China’s Digital Yuan and Stablecoins Challenge Dollar Dominance

For over 70 years, the US dollar has anchored global finance, dominating trade, reserves, and payment networks. That dominance is now challenged. China is advancing a digital currency strategy built around the e-CNY, which by mid-2025 had nearly 300 million wallets and processed more than 7 trillion yuan.

This article explores what China is building, how it stacks up against the dollar’s digital ecosystem, and why the future points to fragmentation rather than outright replacement.

A Direct Challenge to Dollar Hegemony

China’s digital currency strategy represents the most significant challenge to US dollar dominance since the Bretton Woods system was created. At its core, Beijing is combining two pillars: a fully operational central bank digital currency (CBDC) and new yuan-backedstablecoin initiatives emerging through Hong Kong. Together, these form the basis of an alternative global payment infrastructure.

The domestic scale alone is impressive. By mid-2025, the digital yuan (e-CNY) had reached nearly 300 million wallets and processed over 7 trillion yuan ($986 billion) in transactions. Yet China’s ambition goes far beyond digitizing payments at home. Its goal is to build parallel financial systems that can bypass US-controlled infrastructure and gradually expand the yuan’s international role through technological leadership.

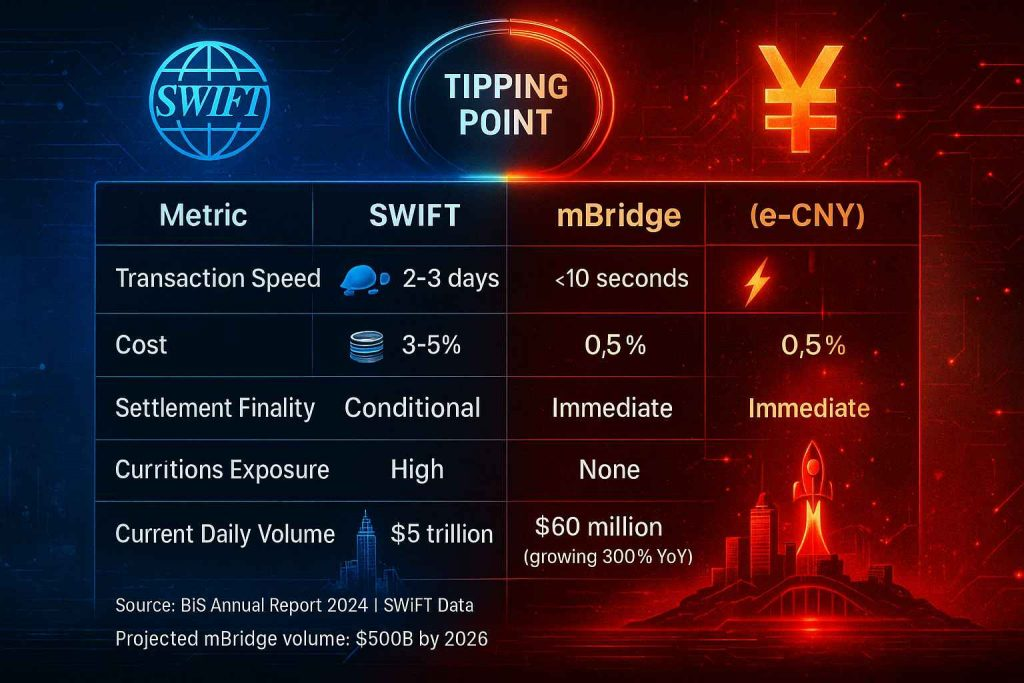

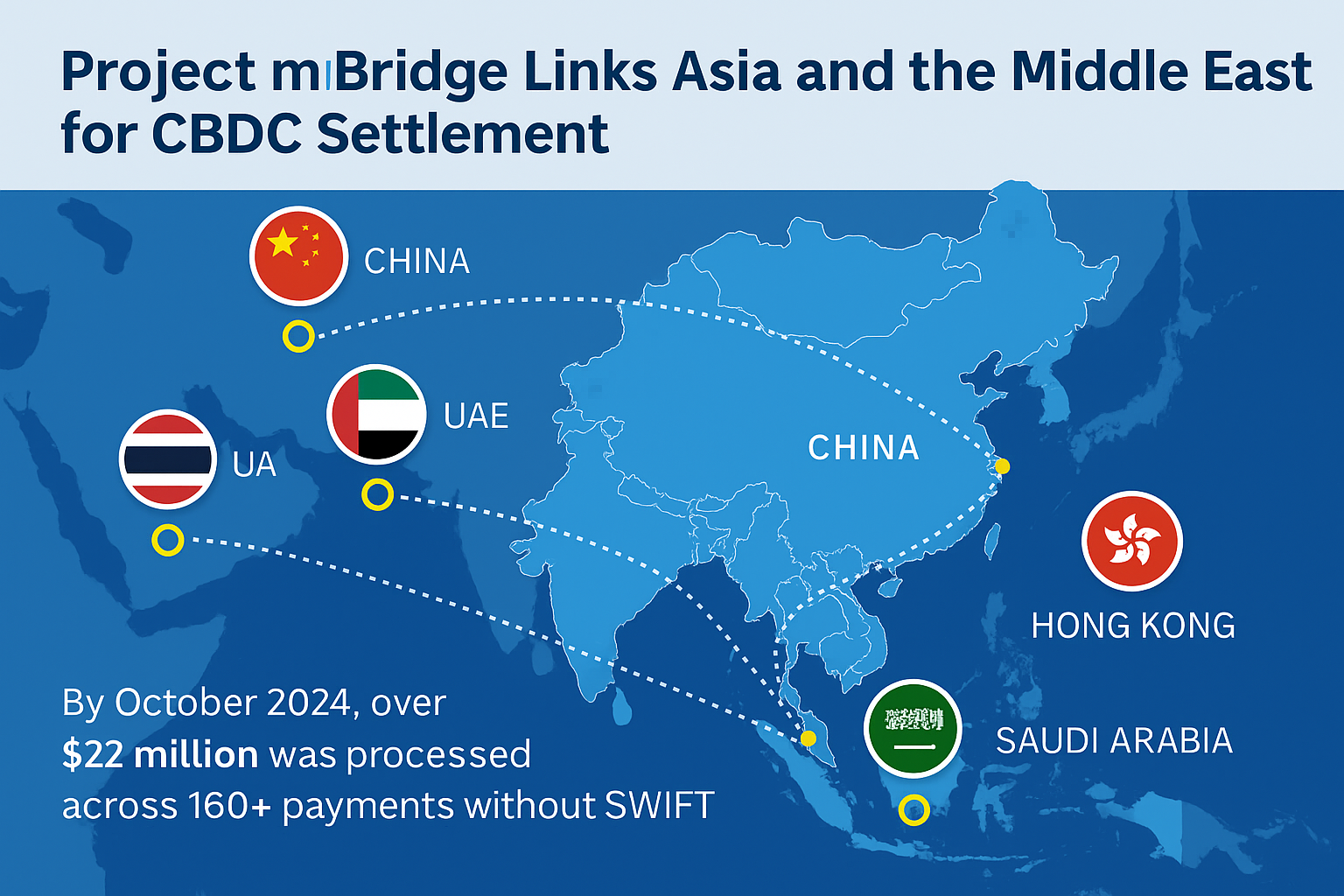

