First Chinese CNH Stablecoin Launches as Global Digital Currency Race Intensifies

China has introduced its first CNH stablecoin for international markets, signaling a new phase in the global push for sovereign digital currencies.

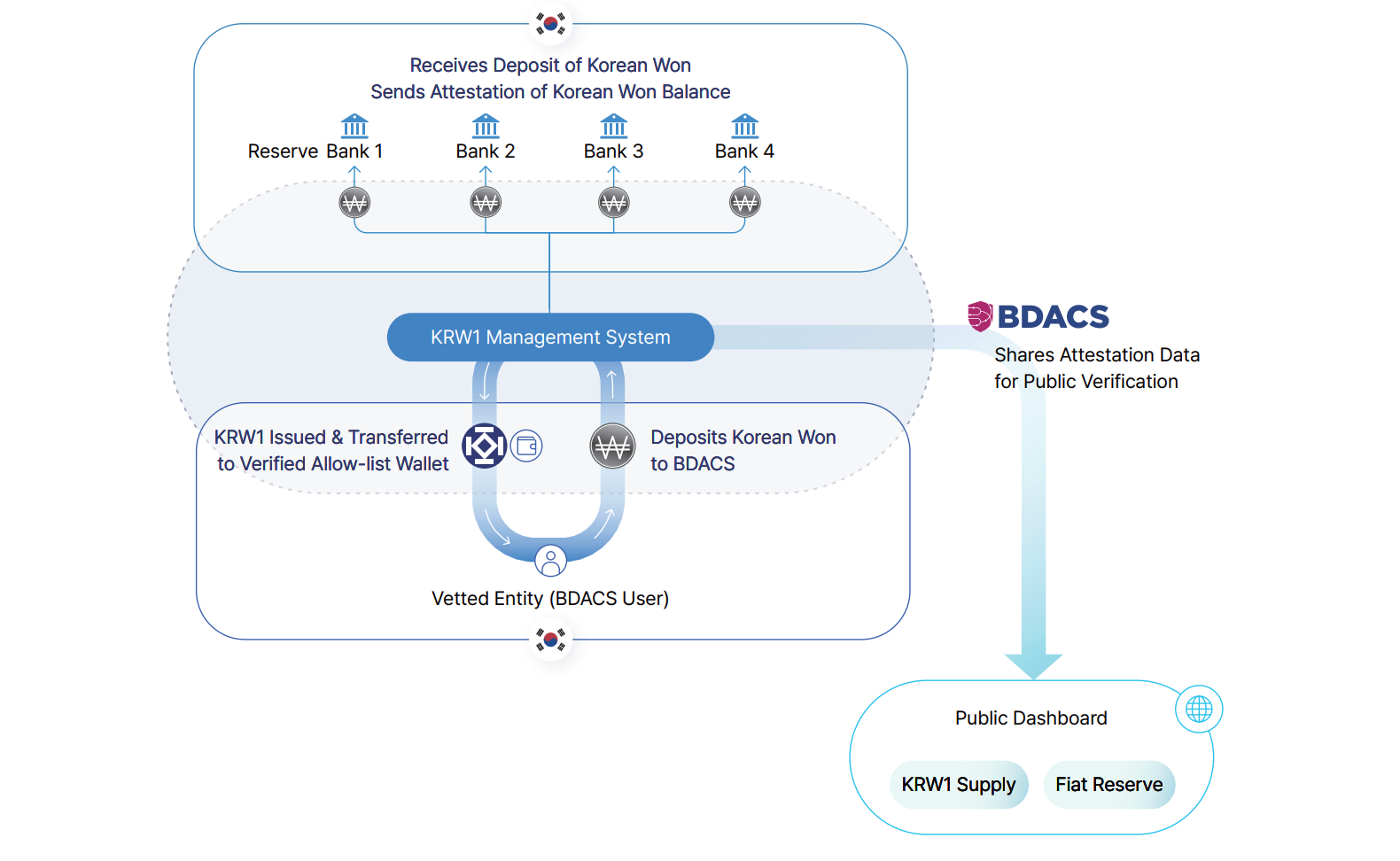

- AnchorX unveiled AxCNH, the first regulated offshore yuan (CNH) stablecoin, while BDACS introduced a KRW1 Korean won-pegged token.

