Bitcoin Whale Opens $235M Short After Earning $200M From Market Crash

- An $11B Bitcoin whale opened a $235M short position after profiting $200M from last week’s market crash.

- The new short was placed at 10x leverage when BTC traded near $111K, signaling expectations of more downside.

- The whale currently faces a $2.6M unrealized loss, with liquidation set at $112,368.

- Blockchain data shows he moved $540M in BTC last week, including $220M to Coinbase.

- Analysts note whales’ selling and short activity as key factors behind Bitcoin’s volatility.

A massive Bitcoin whale, managing an estimated $11 billion in digital assets, has once again made waves in the crypto market – this time by opening a $235 million short position on Bitcoin (BTC). The move follows a successful short during last week’s market crash that reportedly netted the investor over $200 million in profit.

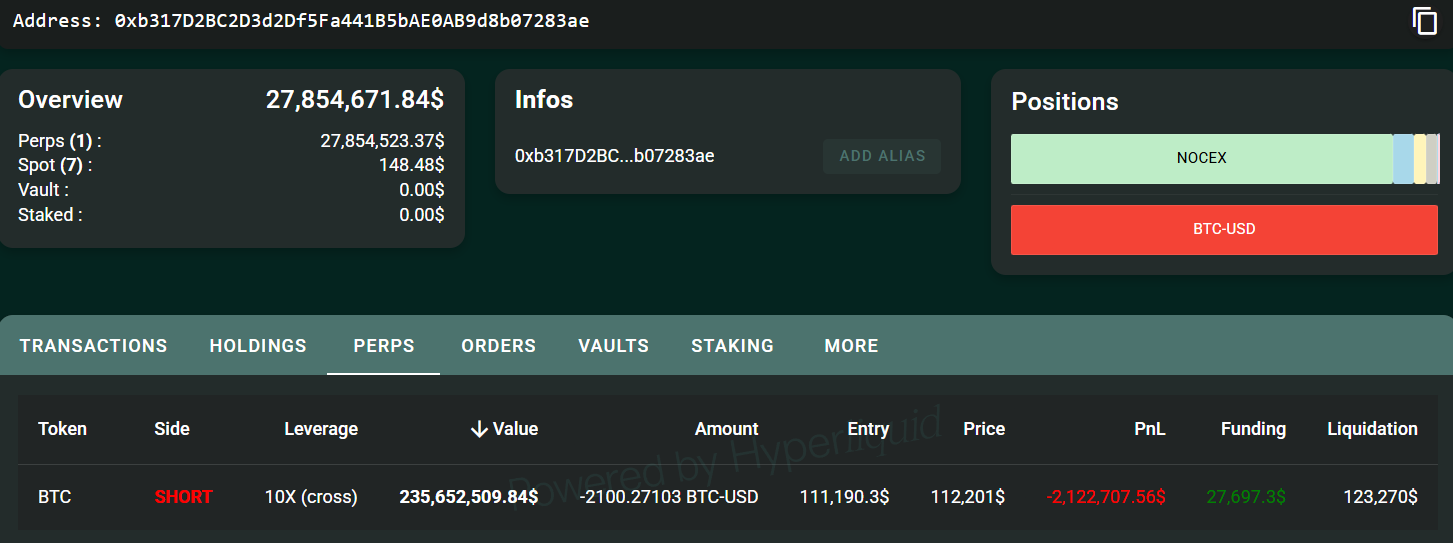

According to data from Hypurrscan, the whale initiated the short position on Monday, using 10x leverage, effectively betting on further price declines. The short was opened when Bitcoin was trading around $111,190, and at the time of writing, the position reflects an unrealized loss of about $2.6 million. The position will be liquidated if Bitcoin’s price rises above $112,368.

The whale’s renewed bearish stance comes amid ongoing tariff concerns and the U.S. government shutdown, both of which have heightened uncertainty in traditional and crypto markets. In trading terms, leverage enables investors to amplify both profits and losses by borrowing capital to increase position size. While this can magnify gains during favorable moves, it can also quickly wipe out capital when the market moves against them.

Blockchain analytics platform Arkham confirmed the whale’s re-entry into the short market, writing:

“The whale who made $200M shorting the Bitcoin crash to $100K has now moved $30M to Hyperliquid and is shorting AGAIN.”

Data also shows the whale moved over $540 million worth of Bitcoin into new wallets last week, including $220 million transferred to Coinbase, suggesting potential preparation for trading or liquidity purposes.

The same investor previously made headlines in September after rotating approximately $5 billion in BTC into Ether (ETH), temporarily surpassing Sharplink, the world’s second-largest corporate ETH holder. Analysts like Willy Woo noted that such large-scale selling and reallocation by long-dormant whales were major contributors to Bitcoin’s sideways price action in August.