The implications are deeply geopolitical. Projects like mBridge, which connects the central banks of China, Thailand, the UAE, and Saudi Arabia, have already demonstrated functional alternatives to SWIFT, the system that currently handles more than $150 trillion in annual global payments. At the same time, Hong Kong has introduced a pioneering stablecoin framework and China is extending free trade zone pilots nationwide. These moves show Beijing is systematically laying the foundation for a post-dollar financial order, even if major structural barriers still stand in the way.

But we have to look at reality. Despite hundreds of millions of wallets and trillions in transaction volume, Chinese consumers remained more loyal to Alipay and WeChat Pay, which already dominate daily digital payments. Rather than abandon the project, Beijing reframed it.

This is where the digital yuan’s story shifts from a domestic payments experiment to a global financial strategy.

China’s Strategic Expansion of Digital Currency Beyond Borders

China’s digital currency strategy has evolved dramatically from homegrown pilots to international expansion. The People’s Bank of China initially launched the e-CNY as a domestic cash replacement, logging 7 trillion yuan in cumulative transaction volume across 29 pilot cities by 2024. Yet domestic challenges, especially competition from entrenched payment platforms, have pushed the initiative outward.

Governor Pan Gongsheng has made the pivot explicit at the 2025 Lujiazui Forum, framing the e-CNY not just as a technical innovation but as part of a broader push to build a multipolar international monetary system. Besides, the central bank has placed digital finance alongside technology finance and green finance as core national priorities.