- AxCNH aims to streamline Belt and Road trade and payments.

- Both tokens are overcollateralized and backed 1:1 by fiat or government debt.

- Nations see stablecoins as tools to expand currency influence and offset inflation.

- Governments hope blockchain rails will boost demand for their currencies and ease debt burdens.

The global competition for sovereign-backed digital currencies gained momentum this week as China rolled out its first regulated CNH stablecoin. Financial technology firm AnchorX introduced the AxCNH token, pegged to the offshore Chinese yuan, during the Belt and Road Summit in Hong Kong. Designed for international markets, AxCNH is intended to power cross-border transactions with countries tied to China’s Belt and Road initiative, which connects Asia, the Middle East, and Europe through trade routes and infrastructure projects.

In parallel, South Korean company BDACS announced the launch of KRW1, a stablecoin pegged to the Korean won. Both AxCNH and KRW1 are overcollateralized, meaning they’re fully backed by fiat deposits or government debt instruments held by custodians to ensure a 1:1 value ratio.

The debuts come amid a broader movement by governments to place their national currencies on blockchain rails. Traditional financial systems can be slow, infrastructure-heavy, and restricted by currency controls, limiting global demand. By digitizing fiat with stablecoins, nations aim to make their currencies more accessible, boost international demand, and counter inflationary pressures caused by excessive money printing.

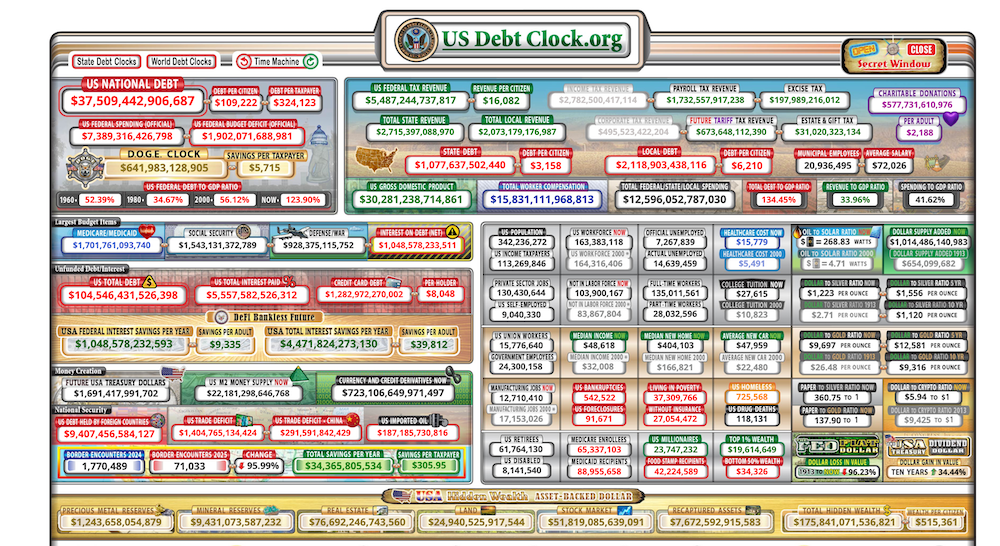

The stakes are high. The U.S. government’s national debt recently exceeded $37 trillion, and stablecoin issuers like Tether and Circle are already among the largest holders of U.S. Treasury bills. These companies effectively turn everyday crypto users into indirect bond buyers, supporting government debt markets and lowering borrowing costs. Anton Kobyakov, an advisor to Russian President Vladimir Putin, even suggested that the United States leverages stablecoins and gold to maintain confidence in the U.S. dollar amid mounting debt concerns.

Final Thought

The launch of China’s AxCNH and South Korea’s KRW1 underscores how digital fiat tokens are evolving into instruments of economic strategy. As more nations issue stablecoins, competition for global currency dominance will only intensify.