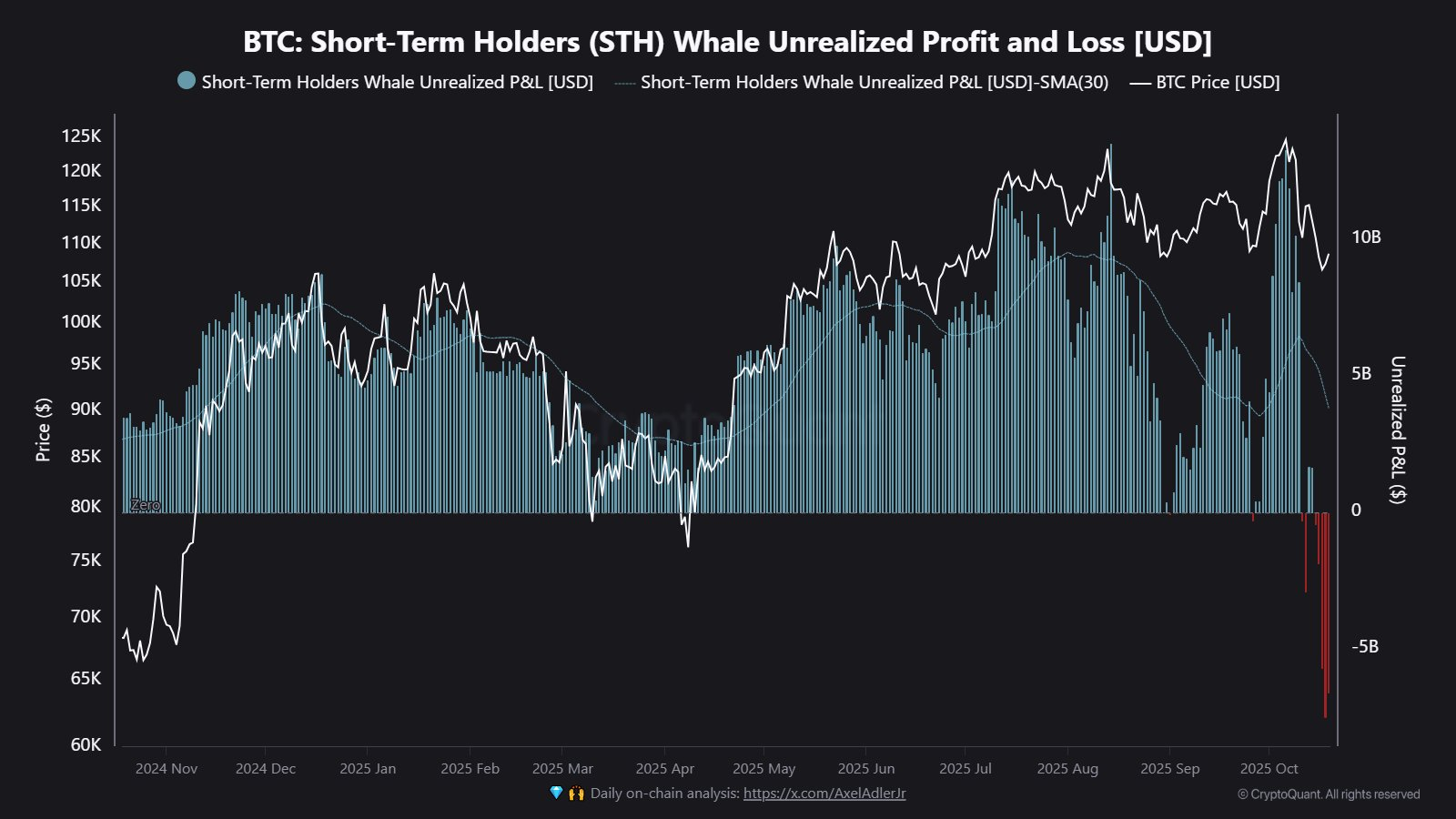

Meanwhile, the broader whale cohort has faced substantial unrealized losses following the latest market correction. According to CryptoQuant, new Bitcoin whales collectively hold $6.95 billion in unrealized losses, as BTC continues to trade below its average cost basis of $113,000 – the largest unrealized loss since October 2023. The firm reported that this group now holds about 45% of Bitcoin’s total Whale Realized Cap, underscoring the concentration of large holdings among a few entities.

Despite this short-term pain, some analysts interpret the recent pullback as a healthy correction. The four-day drop to $104,000 flushed out excessive leverage, setting the stage for more sustainable growth. Glassnode observed a rise in short-term holder supply and “speculative capital,” indicating that new investors are entering the market with more cautious, risk-managed positions.

Final Thought

The $11 billion Bitcoin whale’s renewed short position signals lingering bearish sentiment among major holders, even after profiting from last week’s market crash. While his actions may suggest further downside in the near term, analysts believe the recent correction has reset market leverage and paved the way for a more balanced recovery. Whether this whale’s bold bet pays off or backfires will depend on Bitcoin’s ability to reclaim key support above $113,000.