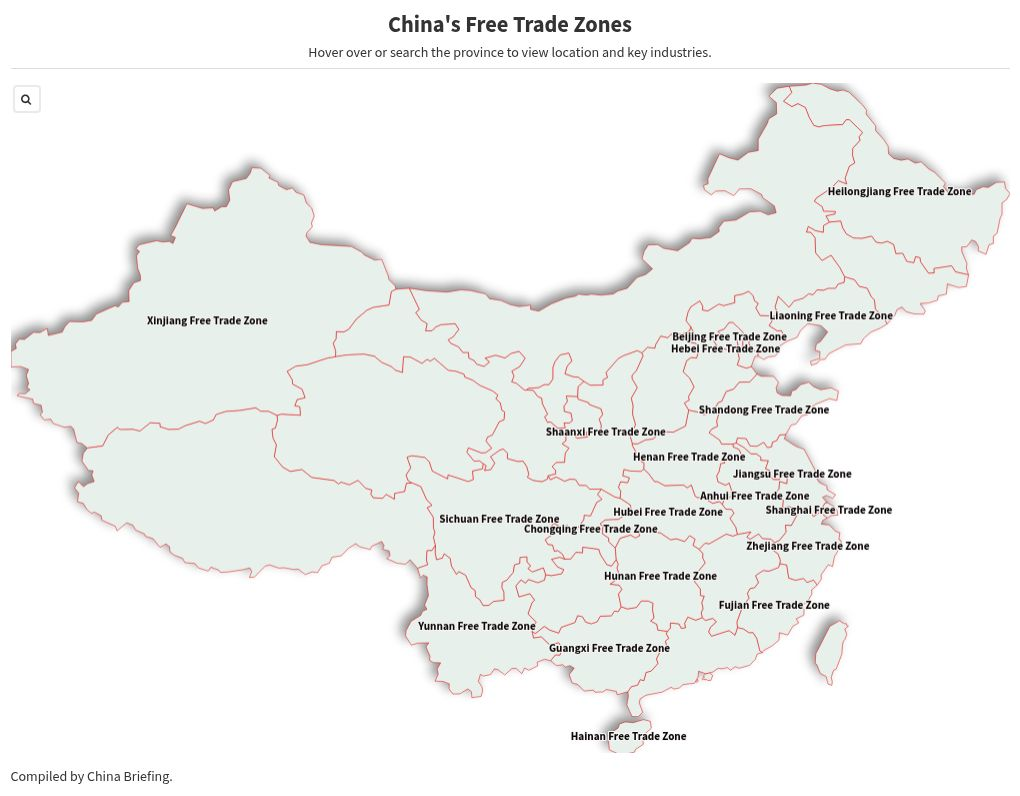

Shanghai’s Pudong New Area has already become a showcase, with pilots spanning trade settlement, e-commerce, carbon trading, and green power trading. At the same time, Beijing is rolling out Pudong’s model across all 21 free trade zones, creating a nationwide sandbox for international applications. But the most critical testing ground lies just beyond the mainland in Hong Kong, and it shows how Beijing's digital currency ambitions will meet the global market under a new regulatory framework.

Hong Kong’s Regulatory Role in Digital Yuan Internationalization

If China’s free trade zones are the domestic sandbox for digital yuan expansion, Hong Kong serves as the international bridge. The territory sits at the crossroads between Beijing’s tightly controlled financial system and global markets, and in 2025 it introduced groundbreaking regulations that give the e-CNY a platform beyond the mainland.

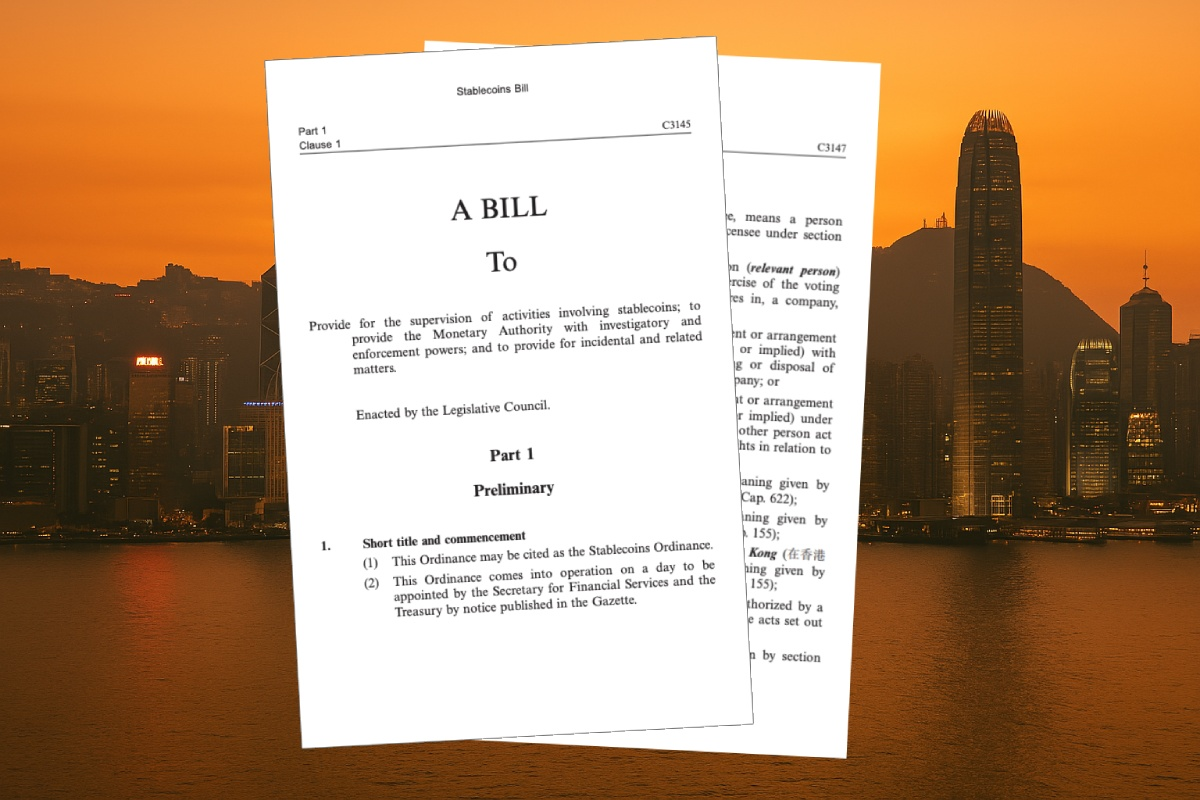

We can take a look at May 2025, when Hong Kong’s Legislative Council passed the Stablecoins Bill, creating one of the strictest global frameworks for fiat-referenced stablecoins and positioning the city as a leading digital asset hub. The bill requires all issuers to obtain a license from the Hong Kong Monetary Authority, hold full reserve backing in high-quality liquid assets, and adhere to robust consumer protection standards. Crucially, it also permits offshore yuan (CNH) backing, providing the only legal pathway for yuan-backed stablecoins, since private digital currencies remain prohibited in mainland China.

