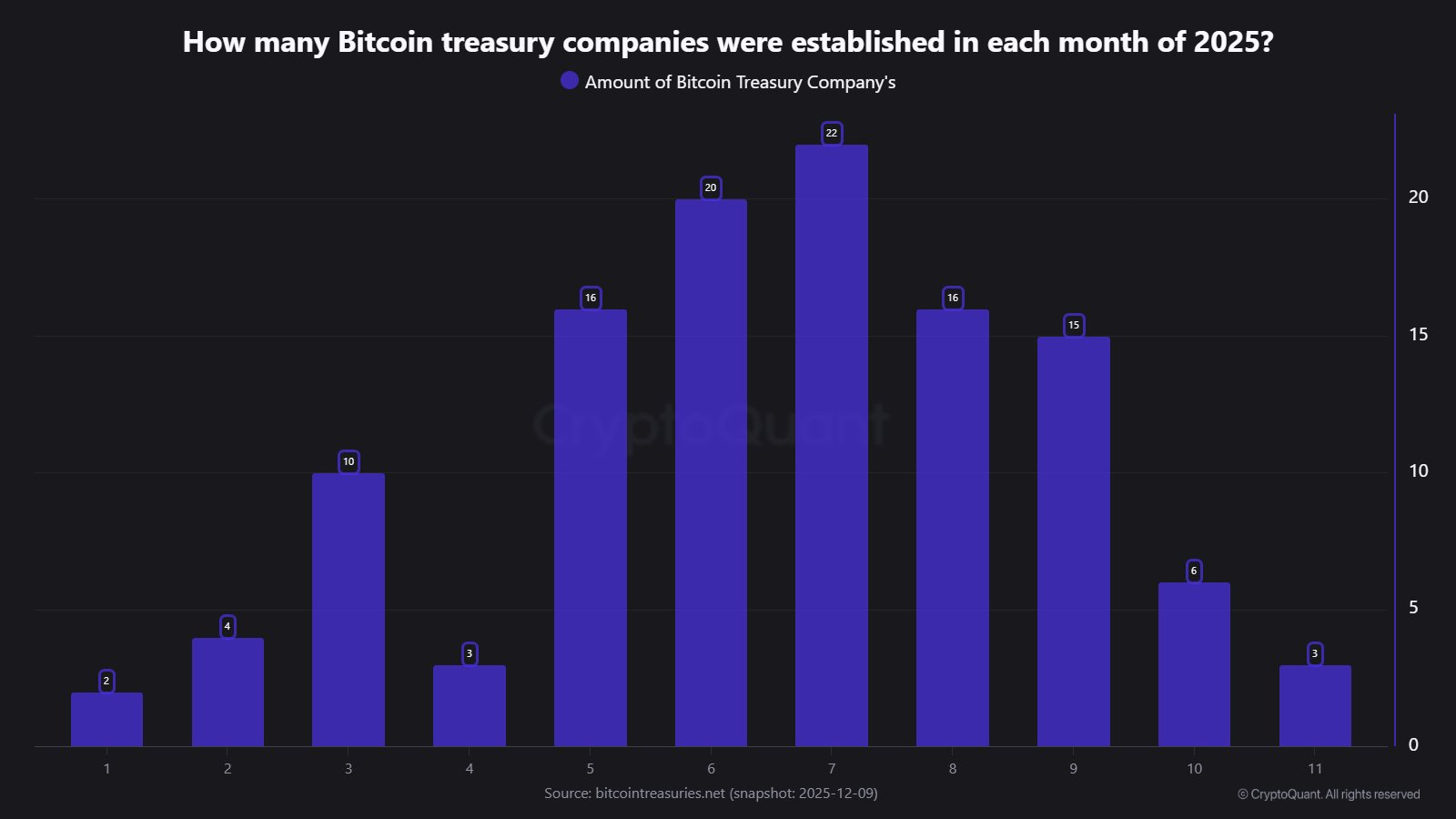

New Bitcoin Treasury Adoption Drops in Q4

The number of new companies adopting Bitcoin fell sharply from a strong peak earlier in the year. In Q3, 53 new companies added BTC to their treasuries. But in Q4, that number dropped to only nine so far.

In total, 117 companies have adopted Bitcoin in 2025 — but CryptoQuant notes that most of these firms hold very small amounts of BTC. Many companies added just a small allocation rather than making major long-term bets.

Some previously active Bitcoin treasury firms have paused their buying. Metaplanet, a well-known Japanese investment company, hasn’t purchased Bitcoin for more than two months. A few companies have even reduced their Bitcoin exposure. For example, UK-based Satsuma Technology sold 579 BTC worth around $53 million, leaving it with 620 BTC on its balance sheet.

These trends show a mixed environment: smaller firms are becoming more cautious, while some investors are taking profits after Bitcoin’s strong movements this year.

Large Bitcoin Holders Continue Accumulating

Despite the slowdown among small and mid-sized companies, major corporate holders continue to buy Bitcoin aggressively. Strategy, the largest corporate holder of BTC, purchased $962 million worth of Bitcoin on Monday — its biggest buy since July.

This latest purchase brings Strategy close to matching the $21.97 billion worth of Bitcoin it acquired in 2024. Large institutions appear to see Bitcoin as a long-term strategic asset, and they continue accumulating during periods of lower market activity.

Current data shows that more than 1 million BTC — worth around $90.2 billion — is held in public company treasuries. This represents 4.7% of the total Bitcoin supply. Another 1.49 million BTC, or 7% of the total supply, is held by spot Bitcoin exchange-traded funds (ETFs). Together, these holdings show how deeply Bitcoin has become integrated into institutional portfolios.

Digital Asset Treasuries Slow Down Beyond Bitcoin

The slowdown isn’t limited to Bitcoin. Digital asset treasury (DAT) purchases across multiple assets are also weakening.

Ripple-backed Evernorth Holdings has stopped acquiring XRP since late October, after purchasing $950 million worth of tokens. Since then, Evernorth has been facing unrealized losses of nearly $80 million due to market declines.

Ether-focused companies are showing an even steeper pullback. BitMine Immersion Technologies, the largest corporate holder of ETH, reduced its buying significantly. Its Ether purchases dropped from $2.6 billion in July to only $296 million in December.

Overall, Ether treasury investments fell by 81% over the last three months — from 1.97 million ETH acquired in August to just 370,000 ETH in November.

These trends suggest that digital asset treasuries are entering a more cautious phase as markets stabilize and volatility shifts.

Final Thought

While Bitcoin treasury adoption slowed in Q4 2025, the biggest corporate holders continue accumulating BTC, reinforcing strong long-term confidence. With public companies and ETFs now holding over 11% of the total Bitcoin supply combined, institutional interest remains a powerful force. Even as smaller companies reduce or pause their crypto buying, major players are quietly strengthening their positions — signaling that Bitcoin’s role in corporate finance continues to grow.