Chintai & Splyce Open Retail Access to Institutional Tokenized Securities on Solana

Chintai and Splyce launched S-Tokens on Solana to give retail users indirect exposure to institutional-grade tokenized securities via a loan-backed “mirror” structure. The move aims to break down the “walled garden” of RWA investing and bring real-world-asset yields to everyday Web3 wallets.

- Designed to let non-accredited users access institutional RWA returns while keeping issuers compliant (KYC/AML applies).

- The Kin Fund (a tokenized real-estate fund on Chintai) will be the inaugural S-Token offering.

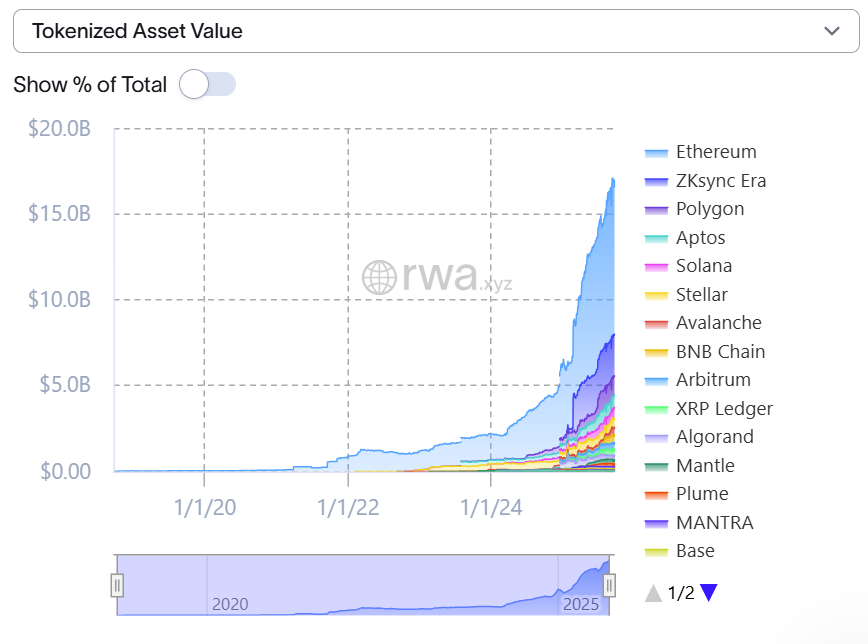

- Solana hosts >$656M in tokenized assets (up 260% YTD), placing it among top RWA chains.

- Users interact via standard Web3 wallets, preserving a permissionless experience.

- S-Tokens aim to address long-standing liquidity and access issues for RWAs onchain.

Chintai and Splyce are pushing a notable expansion of tokenized real-world assets (RWAs) into retail hands with the debut of S-Tokens on Solana. Rather than giving retail buyers direct title to institutional tokenized securities, S-Tokens mirror the economic returns of those assets through a loan-backed construct that preserves compliance for issuers while exposing everyday users to yields that were traditionally reserved for large institutions. That design aims to keep issuers inside regulatory guardrails—standard KYC/AML monitoring is applied to deposits—while delivering a near-permissionless holding experience for token holders.

The first S-Token will track the Kin Fund, a tokenized real-estate product launched by Kin Capital on Chintai’s network. Chintai’s managing director Josh Gordon frames the offering as a solution to two core RWA bottlenecks: distribution and liquidity. By enabling S-Tokens to trade on Solana decentralized exchanges and move through ordinary Web3 wallets, the firms hope to make institutional-grade assets tradable with the same ease as native DeFi tokens, effectively widening the investor base without forcing issuers to relax compliance.

Splyce emphasizes that S-Tokens carry no geographic restrictions in how they are offered—“they’re as permissionless as USDC or USDT,” CMO Ross Blyth told Cointelegraph—while clarifying that on-ramps and deposits remain subject to AML checks. That combination is intended to preserve the regulatory defensibility of RWA issuances while removing practical barriers that have kept these products behind accreditation gates.

The effort arrives at a propitious moment for Solana. Industry trackers show more than $656 million in tokenized assets on the network and a 260% year-to-date growth in tokenized value, figures that put Solana just behind Ethereum, ZKsync Era, Polygon and Aptos in the race for RWA market share. Major tokenized offerings already operating on Solana—such as Ondo’s US Dollar Yield and Ondo’s Short-Term US Government Bond Fund—demonstrate demand for yield-bearing, onchain Treasury exposure. Even institutional names like BlackRock (with its BUIDL product) have extended tokenized liquidity products onto Solana, reinforcing the chain’s institutional credentials.