This clarity has already drawn in major institutions, including Standard Chartered, Bank of China, and BlackRock, to explore compliant yuan-backed stablecoin products under government oversight. At the same time, Hong Kong is running pilots such as Project Ensemble and e-HKD+, which test wholesale CBDC applications, tokenized deposits, programmable payments, and cross-border settlement.

The most important is the city’s strategy. Hong Kong currently processes nearly 75% of global yuan transactions and holds the largest pool of offshore yuan deposits worldwide. By acting as Beijing’s financial laboratory, it allows China to experiment with both CBDC and stablecoin models under controlled conditions. This creates a pathway for yuan internationalization that maintains capital controls on the mainland while still engaging with international markets.

CBDCs vs Stablecoins: Different Roles in China’s Strategy

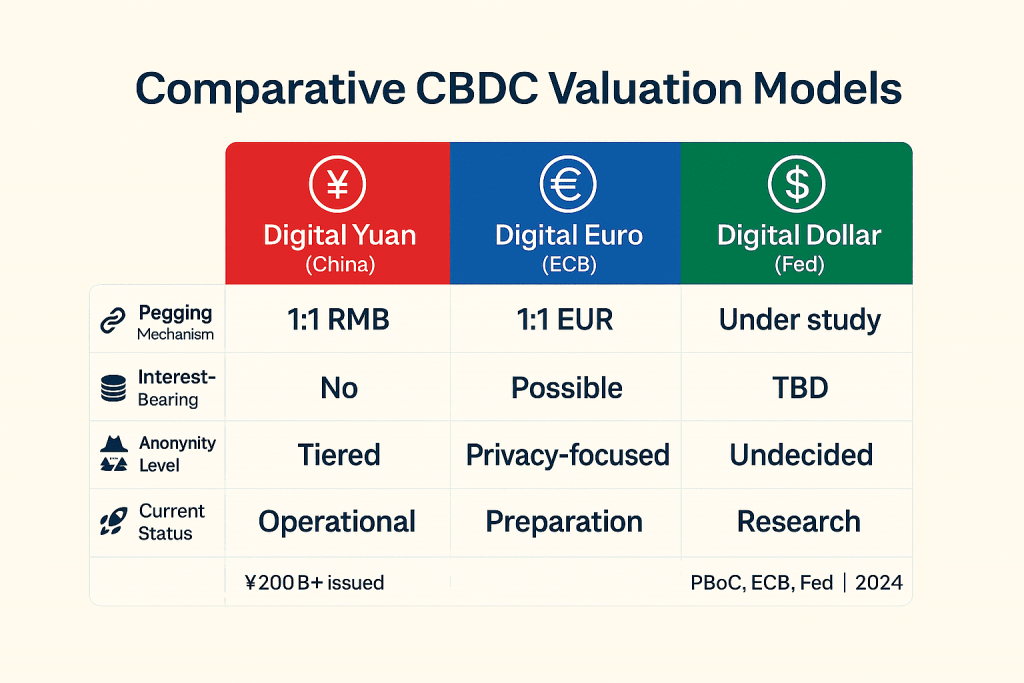

Although both are digital forms of money tied to the yuan, the digital yuan (e-CNY) and potential yuan-backed stablecoins serve very different strategic purposes.

The e-CNY runs on a two-tier centralized system: the PBOC issues it to commercial banks, which then deliver it to users. It gives Beijing direct control, with what officials call “managed anonymity”, small payments stay private, large ones are always visible. It can work offline, support smart contracts, and settle instantly. By 2024, it had cleared 950 million transactions, showing it can handle big scale. Most importantly, it is a central bank liability guaranteed by the state itself.

Stablecoins operate differently. In Hong Kong, licensed issuers can mint tokens backed 1:1 with offshore yuan (CNH). They live on public blockchains, circulate globally, and plug straight into crypto and DeFi systems. Their reach is wide, yet their scale remains narrow: CNH deposits total only 0.88 trillion yuan, compared with the mainland’s 329.94 trillion yuan base. Capital controls keep that gap firmly in place.

The contrast is deliberate. CBDCs concentrate power, making them fit for domestic use and bilateral projects like mBridge. Stablecoins spread access, giving the yuan an opening in digital markets that run beyond Beijing’s direct reach.

