Bitcoin Whale–Retail Divergence Flashes Warning Signal, Says Santiment

- Santiment reports whales have been selling while retail is buying Bitcoin.

- Historically, price tends to follow whale behavior, signaling potential downside.

- Analysts differ: some expect consolidation, others still see room for new highs.

- ETF flows and macro conditions will likely influence Bitcoin’s next move.

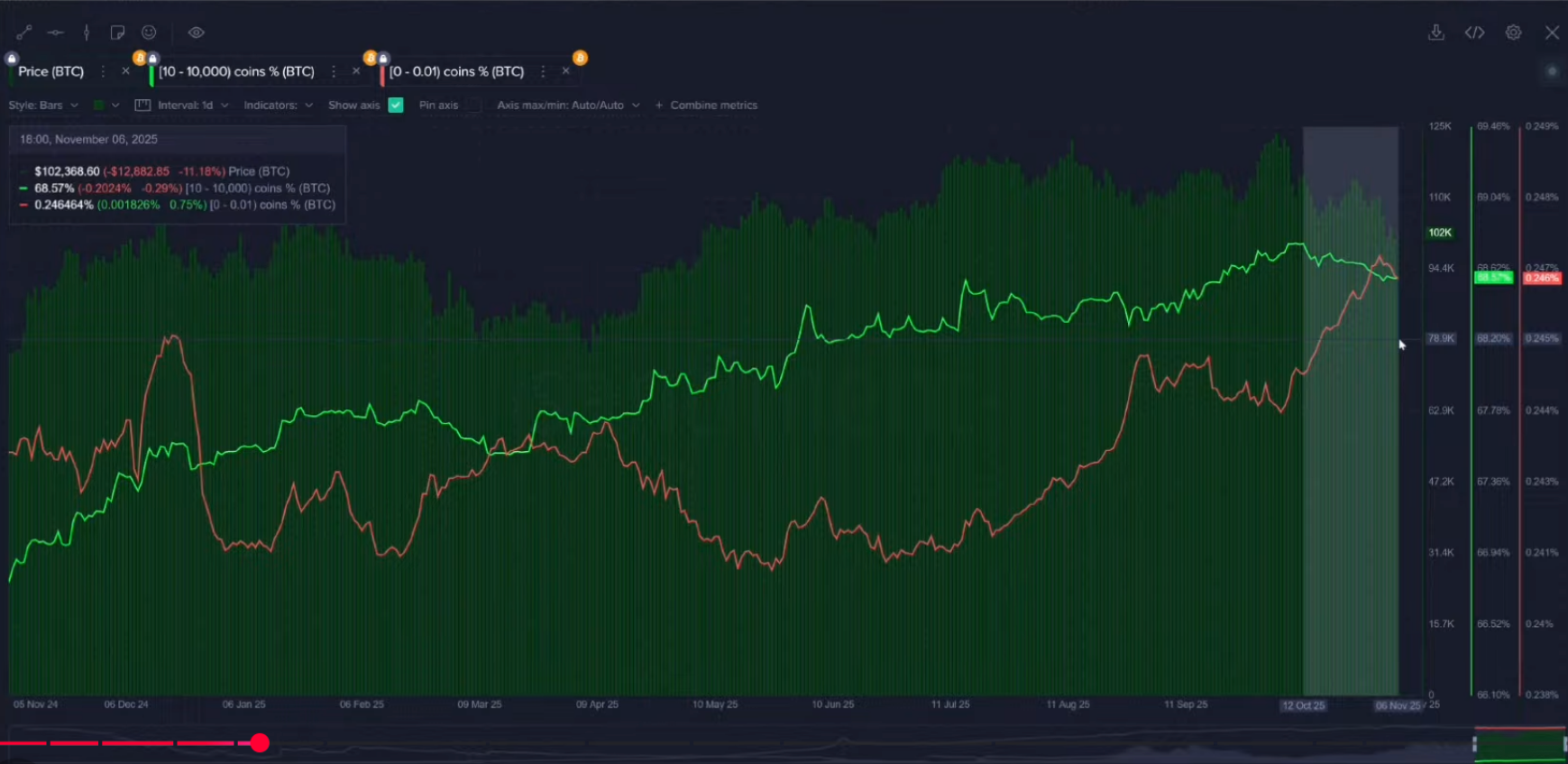

Bitcoin’s recent price action shows a widening gap between retail investors and large holders, raising caution among market analysts. According to data and commentary from sentiment analytics firm Santiment, whales holding between 10 and 10,000 BTC have offloaded roughly 32,500 Bitcoin since mid-October. Retail investors, meanwhile, have steadily increased their buying activity during the same period, scooping up smaller amounts of BTC as prices dipped.

Santiment pointed to this divergence as a historically significant signal. When retail buyers accumulate while whales sell, it has often preceded periods of price weakness. The reasoning is rooted in market influence: larger holders tend to exert more directional control due to the sheer size of their positions. If whales are trimming exposure, it may indicate reduced confidence in near-term upside, while retail enthusiasm can reflect reactive, rather than strategic, demand.

This whale-retail imbalance began as Bitcoin fell from about $115,000 to $98,000 in early November, a drop of roughly 15%. The asset has since partially rebounded to around $103,000, but the investor cohort split remains pronounced. Santiment described it as a “major divergence” worthy of attention, suggesting it could act as a warning if market conditions weaken further.

However, not all analysts interpret the signal as bearish. Researchers at Bitfinex told Cointelegraph they expect Bitcoin to move into a period of consolidation with intermittent volatility rather than a decisive decline. They argue that spot Bitcoin ETF inflows in early October helped push BTC toward $125,000 before macroeconomic pressure, derivatives expiries and profit-taking triggered a pullback. If ETF inflows recover and exceed $1 billion per week again, Bitfinex analysts believe Bitcoin could still move toward the $130,000 range.

Meanwhile, Nansen senior analyst Jake Kennis acknowledged that Bitcoin typically posts strong yearly gains but cautioned that the recent structural breakdown could limit near-term upside. Even so, he noted that a renewed surge remains possible if sentiment and momentum shift decisively.

The divergence between retail and whale behavior captures a broader dynamic in crypto markets: uncertainty mixed with underlying long-term conviction. Whether the next move is a breakout or deeper retracement may hinge on external factors such as macro liquidity conditions, ETF demand and broader risk appetite. For now, the market stands at a crossroads, with both caution and optimism vying for dominance.

Final Thought

Whale selling alongside retail accumulation is a pattern to watch. If macro conditions soften and ETF demand returns, retail buyers may benefit from their early confidence. But if broader market pressure builds, history suggests whale positioning may ultimately prove more influential.