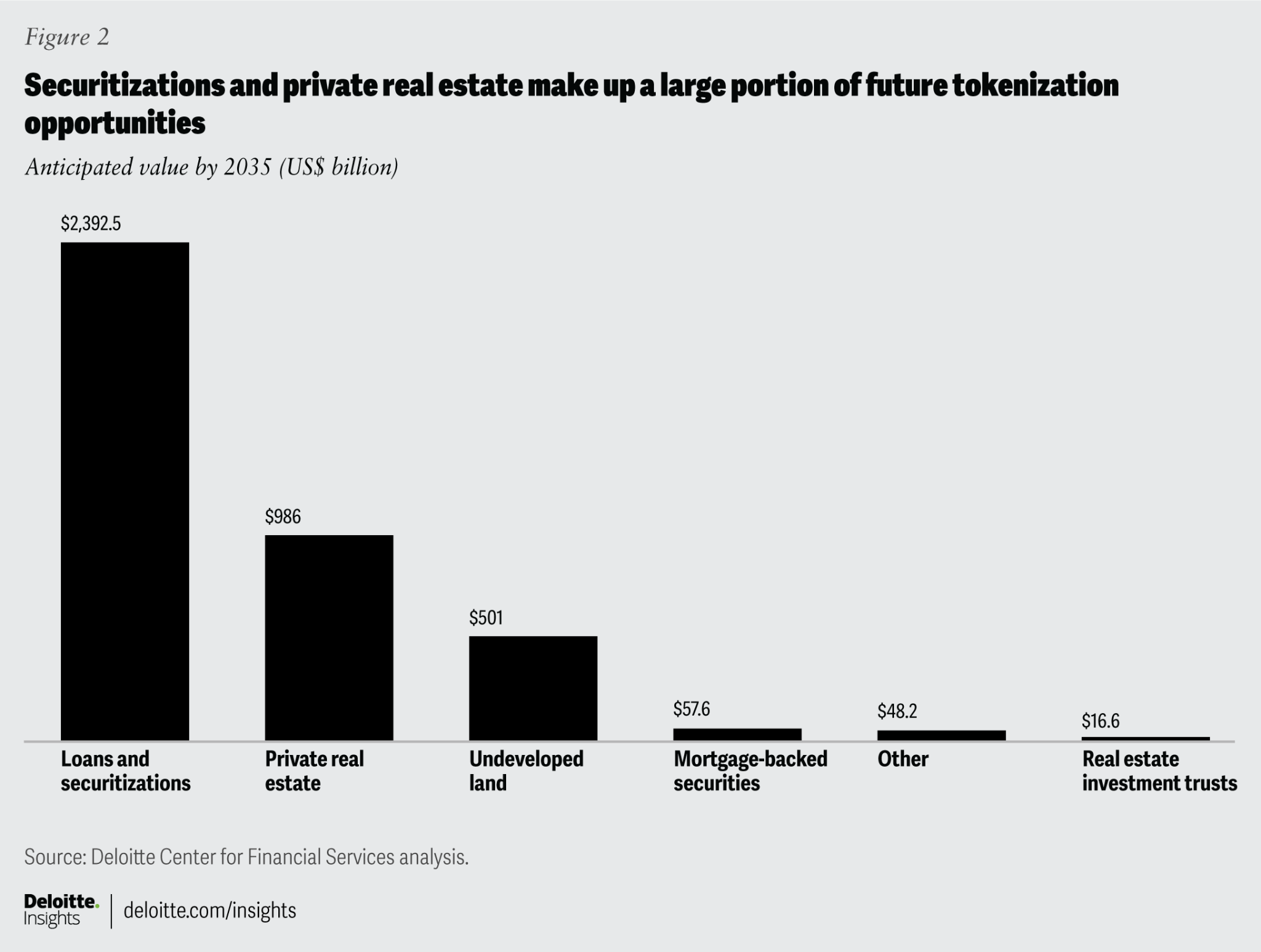

While many of Solana’s largest RWA products still target qualified investors, a wave of projects signals broader retail ambitions: Ondo plans retail extensions on Solana via partners like Alchemy Pay, Forward Industries is pursuing a tokenized stock listing through Superstate, and S-Tokens add another retail-friendly path. If S-Tokens gain traction, they could shift how everyday users access loans, securitizations and private real estate — the tokenization areas Deloitte has flagged as large opportunities for the coming decade.

Wider implications are clear. Bringing institutional-grade yields to retail wallets would deepen onchain liquidity, create new secondary markets for RWAs, and force a rethinking of compliance models that balance investor protection with broad access. Execution risks remain—pricing transparency, counterparty risk, legal clarity and secondary-market depth will determine how far S-Tokens can scale—but Chintai and Splyce are building on a growing Solana RWA ecosystem that already shows significant momentum.

Final Thought

S-Tokens could be the practical bridge between institutional tokenized assets and retail DeFi users: if legal, liquidity and compliance challenges are managed, Solana may become a key onchain marketplace where everyday investors access yields once reserved for large institutions.