As Martin Chorzempa of the Peterson Institute notes, e-CNY faces stiff challenges from Alipay and WeChat Pay at home. Still, abroad it offers leverage in government-to-government settlement, while yuan stablecoins could grow through the crypto channels already in place.

| Aspect | Digital Yuan (CBDC) | Yuan-Backed Stablecoins |

| Issuer | PBOC → commercial banks → users | Licensed issuers in Hong Kong |

| Control | Centralized, state-controlled | Public blockchains, more open |

| Guarantee | Central bank liability, full state backing | Backed 1:1 by offshore CNH reserves |

| Features | Offline payments, smart contracts, instant settlement | Global circulation via exchanges, DeFi integration |

| Scale | 950M transactions (2024), nearly 300M wallets (2025) | CNH deposits only 0.88T yuan vs 329.94T yuan mainland deposits |

| Strategic Role | Domestic payments + bilateral projects (mBridge) | Cross-border adoption via crypto infrastructure |

USD Stablecoins: The Biggest Obstacle for China

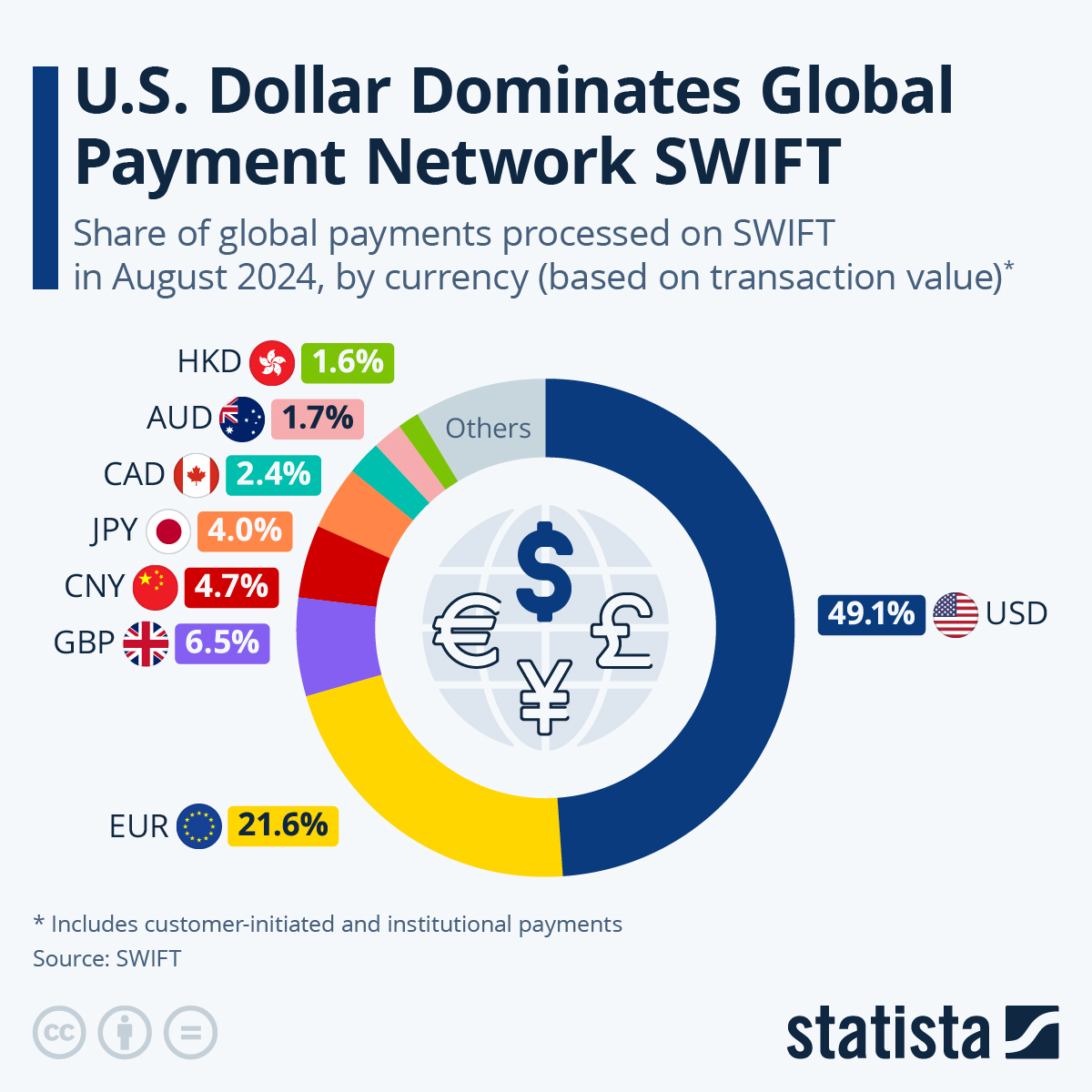

For China, the toughest obstacle is the dollar’s grip on digital assets. Because USD stablecoins control 98% of the market, Tether (USDT) holds $143–146 billion, whileUSDC accounts for $56–71 billion, giving the two nearly $250 billion in liquidity. Together, they process about $27.6 trillion a year, more than Visa and Mastercard combined.

This scale locks in powerful network effects. USD stablecoins are embedded across exchanges, DeFi protocols, and blockchain infrastructure. Replacing them would be costly for users and risky for developers. Their influence even extends into traditional finance: Tether is now the 7th largest holder of US Treasuries, channeling demand straight back into US debt markets.

