Bitcoin Miner Cipher Signs $3B Google-Backed AI Hosting Deal, Plans $800M Note Offering

Cipher Mining locked in a landmark $3 billion, 10-year AI-hosting agreement with Fluidstack, buoyed by a $1.4 billion Google guarantee and a 5.4% Google equity stake. The bitcoin miner also announced an $800 million private convertible note offering to accelerate its data-center expansion.

- Google guarantees $1.4 billion of lease obligations for warrants equal to 5.4% of Cipher equity (~24 M shares).

- Agreement leverages Cipher’s 244 MW Barber Lake site in Texas; fuels a broader 2.4 GW HPC pipeline.

- Zero-coupon convertible senior notes due 2031—plus an optional $120 M upsize—to fund new data centers and growth.

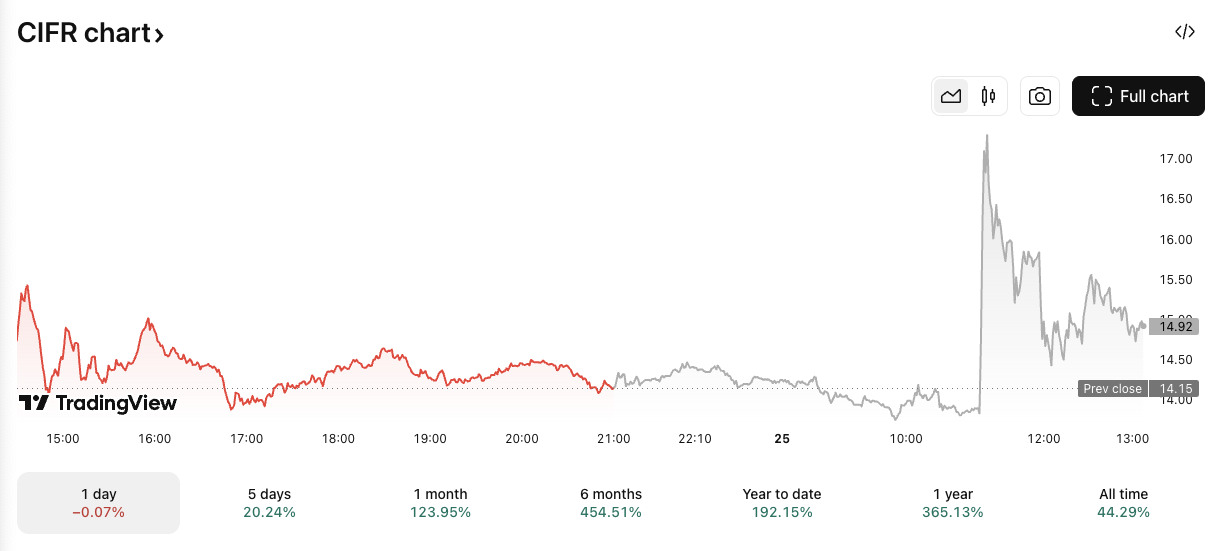

- Stock spiked 22% pre-market to $14.95, market cap $5.6 B, up 192% YTD.

Cipher Mining, the fourth-largest publicly traded bitcoin miner, revealed a sweeping expansion plan combining a multibillion-dollar AI-hosting agreement and a major capital raise. On Thursday the company announced a 10-year colocation contract with AI infrastructure provider Fluidstack, committing 168 megawatts of critical IT load at its 244 MW Barber Lake development in Colorado City, Texas. The deal is valued at $3 billion initially, with two five-year renewal options that could bring the total close to $7 billion.

As part of the arrangement, Google will guarantee $1.4 billion of Fluidstack’s lease payments and, in return, receive warrants to acquire roughly 24 million Cipher shares, representing about 5.4% of pro forma equity. Cipher will maintain full ownership of the project, positioning itself as a key player in high-performance computing (HPC) while diversifying beyond bitcoin mining.

“This transformative transaction reinforces our HPC momentum,” said CEO Tyler Page, noting it could be the first of several such deals as Cipher expands its AI-data-center footprint.

To finance its growth pipeline, Cipher also launched a private placement of $800 million in zero-coupon convertible senior notes maturing in October 2031, with an option for initial purchasers to buy an extra $120 million. Proceeds will support the Barber Lake build-out, fund the company’s 2.4 GW HPC pipeline, and fuel additional site development.

Investors reacted quickly: CIFR shares leapt more than 22% in pre-market trading, later settling near $14.95, giving the firm a $5.6 billion market cap and marking a 192% gain year-to-date, according to The Block.

Final Thought

With Google’s backing and a massive AI-hosting contract, Cipher Mining is staking a claim as a serious contender in high-performance computing while supercharging its shift beyond bitcoin mining.