BlackRock Eyes Tokenized Funds Tied to Real-World Assets, Bloomberg Reports

BlackRock is reportedly exploring tokenization for its funds tied to real-world assets, signaling a deeper push into onchain finance. The move could bring some of the world’s biggest ETFs onto blockchain rails—pending regulatory green lights.

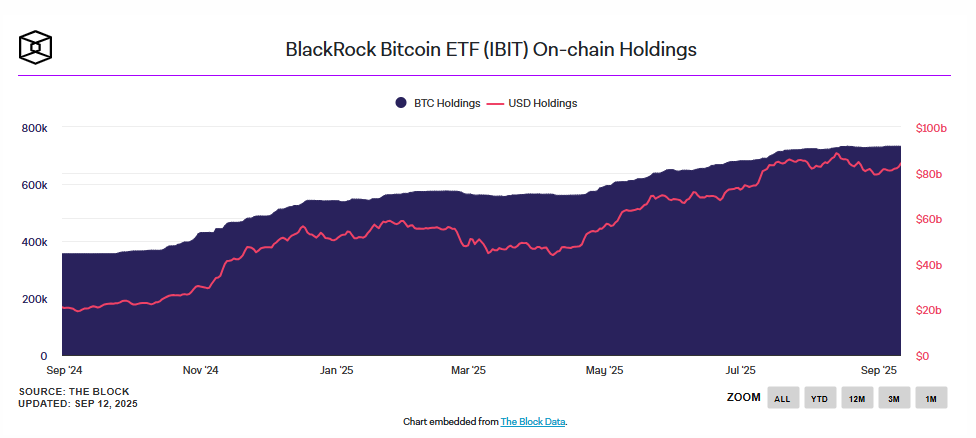

- The firm’s Bitcoin and Ethereum ETFs each hit $10B AUM in under a year, among the fastest ever.

- BlackRock already runs a $2B tokenized liquidity fund (BUIDL), showing real onchain experience.

- Wall Street rivals like Fidelity and Nasdaq are also testing tokenized funds and securities.

- Analysts say tokenization may streamline back-office operations but might not quickly change consumer investing habits.

According to Bloomberg’s Olga Kharif, unnamed sources say BlackRock is examining ways to bring its successful exchange-traded funds onchain, including those tied to stocks and other real-world assets. Any such effort would hinge on regulatory approval.

BlackRock already leads the pack in crypto ETFs: the iShares Bitcoin Trust and iShares Ethereum Trust have attracted $55B and $12.7B in inflows, respectively, both surpassing $10B AUM in under a year. The company also offers thematic products like the iShares Blockchain and Tech ETF, which invests in crypto-related firms rather than tokens directly.

Tokenizing traditional financial products is gaining traction. Fidelity recently launched a blockchain-based version of a Treasury money market fund, while Nasdaq is seeking SEC approval to trade tokenized securities alongside stocks.

BlackRock itself already runs the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), the first tokenized fund to top $1B and now managing more than $2B, according to RWA.xyz. Meanwhile, tokenized equities overall remain small, with less than $500M circulating globally despite interest from players like Robinhood and Kraken.

BlackRock CEO Larry Fink has repeatedly predicted that all financial assets will eventually be tokenized. Yet, Bloomberg ETF analyst Eric Balchunas is cautious, suggesting tokenization may improve back-office efficiency more than it will reshape consumer investing behavior. He doubts it will lure investors away from established ETF products like VOO in the near term.

Final Thought

BlackRock’s exploration of tokenized funds underscores the momentum behind bringing traditional assets onchain. Whether it sparks a retail shift or simply streamlines finance’s plumbing, the world’s largest asset manager is signaling that blockchain-based investing is moving from concept to reality.