Geography deepens the advantage. Roughly 80% of USD stablecoin activity happens outside the US, reaching unbanked populations and fueling digital dollarization in emerging economies. In countries battling inflation like Argentina, Turkey, Nigeria, stablecoins have become both a hedge and a store of value.

Washington has moved to secure this lead. The GENIUS Act of 2025 requires stablecoins to be fully backed by Treasuries or cash, with federal oversight and monthly disclosures. Fed Chair Jerome Powell was blunt: “We will leverage stablecoins to extend US dollar hegemony.” Regulatory clarity plus market depth means the dollar’s digital reach is set to grow, not shrink.

Yuan alternatives face an uphill climb. The yuan accounts for only 2.9% of global payments, compared to the dollar’s 47%. Any yuan-backed stablecoin is limited to offshore CNH markets, a fraction of dollar liquidity. These constraints cap both scale and adoption, leaving USD stablecoins entrenched at the center of global digital finance.

| Aspect | USD Stablecoins | Yuan Digital Assets |

| Market Share | 98% of global stablecoin market | Limited, tied to offshore CNH |

| Liquidity | ~$250B (USDT $143–146B, USDC $56–71B) | CNH deposits ~0.88T yuan |

| Annual Transfers | $27.6T (more than Visa + Mastercard) | Trillions in e-CNY but mainly domestic |

| Adoption Geography | 80% volume outside US, strong in EMs (Argentina, Turkey, Nigeria) | Hong Kong + Belt and Road partners |

| Regulation | GENIUS Act (100% reserves, Fed oversight) | HK Stablecoins Bill (strict licensing, CNH backing only) |

| Strategic Edge | Network effects, integration into DeFi + Treasuries | Sovereignty + sanction resistance, but weaker liquidity |

Capital Controls and Transparency: Barriers to Yuan’s Global Reach

Technology can’t erase old problems. China’s currency is still boxed in by the same structural limits that have held it back for decades: capital controls and weak transparency.

Since the 1990s, Beijing has adhered to the “impossible trinity”: aiming for stable exchange rates, independent monetary policy, and restricted capital flows simultaneously. To enforce that, individuals are capped at $50,000 in annual FX conversion, and regulators have never hesitated to tighten the screws when pressure builds. In 2016, amid heavy capital flight, Beijing slammed the door on outflows. The IMF has been blunt: despite its trade dominance, China remains “much less integrated with the global financial system” than its peers.

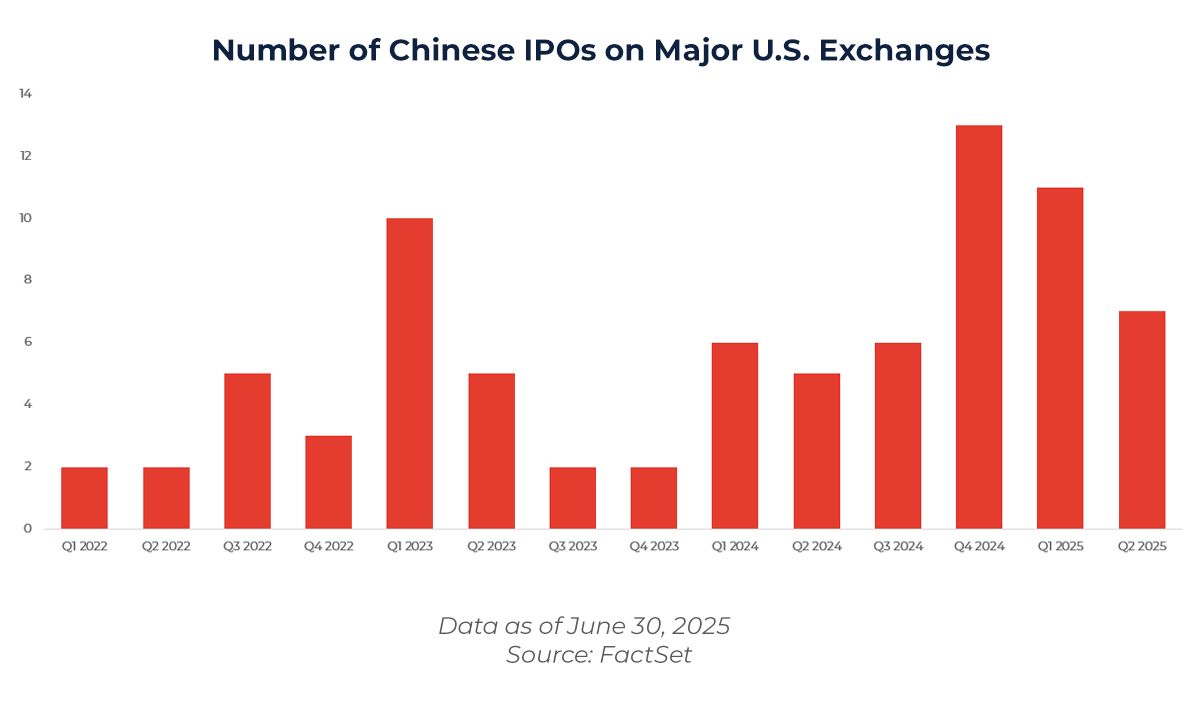

Trust is another obstacle. Chinese firms listed in the US, worth over $1.7 trillion in market cap, have never been fully audited by US regulators. Authorities in Beijing routinely block access to audit papers and restrict interviews, creating a constant risk of delistings. On top of that, the World Bank gives China a governance score of 1.75/5, reflecting opaque rules and limited impact assessments. For investors used to US or European disclosure standards, this is a red flag.

