JPMorgan Says Bitcoin Is Undervalued Compared to Gold, Suggests $170K Fair Value

- JPMorgan analysts say Bitcoin looks cheap when compared to gold.

- The bank highlights the bitcoin-to-gold volatility ratio dropping to 1.8.

- When adjusted for risk, Bitcoin’s fair value could be near $170,000.

- Some analysts remain cautious due to market headwinds and recent price drops.

- Institutional demand and ETFs may lead to slower but steady growth.

JPMorgan analysts believe Bitcoin may currently be undervalued, especially when compared to gold. In a research note released on Wednesday, the firm explained that Bitcoin’s price has fallen behind gold when adjusting for volatility — a calculation often used by large investors to evaluate risk and value.

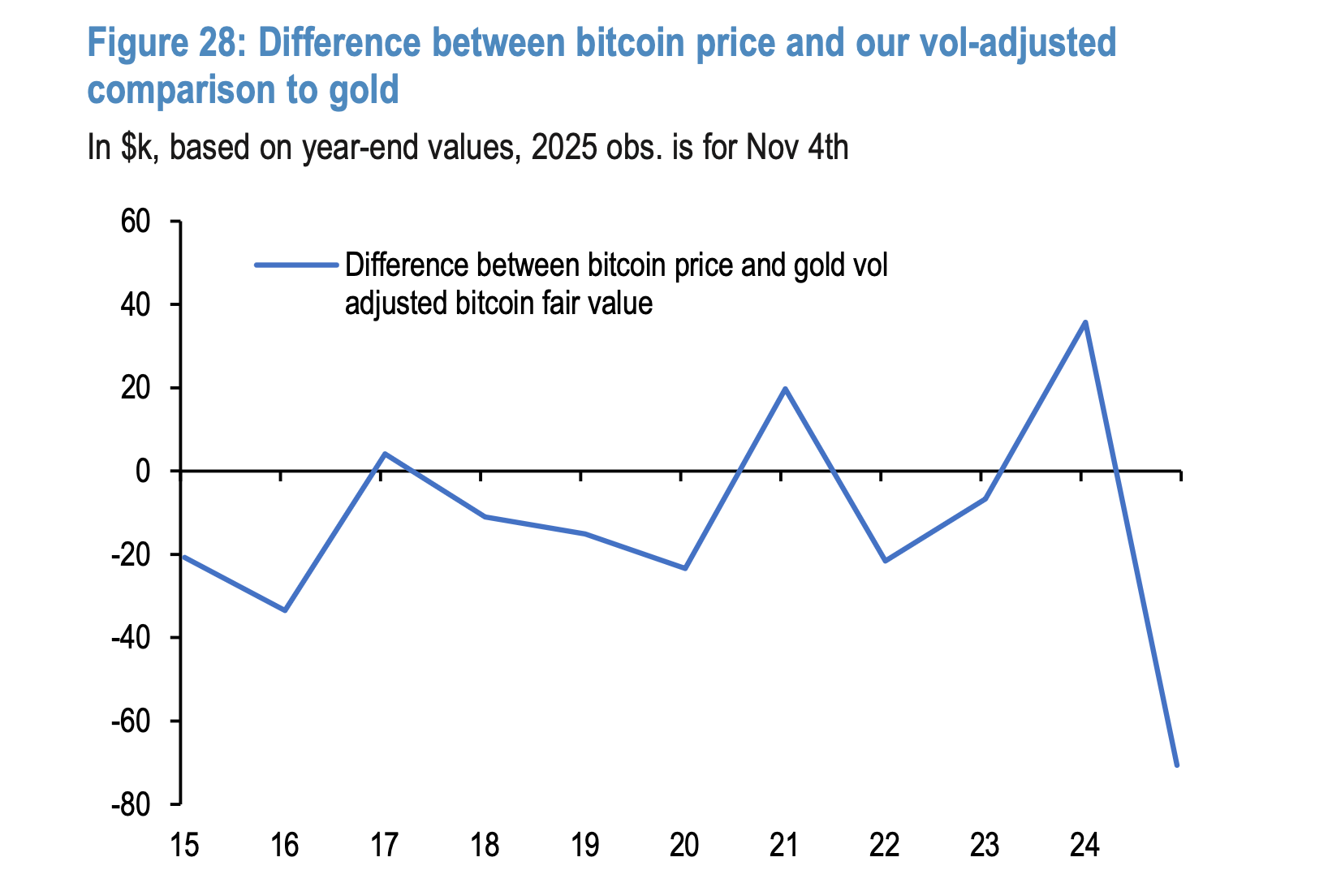

The key metric highlighted is the bitcoin-to-gold volatility ratio, which now stands at 1.8. This means Bitcoin is viewed as 1.8 times more risky than gold. When analysts adjust Bitcoin’s market cap based on this ratio, they arrive at a fair value closer to $170,000 — roughly 67% higher than where Bitcoin is currently priced. According to JPMorgan, this gap signals “significant upside” for Bitcoin over the next 6 to 12 months.

This forecast comes as Bitcoin has recently struggled to hold above the $100,000 support level. A drop earlier this week pushed the price below both psychological and technical support zones, causing concern among traders. Several analysts and investment firms have responded by lowering their price targets for Bitcoin in the near term. Galaxy Digital, for example, reduced its 2025 forecast from $185,000 to $120,000, citing whale selling, shifting investor interest, and evolving market behavior.

However, not all analysts view the slowdown negatively. Some say Bitcoin is entering a “maturity era,” where institutional investors, ETFs, and long-term holders influence the market more than short-term traders. In this environment, price movements may be less explosive, but potentially more stable over time.

This shift in market structure means Bitcoin may not rise as quickly as it has in past cycles. But according to JPMorgan, the long-term valuation gap still suggests strong growth potential. If Bitcoin begins to close the difference in risk-adjusted value relative to gold, the $170,000 level could become a realistic target.

Final Thought

While short-term market pressure and uncertainty remain, Bitcoin’s long-term outlook looks strong through the lens of institutional valuation. If the market continues to mature and confidence increases, Bitcoin could gradually move toward the fair value levels highlighted by JPMorgan.