These weaknesses carry over to the e-CNY. The digital yuan can’t escape the fact that it’s not freely convertible. International use depends on bilateral agreements and approvals, not open market demand. Even Project mBridge, while proving that cross-border CBDC settlement works, is limited to specific corridors rather than universal adoption.

The comparison is stark. The dollar offers deep markets, full convertibility, and Fed swap lines in times of crisis. The euro, despite its politics, moves freely across borders with clear rules. Even the yen, from a smaller economy, makes up 6% of global reserves compared with the yuan’s 3%, thanks to its open, trusted markets.

Expert Views: Evolution, Not Revolution

Most analysts agree: China’s digital currency project is serious, but it won’t overturn the global system overnight.

Martin Chorzempa of the Peterson Institute, author of The Cashless Revolution, calls Project mBridge the most meaningful step so far. For the first time, several central banks have completed real CBDC transactions outside SWIFT. He argues that is where genuine competition with the dollar begins. Yet he also points out the weakness at home: e-CNY has struggled to gain traction against Alipay and WeChat Pay. His take is clear — cross-border use may give Beijing leverage, while yuan stablecoins could find more practical adoption globally. In testimony to Congress, he cautioned that hype has “outpaced reality.”

Other voices emphasize geopolitics. Ananya Kumar of the Atlantic Council highlights that mBridge matters not as a concept but as an operational system: multiple jurisdictions have already settled live transactions. For her, the key is that countries are adopting it for political reasons as much as technical ones.

Stanford’s Darrell Duffie frames the stakes around sanctions. If China can expand the reach of its rails, it could blunt the effect of US financial restrictions, giving Beijing more room to maneuver. Still, he warns that the e-CNY would also allow China’s security agencies to monitor any transaction flowing through its system, foreign or domestic.

The Carnegie Endowment pushes this further, noting that a scaled e-CNY network could enable transactions aimed at evading US sanctions. Whether this happens depends on one critical choice: will Beijing let foreign institutions hold large e-CNY balances? For now, that remains politically sensitive.

Put together, expert consensus tilts toward evolution, not revolution. The digital yuan is unlikely to dethrone the dollar soon, but it could carve out space in trade corridors, among aligned states, and in geopolitical flashpoints where alternative payment rails matter more than liquidity depth.

US regulatory response demonstrates strategic monetary competition

Washington has treated China’s digital currency push as a direct challenge, and moved quickly to secure the dollar’s position. The centerpiece is the GENIUS Act of 2025, the first federal framework for payment stablecoins.

The law requires issuers to hold 100% reserves in Treasuries or cash, publish monthly disclosures, and operate under federal licenses. Stablecoin issuers must also function as insured depository institutions, closing the door on lightly regulated players. Treasury Secretary Scott Bessent spelled out the intent: “We will leverage stablecoins to extend US dollar hegemony.”

Oversight is spread across the Fed, OCC, and FDIC, creating a comprehensive regime. Fed Chair Jerome Powell has underlined that any US CBDC would require congressional approval, but he supports “well-regulated private stablecoins” as part of the dollar’s future. This approach leans on America’s greatest advantage: the depth of its Treasury market, the reach of correspondent banking networks, and decades of global trust.

The contrast with China is sharp. Beijing relies on centralized control, while Washington backs private-sector innovation under strict supervision. The US model lets market forces drive adoption, anchored in the credibility of its institutions.

Execution, however, is not seamless. Federal-state coordination can be messy, and China’s centralized system is more agile. Meanwhile, mBridge is gaining traction among countries that together account for nearly 38% of global trade, offering Beijing an opening with partners seeking alternatives to US-controlled rails.

Even so, the US holds the stronger hand. Regulatory clarity has only deepened the integration of USD stablecoins into both crypto and traditional finance, reinforcing the dollar’s role as the global default. The challenge ahead lies less in building technology and more in forging alliances and standards that keep the world tied to dollar-centric systems.

Geopolitical Implications: Digital Currencies as Strategic Tools

Digital currencies are no longer just about monetary policy. They have become instruments of geopolitical competition, with China’s digital yuan strategy directly challenging the dollar-based order that has underpinned global trade since World War II. The implications stretch across three fronts: sanctions circumvention, alliance building, and the creation of payment rails that run outside US oversight.

The clearest case is Project mBridge. The platform links the central banks of China, Thailand, the UAE, Hong Kong, and Saudi Arabia, enabling direct CBDC settlement. By October 2024, it had processed more than $22 million across 160+ real-value payments, proving that central banks can move money without SWIFT. Considering SWIFT clears over $150 trillion annually, the scale is tiny, but the symbolism is huge. The BIS even handed operational control to participants, showing the project had matured beyond a pilot.

The geopolitical appeal lies in sovereignty. Countries under US sanctions, from Russia to Iran, see alternative systems as critical infrastructure. BRICS states have floated the idea of a “BRICS Clear” network, with China expected to provide the technical backbone. Research suggests that nations aligning with such projects could represent up to 38% of global trade, enough to form genuinely multipolar networks.

The Belt and Road Initiative (BRI) strengthens this positioning. With more than 60 participating countries covering two-thirds of the world’s population, BRI projects naturally create yuan-denominated payment flows. Embedding digital yuan settlement into these deals could accelerate adoption by replacing slow correspondent banking channels, which often take days or weeks with near-instant transfers.

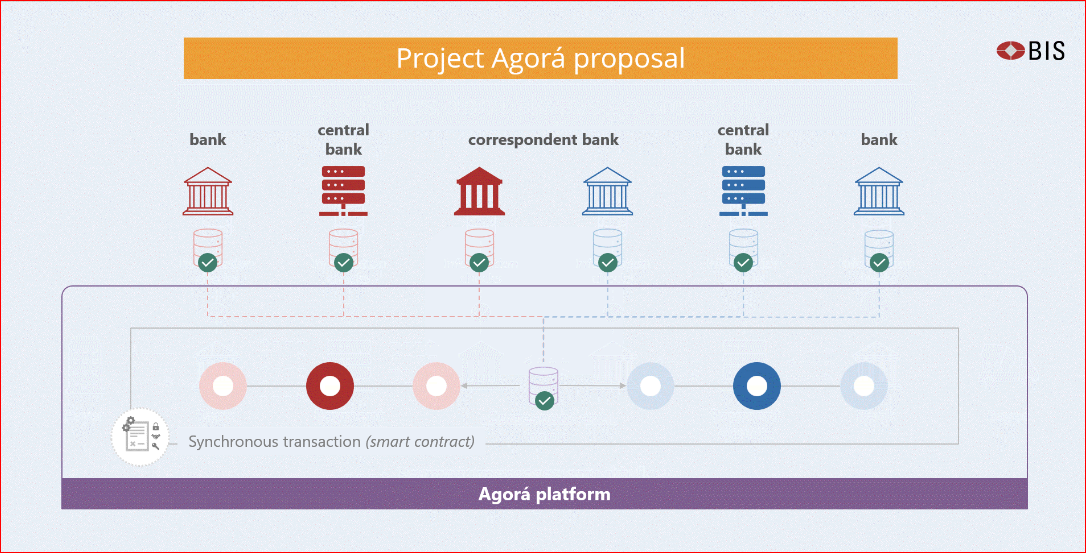

The West is not standing still. The US Federal Reserve has launched Project Agorá, which focuses on tokenized commercial bank money rather than sovereign CBDCs, while Europe is advancing both the digital euro and a MiCA-based regulatory framework. These efforts aim to keep transatlantic finance integrated while leaving room for innovation.

At its core, the competition reflects two models of governance. China emphasizes state control and bilateral agreements, appealing to countries that value monetary sovereignty and sanctions resistance. The US leans on private-sector innovation under tight regulation, benefiting from deep markets, convertibility, and global network effects.

Over the next decade, outcomes will depend less on technology alone and more on geopolitics. Nations will face a choice: join the USD stablecoin ecosystem, which offers liquidity and efficiency under US oversight, or experiment with China’s CBDC rails, which trade efficiency for sovereignty and resilience against sanctions.

Market Outlook: Fragmentation Over Replacement

The outlook points to fragmentation, not replacement. China’s strategy is building regional payment rails, not a global system to rival the dollar. The split reflects different tech models, regulatory paths, and political alignments.

On the dollar side, stablecoins remain dominant. They hold 98% of the market, backed by the GENIUS Act, which requires full reserves in Treasuries or cash. Tether and Circle together account for nearly all liquidity. With 77% of flows driven by algorithmic trading, USD stablecoins are hardwired into crypto markets and reinforce US demand for Treasuries.

China is targeting the weak spots. Sanctioned states, Belt and Road partners, and yuan-friendly economies offer adoption pools. Around 15% of China–Russia energy trade already bypasses the dollar. Hong Kong adds another lever with CNH-backed stablecoins, giving offshore access without loosening mainland capital controls.

The next battle will be over interoperability. Today, systems are siloed. If standards emerge for cross-platform transfers, switching costs drop and market share could shift. China’s early CBDC work positions it to shape those standards, but uptake will depend as much on politics as on code.

Conclusion

China has built the most serious digital challenge to dollar power since Bretton Woods. Nearly 300 million wallets, 7 trillion yuan ($986B) in transactions, cross-border pilots like mBridge, and Hong Kong’s stablecoin law prove its intent.

Yet the barriers are real. Capital controls, weak transparency, and limited convertibility keep the yuan at only 2.9% of global payments, compared to the dollar’s 47%. These limits stop the yuan from becoming a true reserve currency, no matter how advanced the tech.

The choice for countries is sharper than ever: liquidity and efficiency under USD rails, or sovereignty and sanction resistance under China’s digital system.

China plays the long game. It may not dethrone the dollar soon, but it will redraw the map. The future looks less like one global system and more like a fragmented order, where digital money doubles as infrastructure and as a weapon of power.